Recently updated on January 13, 2025

The rise of generative AI in banking marks a new chapter in innovation. As financial institutions embrace its transformative potential, the boundaries of what’s possible in banking are redefined.

But it’s not just a possibility of the future anymore; it’s something already delivering unprecedented value to customers. We see it in smarter chatbots, automated processes, and hyper-personalized customer experiences across banking applications.

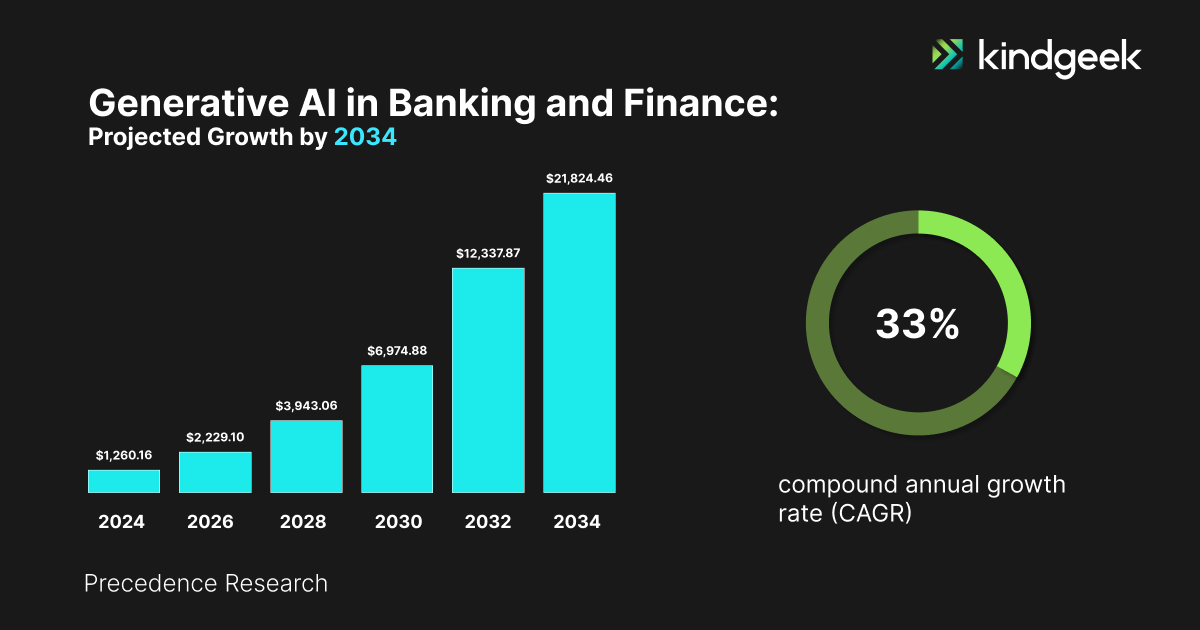

According to Precedence Research, the generative AI market in banking and finance is expected to grow from USD 1,260.16 million in 2024 to USD 21,824.46 million by 2034, at a CAGR of 33%. This rapid growth highlights the increasing adoption of this technology in financial services over the next decade.

Whether you’re looking to improve customer experience, streamline operations, or safeguard against fraud, generative AI offers the tools to make it happen.

This article breaks down the essentials of gen AI in banking, helping you understand how it can improve financial services. If you’re a banker, tech enthusiast, or simply curious about the future of finance, here’s what you gain: answers to key questions, use cases, and a glimpse into the future.

Content:

- Understanding AI in Banking

- The Rise of Generative AI in The Banking Industry

- How Banks Are Using Generative AI

- What’s Next for Generative AI in Financial Services?

- Challenges Facing Generative AI Adoption in Banking

- Consider Kindgeek Your Trusted Partner

- Final Thoughts

Understanding AI in Banking

In banking, AI implies using artificial intelligence technologies to make financial services smarter, faster, and more personalized. It’s powered by advanced machine learning algorithms, natural language processing (NLP), and data analytics, enabling systems to process large amounts of data, learn patterns, and make intelligent decisions.

The application of AI in banking spans from conversational tools that enhance client interactions to generative AI and large language models, offering fresh pathways for automation and superior service delivery. It helps banks automate routine tasks, keep fraudsters at bay, and foster loyalty to maintain a strong customer base.

Here are some of the most notable advantages it provides:

- Enhanced Efficiency: AI-powered automation eliminates manual processes, speeds up transactions, and reduces errors.

- Improved Customer Experience: Chatbots and virtual assistants provide instant, personalized support 24/7, making banking convenient and stress-free.

- Fraud Detection: AI systems process transactions instantly, spotting anything suspicious before it causes damage.

- Smarter Decisions: With AI’s data processing capabilities, banks can uncover insights that lead to better strategies and services.

- Cost-Effectiveness: By optimizing processes, AI helps banks cut costs while boosting performance.

