Recently updated on July 29, 2024

Key Factors to Keep in Mind When Selecting a Payment Provider

Tips for Evaluating Different Payment Providers

Best payment providers on the market today

Conclusions

Variety is definitely a benefit, but sometimes it makes it difficult to choose. Payment providers (or payment gateways) are legion, so it is effortless to fall victim to analysis paralysis while trying to choose the one that will power up your business. Whether you’re a startup seeking seamless transactions or an established enterprise aiming for global reach, the answer to the question of how to choose payment service providers can significantly impact your operations and customer experience. As always, there is only a universal solution for some problems. You should decide which payment provider to use based on the type of service you provide and the market you want to target.

This article serves as a comprehensive guide, offering strategies and essential factors to consider when deciding to select the perfect payment partner tailored to your business needs. It will also give you the answer on how to choose PSP providers.

Key Factors to Keep in Mind When Selecting a Payment Provider

Before jumping into the topic of choosing online payment service providers, you should understand the differences between payment gateway, payment processor, and payment provider to decide which one suits your needs best.

Payment Gateway

- A payment gateway is a technology service that acts as an intermediary between a merchant’s website or point-of-sale system and the financial institutions involved in processing a payment. It securely authorises and facilitates the transfer of payment data between the customer, merchant, and payment processor.

- It encrypts sensitive payment information (such as credit card details) to ensure secure transmission over the Internet.

- The payment gateway enables the online or in-store authorisation and communication required to complete a transaction.

Payment Processor

- A payment processor is a financial entity or company that provides the infrastructure and services necessary to enable transactions between the merchant, the customer, and the various financial institutions involved (such as banks and card networks like Visa, Mastercard, etc.).

- Payment processors manage the transaction flow, transmitting transaction data, verifying the payment details, and facilitating the movement of funds between the buyer’s and seller’s accounts.

- They often handle transaction routing, authorisation, clearing, and settlement functions.

Payment Provider

- A payment provider is a broader term encompassing both payment gateways and payment processors. It refers to a company or service that offers comprehensive solutions for accepting and processing payments.

- Payment providers may offer services beyond gateways and processors, such as fraud prevention tools, recurring billing options, multi-currency support, and more. They aim to provide merchants with payment-related services to manage their transactions effectively.

While choosing a solution for your company, you should also consider:

- The location of your company. The providers are limited to their partners and licenses for geographic regions. So, not all providers will be able to provide in your country

- Payment methods you require. Not all providers support all methods

- The currencies you want to operate with. Remember, people prefer using their domestic currency

- Whether a provider is PCI compliant. If not, the providers are not secure for a business

- Whether a provider is GDPR compliant. It is a must if you want to work with the EU market.

Moreover, there are things you should avoid when choosing a payment provider:

- Complicated integration or setup (it is not that difficult to create an easy-to-install service today. If a provider fails to do so, be ready for further unnecessary complications)

- Lack of transparency

- Inapparent fees (if a payment provider makes it difficult to determine the exact price of its services, it does not consider its price a competitive one)

- Lack of flexibility regarding adaptation to your service and/or programming language

- Reliable and easily-accessible support

Tips for Evaluating Different Payment Providers

Several key factors should be considered when evaluating a payment service provider to ensure they align with your business needs, security requirements, and customer expectations. If you wonder how to choose a payment service provider, here are the critical factors to consider:

Security and Compliance

Ensure the provider adheres to industry-standard security protocols (like PCI DSS compliance) to protect sensitive payment information. Look for encryption, tokenisation, fraud detection, and data security measures.

Fees and Pricing Structure

Understand the provider’s fee structure, including transaction fees, setup fees, monthly fees, chargeback fees, and any hidden costs. Compare these against the services offered to determine the overall value.

Scalability and Growth Potential

Consider if the provider can accommodate your business’s growth by offering scalable solutions, higher transaction volumes, and additional features as your business expands.

