Recently updated on May 21, 2024

In 2018, in the US alone, the insurance industry totaled $1,22 trillion in net premiums with 2.7 million employees and $49.5 billion of payments in property losses. The industry is a giant, and its economic impact is colossal. And, what even more colossal is the amount of paperwork and the complex processes that run insurance companies. As the number of clients and data grows with each day, the amount of mind-numbing work follows the example. The said work takes its toll on employees and increases the possibility of mistakes and mishaps, which can damage insurance companies’ well-being. The surest way of addressing the issue of the bureaucracy is creating and implementing insurance agency management software, which, through automation and optimization of processes, can significantly mitigate the negative effect of workload and streamline the performance of insurance agencies.

This article will lead you through the world of agency management systems for insurance organizations and elaborate on the benefits of developing software solutions for the insurance industry.

Content:

1. CRM Software for Insurance Industry: What & Why?

2. Insurance Agency Management Software Functions

3. Advantages of Insurance Agency Management Software

4. Custom vs Out-of-the-box Management System

5. How to Create Software for Insurance Company?

6. Conclusion

CRM Software for Insurance Industry: What & Why?

What are insurance agency software solutions?

First of all, we need to establish that management software for insurance companies falls into the category of customer relationship management (CRM) systems. However, there is a vivid distinction between universal CRMs and specialized CRMs.

In general, CRM is a software system that helps to manage a company’s interaction with customers by providing a single point of access to all relevant data, performing data analysis, automating client-related business processes and/or communication, etc. The main idea behind a CRM system is to provide a company with full control over its customers’ interactions to drive growth and insights.

CRMs for sale, such as salesforce, are created to fit the broadest profile possible, providing generally-demanded functions, which can include communication with clients, customer support, marketing automation platform, data processing functions, etc.

On the other hand, specialized CRM is created to fit the needs of a particular company from a particular industry. Such a system may not have some of the functions universal CRMs provide, but, at the same time, have industry-specific features. For instance, CRM software for insurance agents must analyze insurance commissions, while there is no need for such a feature in casual CRM.

Ideally, insurance agency management system software is a CRM with some ERP (enterprise resource planning) ‘features’ tossed in.

Why build an insurance agency software?

According to PWC’s 2017 CEO survey, 42% of insurance companies were concerned with the speed of software disruption and how the changing world of tech can affect their business. Moreover, 28% of CEOs identified digital capabilities as the top priority for business development. In addition, the CRM software market is expected to grow to $40.26 billion by 2023, which is a $5 billion increase since 2018. ROI of CRMs is quite difficult to measure considering the massive effect the software has on all aspects of businesses. However, some estimates demonstrate a 65% increased sales quota and a 50% increase in productivity. No matter the exact numbers, companies of all sorts and sizes continue to implement CRMs and other types of management systems to boost their performance.

Add to the mentioned above the fact that in the insurance industry “… budgets are starting to shift away from core applications toward analytics, artificial intelligence, and other advanced functionality to enable more flexible, customized products and enhanced customer experience.” As a result, we see that the insurance industry is ripe for the all-consuming digital transformation, which is necessary for competitiveness and growth.

Insurance Agency Management Software Functions

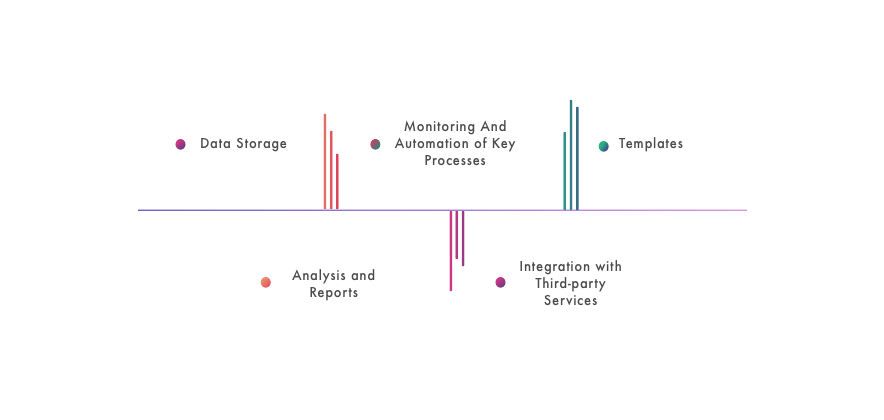

Management software for insurance companies should be a multi-purpose tool that can handle external and internal business processes while serving as a reliable data hub. Thus, the functions of CRM software for the insurance industry are:

Data Storage

Software for insurance companies has to store and protect information. The information includes client data (such as names, addresses, contacts), info on contracts, transactions, notes, related documents, and statements. Overall, if you decide to build CRM software for an insurance agency, it’s up to you to decide which data exactly should the system contain and process. In this case, any company-specific needs will be covered.