The Rise of Generative AI in The Banking Industry

AI in financial services is not limited to automation; it opens up endless possibilities. Unlike traditional AI, which focuses on recognizing patterns, generative AI takes it further by creating new content, ideas, and even solutions.

Among the most common generative AI use cases in banking, you can find it employed to automate customer service, simulate financial scenarios for risk assessment, and even assist in designing new products. This tech offers insights that make banking operations smoother and more secure.

How Banks Are Using Generative AI

There’s a noticeable shift in how banks operate and serve their customers, driven by the rise of generative AI use cases in financial services. Here are some of the most impactful applications:

Customer Service and Support

Generative AI powers smart chatbots and virtual assistants that can handle everything from answering complex questions to offering financial advice. Customers get the help they need when they need it.

An example of generative AI enhancing customer service is bunq’s AI assistant, Finn, which now offers real-time speech-to-speech translation within the app, enabling seamless communication between customers and support agents in multiple languages.

Additionally, Finn’s ability to process visual information, like receipts and documents, showcases how AI can automate routine tasks while personalizing the customer experience.

Fraud Mitigation and Security

Generative AI generates predictive models that identify suspicious activity and prevent fraud before it strikes. These security measures are provided around the clock, continuously analyzing vast amounts of data to detect and respond to potential threats in real time.

With advanced algorithms, including Generative Adversarial Networks (GANs), AI can identify patterns of suspicious activity faster than traditional methods. GANs, in particular, are used to generate synthetic data that mimics legitimate transactions, training AI systems to recognize patterns without exposing sensitive data.

An excellent example of generative AI in fraud detection comes from Mastercard, which developed its proprietary AI model, Decision Intelligence Pro. By analyzing transaction patterns and leveraging vast amounts of data, Mastercard’s AI can improve fraud detection rates by up to 300%. This demonstrates how generative AI can be a game-changer for security in the banking sector.

Personalized Financial Advisory

Using generative AI for financial services provides an in-depth exploration of customer data to personalize wealth management strategies. It’s like acquiring a financial advisor, but one available 24/7 and within reach for all income levels.

In 2023, Morgan Stanley launched an assistant powered by GPT-4 to help financial advisors by providing quick access to over 100,000 research reports and documents.

Like Morgan Stanley’s approach, the Commonwealth Bank of Australia also harnesses generative AI to enhance personalized financial advisory services. By delivering tailored notifications through its app and streamlining processes like loan income verification, CommBank is improving customer experiences and enabling staff to focus on high-value client interactions.

These advancements, driven by AI, are helping both banks optimize efficiency and offer more personalized, data-driven financial advice.

Process Automation

Generative AI handles repetitive tasks with ease, freeing up employees to focus on more strategic work. From automating email responses to generating reports, it streamlines processes effortlessly.

For example, Morgan Stanley has expanded OpenAI-powered generative AI tools with AskResearchGPT for its investment banking and trading division. It allows staff to extract insights from over 70,000 annual reports, boosting productivity through faster access to high-quality research.

This case shows how AI enables staff to focus more on high-value tasks, such as client engagement and decision-making, while the AI handles time-consuming data analysis.

Compliance with KYC regulations

Know Your Customer (KYC) procedures are essential for ensuring compliance with anti-money laundering (AML) regulations and mitigating risks associated with financial crimes. Gen AI offers to make these procedures faster, more accurate, and cost-effective.

A prime example is Airwallex, a global payments company implementing a generative AI copilot to accelerate KYC assessments. This tool has reduced false-positive alerts by 50% and sped up onboarding by 20%, transforming the previously slow and error-prone process.

These generative AI in banking use cases highlight the many possibilities for innovation and security within the sector, which will undoubtedly continue to change finance.

What’s Next for Generative AI in Financial Services?