Integration and Compatibility

Check if the payment provider seamlessly integrates with your existing systems (e-commerce platforms, POS systems, etc.). Ensure compatibility and ease of implementation with your current infrastructure.

Customer Support and User Experience

Evaluate the quality and availability of customer support. A responsive and knowledgeable support team addresses issues promptly and efficiently.

Assess the payment provider’s user interface for merchants and customers. A smooth, user-friendly experience can impact conversion rates and customer satisfaction.

Best payment providers on the market today

So now you should know how to choose a PSP provider. Let’s see which ones are on the market for you.

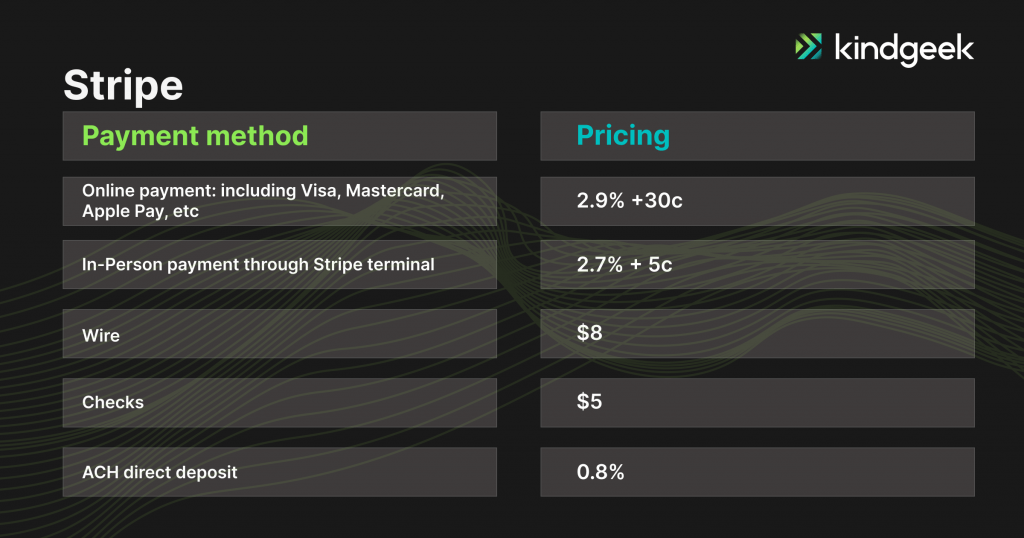

Stripe

Prices:

Key Advantages:

- Customised UX. Provides a UI toolkit that can be used to create unique Stripe payment forms.

- Quick and easy to set up or integrate into an existing website.

- Sigma’s service allows viewing data and analytics in a real team, providing constant insights.

- It has a feature that allows the customer to divide payments between themselves and those who use their service to sell stuff.

- Accepts ACH (Automated Clearing House) payments, which are direct charges to bank accounts.

- It covers 26 countries and works with 135 currencies.

- Works with AliPay, which allows targeting the Chinese market.

Key Disadvantages:

– Stripe holds platform owners responsible for any charges.