Templates

The insurance management system should provide storage of the most prevalent templates for documents and allow employees to quickly fill them out. The templates may include invoices, documents, contracts, applications for insurance, etc.

Monitoring And Automation of Key Processes

The system should ‘keep an eye’ on the processes of transactions, insurance history of clients, and track prospects. As a result, a company will have relevant, up-to-date information and full control over key processes. If there are company-specific operations that can be automated, the insurance management system should automate them.

Analysis and Reports

Data analysis is one of the primary drivers behind insights and informed strategic decisions, which is perhaps among the most important long-term benefits insurance management software can provide. The software system should be able to search, group, and sort data, and create reports for further analysis.

Integration with Third-party Services

If there is such a need, the insurance software can be integrated with other services to provide a smoother workflow. For instance, the system can be connected with customer support services, such as IP telephony.

Overall, if you want to create a custom insurance company management software, it will be a unique piece of tech that is developed to fit the unique profile and needs of your company. The limits are only your imagination and tech limitations.

Advantages of Insurance Agency Management Software

If you decided to digitally transform your insurance company by implementing management software, your business will obtain the following benefits:

Decreased costs. Automaton and optimization of the processes lead to reduced workload and costs.

Less paperwork, more effective communication.

Mitigation of a human factor. The less work a human does, the less likely a human-related error to occur.

Reduced stress levels. Your employees will be glad to work with a management system that makes their lives easier.

Reduced time to add or make product changes, which decreases time to market. Deliver new insurance propositions as quickly as possible.

Increased customer satisfaction. The service is overall faster, customers receive answers faster, the applications are processed more quickly.

More control over the company. Proper management software is a control panel that grants unprecedented control over the business.

Security. Your data will be well-protected behind the walls of a well-constructed back end architecture.

Strategic benefit. Data analysis and reporting will be a driver of major strategic decisions.

Custom vs Out-of-the-box Management Solution

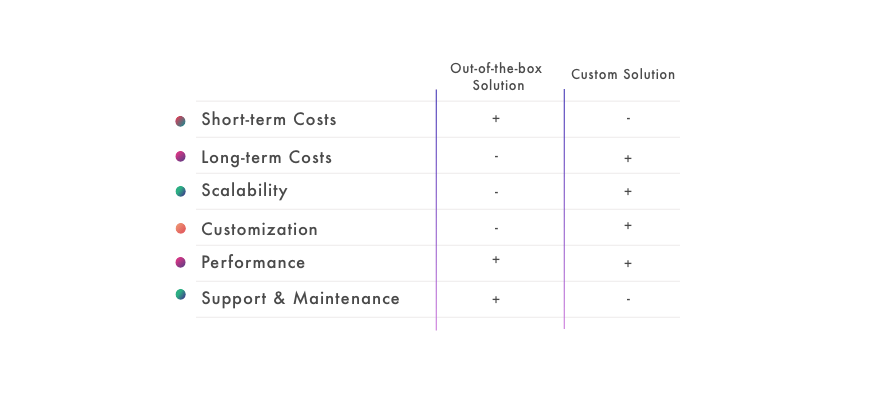

If you decide to implement a CRM system, you are presented with two options. The first one is to buy a universal out-of-the-box management solution. The second one is to build insurance agency software with the help of a software development team. Both options have their pros and cons.

Out-of-the-box Management Solution

There are various for-sale or open-source CRM solutions for companies of different sizes, such as Salesforce, Zendesk Sell, Netsuite CRM, etc.

Advantages of out-of-the-box software

– Easy to install and use. Software for the mass market is ready to be installed and used. The only hindrance will be the time required to educate personnel on how to use the software.

– Cheap in the short-term. The monthly fees are insignificant compared to developing a custom solution.