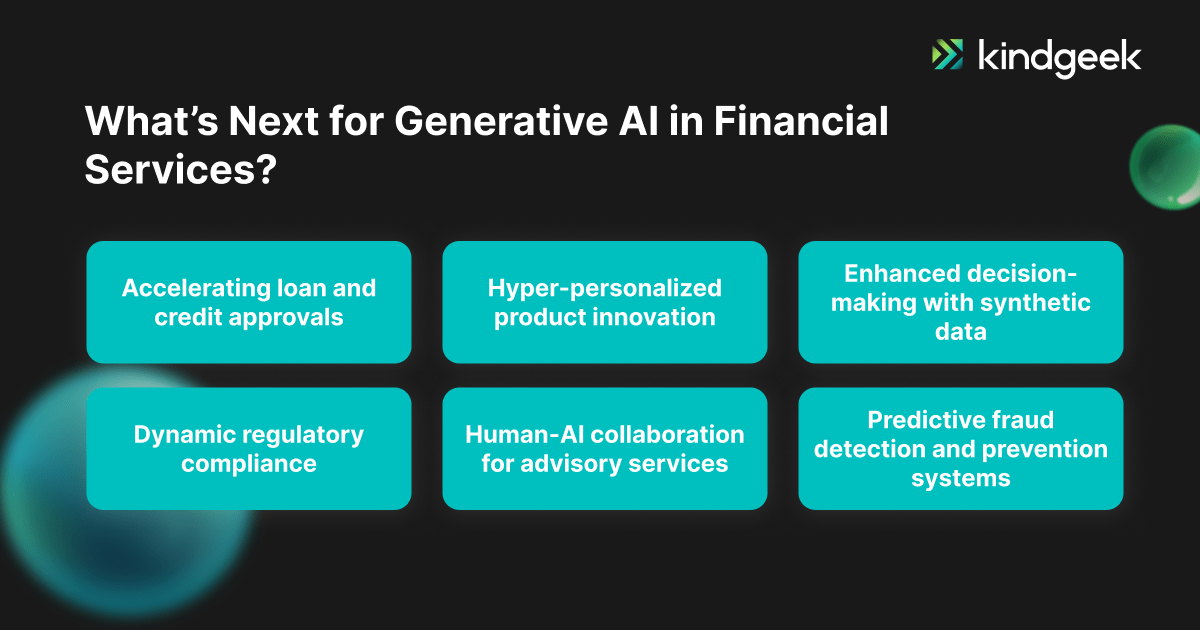

The future of generative AI in banking is very promising. As the technology evolves, banks will use it to deliver experiences that are more personalized, innovative, and secure than ever before. Imagine:

- Accelerating loan and credit approvals. Generative AI can revolutionize lending by automating credit evaluation. It can assess creditworthiness, simulate repayment scenarios, and even draft loan agreements, significantly reducing approval times.

- Hyper-personalized product innovation. Generative AI is a powerful tool for meeting the specific needs of diverse customer segments. Its ability to generate novel solutions can enable banks to better address customer demands and drive product differentiation in a competitive market.

- Enhanced decision-making with synthetic data. Generating synthetic data is one of the most promising applications of generative AI. This approach allows financial firms to create realistic datasets for training machine learning models without compromising customer privacy or regulatory requirements. Synthetic data could become essential in areas like credit scoring and market trend analysis.

- Dynamic regulatory compliance. Navigating the complexities of financial regulations is challenging, but generative AI can help institutions stay compliant by analyzing legal documents and generating reports to meet regulatory standards.

- Human-AI collaboration for advisory services. Rather than replacing human advisors, generative AI will complement their expertise. AI-driven insights can empower advisors to provide clients with more informed and strategic recommendations, whether it’s optimizing investments, managing debts, or planning for retirement.

- Predictive fraud detection and prevention systems. Future fraud detection systems powered by gen AI will identify suspicious activities and anticipate and prevent potential threats. This will ultimately protect both customers and businesses from financial losses due to fraud.

While the potential is enormous, it’s crucial to approach this future with a focus on ethics, transparency, and customer trust.

Challenges Facing Generative AI Adoption in Banking

Of course, no innovation comes without its challenges. Implementing generative AI in financial services is no exception. Even leading banking institutions like Wells Fargo are taking a cautious approach to gen AI.

Here’s what banks need to keep in mind:

- Protecting customer data: With great power comes great responsibility. Handling sensitive financial data requires ironclad security and strict compliance with privacy laws.

- Investing in technology: Building and integrating generative AI systems doesn’t come cheap. Banks must weigh the costs against the potential long-term benefits.

- Avoiding bias: AI models can unintentionally reflect biases in their training data, which could lead to unfair outcomes. Ensuring fairness is a top priority.

- Navigating regulations: AI in banking is still a relatively new frontier, and regulatory frameworks are evolving. Banks need to stay ahead of the curve to avoid compliance issues.

- Building trust: Customers and stakeholders may hesitate to fully embrace AI-driven systems. Transparency and clear communication are key to overcoming this challenge.

Consider Kindgeek Your Trusted Partner

At Kindgeek, we’re here to help you navigate the exciting world of generative artificial intelligence with our AI services. From seamless integration to transformation assistance, we’re committed to making your AI experience smooth and successful.

With our help, you can customize AI your way and find the key to unlocking new possibilities in modern banking. We provide end-to-end integration of a custom AI solution, expert guidance in AI discovery, or a comprehensive technical audit of an existing solution.

Ready to take the leap?

Final Thoughts

The benefits of generative AI for banking are hard to overlook, with real-world use cases demonstrating its transformative impact. From enhancing customer experiences to driving operational efficiency, its potential is vast and still unfolding.

However, realizing this potential requires careful planning, ethical considerations, and solid implementation approaches.

As banks and financial institutions continue to embrace generative AI, they are poised to lead the industry into the future. Now is the time to seize the opportunity and unlock the full power of generative AI to redefine how you deliver financial services.