Recently updated on September 5, 2025

These days, banks and financial organizations face increasing pressure to maintain operational efficiency. And the challenges are compounded by increasing competition from fintech companies, skilled labour shortages and ever-evolving customer expectations.

To stay competitive, companies must adopt innovative solutions to streamline operations, and reduce inefficiencies. One of such solutions is Robotic process automation (RPA), an indispensable element of modern digital transformation.

With a global market size being valued at a whopping $28.31 billion in 2025, it is predicted to soar to approximately $ 211.06 billion by 2034, growing at a CAGR of 25.01% from 2025 to 2034.

In this article let’s explore RPA, along with its value and impact on the financial services industry. Buckle up for a brief deep dive.

Understanding Robotic Process Automation

So, what is RPA in finance? RPA is the term for intelligent automation that uses computer-coded software to simulate human interaction with digital systems and applications to complete time-consuming business tasks.

The software, referred to as a bot, or robot, in this context, uses machine learning (ML) and artificial intelligence (AI) to execute repetitive manual tasks that humans would normally carry out – be it data entry, transaction analysis, or navigating several software programs.

What makes RPA so sought-after in finance and banking is its effective automation capabilities. With the need to manage voluminous piles of data, banks cannot afford to get stuck by manual, repetitive back-office processes.

With RPA on board, banks and financial institutions can improve efficiency and redirect their efforts to more complex and strategic tasks across departments.

The distinct advantage of RPA lies in its seamless integration with legacy systems, enabling financial companies to modernize without replacing core systems.

Therefore, by selecting the right portfolio of use cases and ensuring proper configuration, organizations can significantly accelerate core processes, reduce operational expenses, and bolster productivity, allowing teams to focus on higher-value tasks.

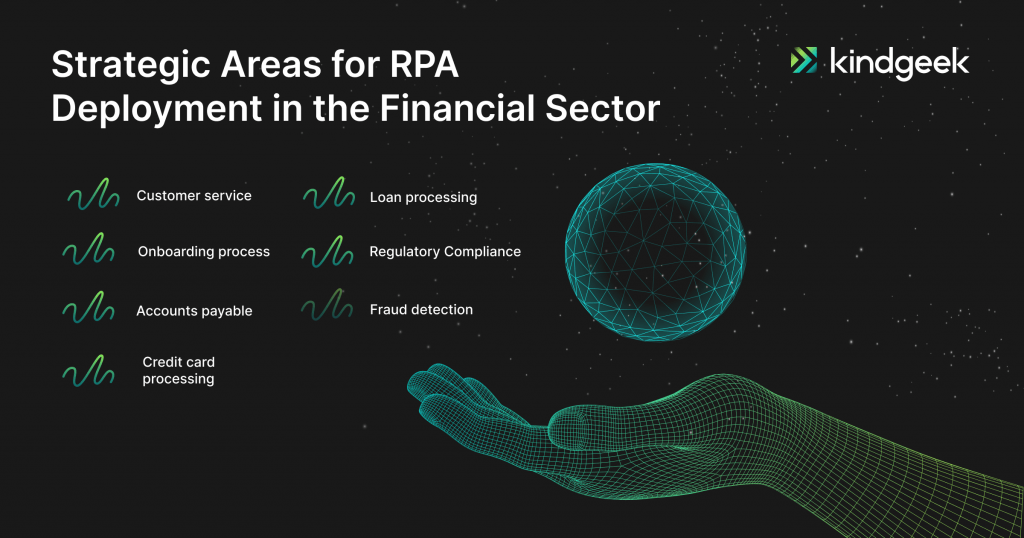

Strategic Areas for RPA Deployment in the Financial Sector

Customer service

Among such a fierce competition that exists in the financial service industry, customer service stands as an evergreen priority. Nevertheless, given the high volume of inquiries that banks receive daily, it gets quite challenging to maintain responsiveness and, therefore, customer satisfaction across multiple communication channels. And that’s when RPA comes to the rescue.

Robotic process automation is able to seamlessly manage routine customer queries, like balance-checking, transaction status, or account updates. Not only does it improve response times, but it also frees human agents to focus on more complex issues, improving the overall customer experience.The other perk of RPA is that it can respond to requests in real-time 24/7, process to minimize, if not eliminate, thereby reducing wait times and improving customer satisfaction.

Customer Onboarding

In the financial customer journey, onboarding is where impression matters most. Still, the related obligatory activities around it are time-consuming and error-prone.

Utilizing RPA, companies can streamline account setup by automating customer data collection and verification of documents, therefore significantly reducing both time and effort, and enhancing overall customer experience.

Accounts payable

Accounts payable is a straightforward yet repetitive process within the banking system. While this workflow is crucial to keep the financial operations running smoothly, it is largely monotonous, and doesn’t call for complex human judgement. That being said, accounts payable stand as a great fit for automation.