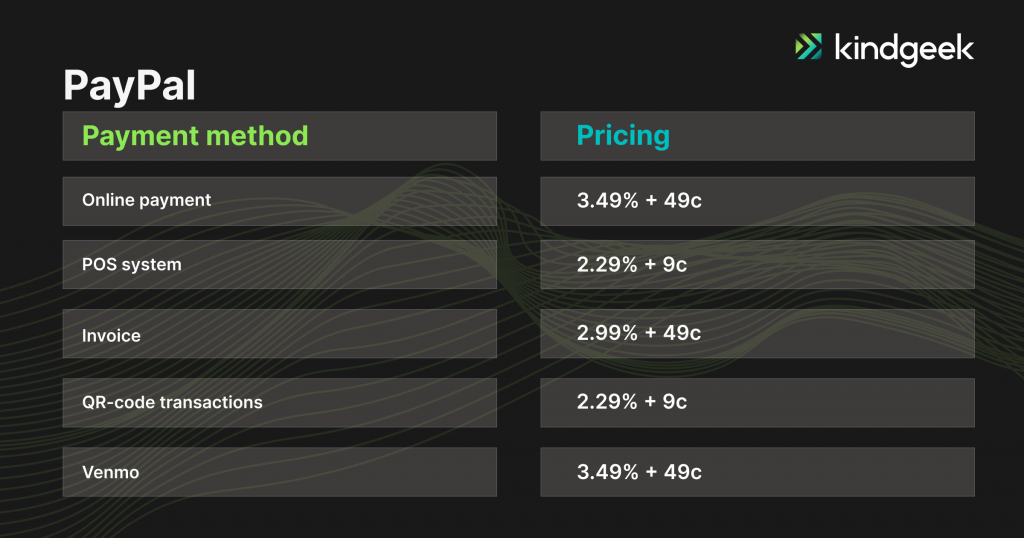

PayPal

Prices:

Key Advantages (including Payments Pro plan):

- Complete drop-in UI offers a quick and simple way of accepting payments.

- Works in 200+ countries and regions

- Custom checkout

- Once a payment is sent and processed, it will be available to you in minutes

Key Disadvantages:

- Payments Pro plan is required for a fully customised experience

- Many currencies are not available

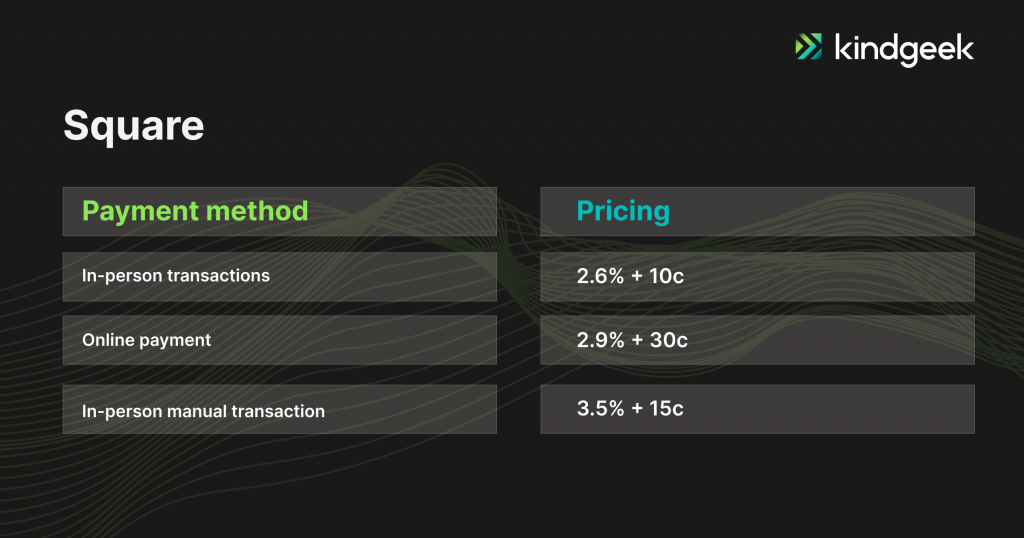

Square

Prices:

Key Advantages

- Simple and user-friendly tools that are easy to set up and use.

- Various payment methods, including credit cards, debit cards, mobile payments (e.g., Apple Pay, Google Pay), and contactless payments.

- The pricing model is straightforward, with no long-term contracts, monthly fees, or termination fees for basic services.

- Fast and reliable deposit options often provide next-day deposits for most transactions.

Key Disadvantages

- Customisation options may be limited compared to other providers.

- Challenges in effectively managing and resolving disputes.