– Community and support. Out-of-the-box software has communities that can help resolve issues, and years on the market mean that a lot of initial bugs were fixed.

Disadvantages of out-of-the-box software

– Rigid. Out-of-the-box software is difficult to customize to a company’s specific requirements. Also, it may lag behind the market as changes are difficult to implement on such a scale.

– Long-term pricey. With most software, you will have to pay for the software for as long as you use it. A vendor may also change a pricing policy. For instance, Salesforce costs start from $5/user/month, but the implementation may cost anywhere from $16/hour to $190/hour. On top of that, it may have excessive features a company simply does not need, but still pays for.

– The issue of compromise. Mass-market software is created to fit the ‘average’ company. As a result, such systems make compromises that may decrease their efficiency for the sake of prevalence.

Going with an out-of-the-box CRM system is like renting an apartment: depending on circumstances, it may be a necessity, a viable solution, or a beneficial option.

Custom Management Solution

If you decide to create a custom CRM solution, you will commit to an initially costly and lengthy endeavor, which, however, will result in a long-term profitable, scalable, and reliable solution.

Advantages

– Perfect fit. The software will be created to be an ideal fit for your company, with features that complement the organization.

– Easy customization. Adding new functional/updating custom software is just a matter of your wish, time, and investments.

– Full control and ownership. With custom software, you don’t depend on third-party vendors and have full control over your system.

– Easy to scale. Scaling with custom CRM is much easier compared to out-of-the-box solutions.

Disadvantages

– Costly to start. Making software for insurance agents will take investments and time.

– Support and maintenance. You will need a team that will support and maintain your software.

– Real-life testing. No matter how thorough the quality assurance phase of the development process is, it is not possible to test the custom system considering all possible business cases. The adjustments will have to be made on the run.

Custom CRM is like a house that was built personally for you: it took some money and time to create, but the final result, is as comfy, cozy, and personal as possible.

How to Create Software for Insurance Company

If you decided to create software for an insurance company to harness the advantages that software grants, you will have to follow a well-trodden path of software development. Usually, but not always, the path is the following.

1. Idea and Research

The idea is a punch required to make gears of the development machinery turning; the idea is essential and precious. However, a simple idea is not a solid foundation for building a digital product. You need a well-researched plan instead. Therefore, you have to distill the idea and crystallize it into accurate blueprints for building a future system. Ideally, this work is performed by a team of business analysts and software engineers. Such a team conducts research to determine how exactly the function of the management system should look like; what features it needs in order to be scalable, relevant, and competitive; what back-end architecture should the system have.

2. Design

The next stage is to determine the visuals of the system, the user interface that will be the face of the management solution employees will interact with. The management system should be appealing and intuitive so personnel does not struggle to learn how to use a system and enjoys working with it. UI/UX designers will handle this task and deliver the visual blueprints of the future system.

It often happens that research and design stages are combined into one phase. Here, at KindGeek, we call it the Discovery Phase.

3. Software Development

After the first two stages or discovery phase, software developers will have everything required to construct a reliable and easy-to-use insurance agency management system. The development is a complex process, which will take quite some time.

Usually, the development process is split into iterations, which are called sprints, during which the parts of the functionality are developed and tested to avoid bugs and ensure overall quality. Roughly, the structure of each sprint is the following one

– Planning

– Design

– Development

– QA phase

– Review

Moreover, throughout the development process, a project manager will communicate with you to hold you updated on the progress, consider your feedback, answer your questions, and simply will be responsible for your inner peace regarding the smoothness of your insurance company management system’s development

4. Support and Maintenance

After the insurance management software is delivered and ready for use, the tech team you’ve worked with can support and maintain the system to ensure that its function is updated, bugs and issues fixed, and everything runs smoothly.

Conclusion

The insurance industry is no exception to the allure of digital transformation. The automation of management practices is the first in the line. Developing insurance agency management software is a viable and sure way of boosting performance, saving money, reducing workload, and increasing customer satisfaction.

If you decide to create a CRM system for your insurance organization, we can help you. KindGeek is a full-cycle software development company with years of experience developing software for fintech, education, healthcare, and other industries. On top of that, we have a strong BA department, which helps refine ideas and develop a reliable foundation upon which a digital product can be built. We can become your trusted digital partner.

If you are interested, contact us.