RPA automates invoice processing, matching purchase orders with invoices and routing them for approvals. By leveraging RPA, financial institutions can enhance operational efficiency, minimize the likelihood of human error, and redirect human expertise towards more analytical tasks that necessitate strategic thinking.

Credit card processing

Due to reliance on manual efforts for customer data verification, document checking and credit evaluations, it could take whole weeks for a bank to process credit card applications. Such slow credit card approvals led to high customer dissatisfaction and increased operational costs.

Now, with RPA for finance, banks can automate these tasks, cutting down processing times from weeks to a few hours. RPA bots can:

- Interact with multiple systems at once to verify customer information

- Automate document collection and verification.

- Manage background and credit checks as per predetermined rules

- Make prompt, data-driven decisions on application approval

By automating credit card processing, banks can achieve better accuracy, greater optimization and customer satisfaction.

Fraud detection

Fraud is a growing concern in the financial sector, posing significant risks to both institutions and their customers. In this respect, RPA can be employed to ensure faster and more effective fraud detection through real-time monitoring of transactions.

Unlike manual processes, RPA bots can speedily sift through voluminous piles of data to pinpoint unusual patterns or suspicious transactional activity. The software automatically flags suspicious activity for review, allowing financial institutions to proactively address issues on time.

ficiency.

Loan processing

Likewise, processing a mortgage loan can take several weeks due to manual steps like credit checks, employment verification, and document analysis. And yes, even small errors could cause costly delays.

From origination to post-closing, RPA can automate these repetitive and rule-based tasks, resulting in 80% process acceleration.

Compliance

With ongoing regulational changes and complexity of banking operations, RPA can help financial institutions reduce the hurdle of maintaining compliance. The software can automate compliance checks and grant that all processes comply with the latest regulatory norms.

It includes streamlining KYC processes, AML checks, and other compliance-related tasks, thus helping to reduce the chances of facing penalties and legal issues in the future.

Assessing the Impact of RPA in Finance and Banking

1. Increased Efficiency

RPA streamlines repetitive financial processes, and performs much faster than humans do, drastically decreasing processing time. This optimizes workflows, providing finance teams with the ability to manage higher workloads with less delay.

2. Employee Productivity

Taking over repetitive processes, RPA enables finance professionals to focus on strategic tasks like financial planning, analysis, and decision-making. This shift from repetitive work to more value-added activities boosts overall productivity and employee satisfaction by 85%.

3. Cost Savings

By automating routine tasks, RPA minimizes the need for manual work, lowering operational costs by up to 80% in certain finance tasks according to Accenture. It also reduces costs associated with human errors, compliance breaches, and overtime pay.

4. 24/7 Operations

Unlike human workers, your RPA bots operate continuously and don’t need to take breaks. It means that the critical financial functions, like transaction monitoring and report generation, can run round-the-clock, driving responsiveness and operational agility.

5. Improved Accuracy

Manual financial processes are susceptible to error, which may potentially result in financial loss or issues with compliance. RPA bots are programmed to perform tasks without deviation, hence eliminating data entry errors, miscalculations, or reporting inaccuracies and preserving data integrity.

6. Enhanced Compliance

Given the heavily regulated nature of finance, strict adherence to laws and standards is an indisputable must. RPA grants consistent compliance through a firm reliance on predefined rules. Additionally, RPA maintains a comprehensive log of every action executed, providing a detailed audit trail for regulatory reviews.

7. Seamless scalability

RPA solutions can be easily scaled up or down as needed to meet the changing operational needs. During peak financial periods, like fiscal year-end or tax season, bots can take over increased volumes of work, eliminating the need to hire and subsequently train additional staff.

8. Faster Processing Times

With RPA’s robust capabilities, processes like loan approvals, and fraud detection can be accelerated by up to 90%. Bots can simultaneously check data validations, conduct calculations and generate reports in real-time. Accountability, processing times, and overall service deliverability are all improved.

9. Better Data Management

RPA solutions transform the way data is collected, processed, and stored. Bots can pull data from multiple systems, allowing for more consistent and accurate information handling. In turn, the ease of data management drives better financial analysis, forecasting, and decision-making.

10. Enhanced Customer Service

The software can expedite back-office activities which results in faster responses to consumer queries related to account management, billing, and payments. This ultimately results in higher levels of customer trust and satisfaction.

Final Thoughts

With so many benefits in its favor, the deployment of RPA in finance operations stands as an undeniable game-changer, driving transformative improvements across the industry.

Not only does RPA streamline processes, but it also drives cost savings and enables scalability, ensuring that banks can stay flexible and easily adapt to growing demands in the market.

And while the journey to automation may be challenging, the significant rewards it brings make the adoption essential, but speed and strategy effectiveness matter here.