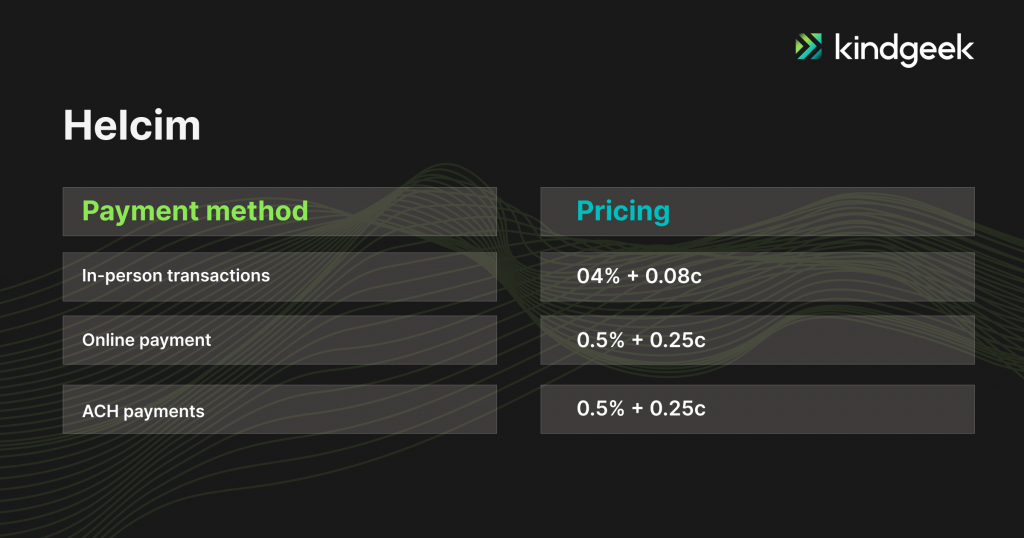

Helcim

Prices:

Key Advantages

- Transparent and straightforward pricing structure.

- Responsive and knowledgeable customer support.

- Various payment solutions include online payments, in-person card-present transactions, virtual terminals, and mobile payments.

- Advanced security features include tokenisation, encryption, and compliance with PCI DSS standards.

- Customisation options for businesses.

Key Disadvantages

- Its services might need to be more scalable and suitable for larger enterprises with high transaction volumes.

- Primarily focused on North American markets.

Conclusions

Your approach to choosing payment network providers is crucial and demands a thoughtful assessment of several critical factors. Firstly, understanding your business needs and specific requirements is fundamental. Consider the volume and nature of transactions, the desired payment methods, international reach, and scalability. Secondly, scrutinise the fee structure and associated costs meticulously. A clear understanding of the financial implications is crucial, whether it’s transaction fees, monthly subscriptions, chargeback expenses, or hardware costs. Additionally, prioritise security and compliance measures to protect sensitive customer data and adhere to industry standards like PCI DSS.

Furthermore, the provider’s reliability, customer support quality, and ease of integration with your existing systems are paramount considerations. A PSP’s reputation, user reviews, and track record for uptime can indicate its reliability. Exceptional customer support is indispensable for addressing concerns promptly. Finally, test the provider’s compatibility and ease of integration with your business operations to ensure a smooth implementation process. By meticulously evaluating these factors and aligning them with your business objectives, you can confidently answer the question: How to choose online PSP providers that cater to your specific needs, drive efficiency, and foster growth in your online payment ecosystem.

What is a payment provider, and why do you need one?

A payment provider is a company or service that offers comprehensive solutions for accepting and processing payments. They aim to provide payment-related services to manage your transactions securely and effectively.

How do I choose the best payment provider for my business needs and goals?

While choosing a solution for your company, you should consider the location of your company, payment methods you require, the currencies you want to operate with, whether a provider is PCI compliant, and whether a provider is GDPR compliant.

What are the costs and fees associated with using a payment service provider?

The costs associated with using a payment service provider can include transaction fees, potential monthly fees, chargeback fees, fees for PCI compliance, charges for international transactions or currencies, hardware expenses for in-person transactions, and additional costs for virtual terminals or custom integrations.