The abbreviation PFM stands for Personal Finance Management, and it usually refers to the ways and techniques used to monitor your finances and manage your money. It can also refer to the digital banking software solution, that provides a user with useful and intuitive tools to do such management effectively.

Whether you are someone willing to step up your finance management game and learn a true PFM meaning or a business wanting to learn more about potential users of a PFM app to enter the market with your own outstanding product, this article is for you.

Personal Finance Management: Overview

Now, that we`ve figured out what does PFM stand for, let`s delve deeper into its basics.

Digital banking services, typically offered by traditional banks through their websites and mobile apps, can also provide a foundation for personal finance management. They offer features like real-time account balances, transaction history, and basic categorization of expenses. These tools allow users to monitor their spending and get a general overview of their financial situation.

While digital banking offers a good starting point, dedicated personal finance management services typically provide more advanced and comprehensive features, such as advanced budgeting tools, goal-based savings, personalization and others.

By offering these more advanced and integrated features, specialized PFM apps and platforms can provide a more comprehensive and effective approach to managing personal finances compared to basic digital banking services. They empower users with deeper insights, more powerful tools, and a more holistic view of their financial lives, enabling better decision-making and progress towards financial goals.

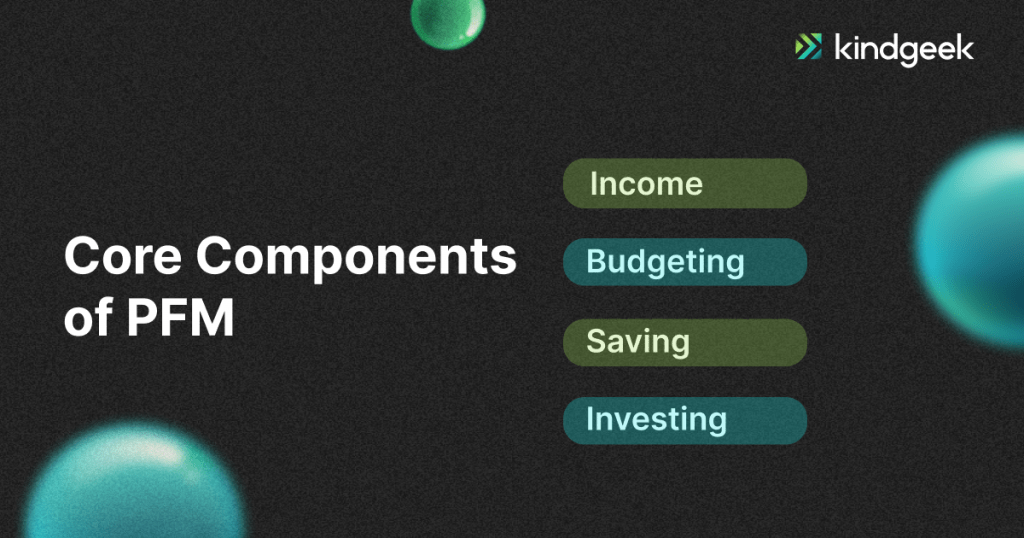

Core Components of PFM

Personal finance is all about setting and achieving personal milestones. So, before starting to search for techniques and tools, it is better to set a goal first, weather its a short-term or a life-long one. Most of the PFM apps will help with that, as well as provide an efficient way to track the progress.

Understanding some of the key aspects of the tracking will make an individual finance management journey easier. PFM platforms should help here as well. So, what are those aspects:

Income management

That is the first step of any financial management journey. It is the total amount of income for the chosen period, which may be allocated to the sections we will explore later. This includes salary, wages, dividends, and other forms of income. PFM platforms usually allow you to separate different sources of income to make management easier and clearer.

Budgeting and Expense tracking

Now, after having a better understanding of the amount and sources of the income, it`s time for budgeting. This means creating a comprehensive plan for income and expenditures, allowing individuals to understand their cash flow and make informed decisions about spending. Expenses monitoring can help identify areas of overspending and find opportunities to cut costs or reallocate funds to more important priorities.

Saving

This aspect is important for setting aside a portion of income for future use, whether for emergencies, specific goals, or long-term financial security. Effective savers develop strategies to consistently put money aside, often automating the process to ensure they pay themselves first before allocating funds to discretionary expenses.

Investing

This is a more individual but still very important aspect of financial management. It takes saving a step further by putting money to work with the aim of growing wealth over time. This area of personal finance requires understanding various investment vehicles, assessing risk tolerance, and developing strategies for long-term growth.

Personal Finance Management: Strategies and Practices

Now, that we have an understanding of what is personal finance management, let`s take a look at how to start using it. There are many techniques for approaching a PFM wisely. Some are straightforward and don`t require any preparation, and others require time and tools. The best combination is to find a strategy that works for you and a PFM platform that accommodates that strategy. Let`s talk about some of the said techniques:

Zero-based budgeting

This is a meticulous approach to financial planning that requires allocating every dollar of income to a specific purpose. This technique ensures that no money is left unaccounted for, effectively giving each dollar a “job” within your financial ecosystem. This method promotes conscious decision-making about expenditures and helps identify areas where spending can be optimized.

The 50/30/20 rule

This approach suggests allocating 50% of income to needs, which include essential expenses like housing, food, utilities, and transportation. The next 30% is designated for wants, encompassing non-essential expenses such as entertainment, dining out, and hobbies. The remaining 20% is earmarked for savings and debt repayment, focusing on building emergency funds, investing for the future, and reducing outstanding debts.

The envelope system

This is traditionally a physical method using cash and actual envelopes, that has evolved to include digital adaptations in many modern budgeting apps. This technique involves dividing the monthly budget into distinct categories. Each category is assigned a specific spending limit. The key principle is that once the allocated amount for a category is depleted, no further spending should occur in that area until the next budget period.

Pay yourself first

This is a savings-focused technique that treats saving as a non-negotiable expense. Rather than saving whatever is left after all other expenses are paid, this method prioritizes setting aside a predetermined amount or percentage for savings immediately upon receiving income. The remaining income is then used for living expenses, encouraging individuals to adjust their lifestyle to fit within these means. It can be effectively combined with other budgeting methods to create a comprehensive financial management strategy.

Putting PFM into Practice

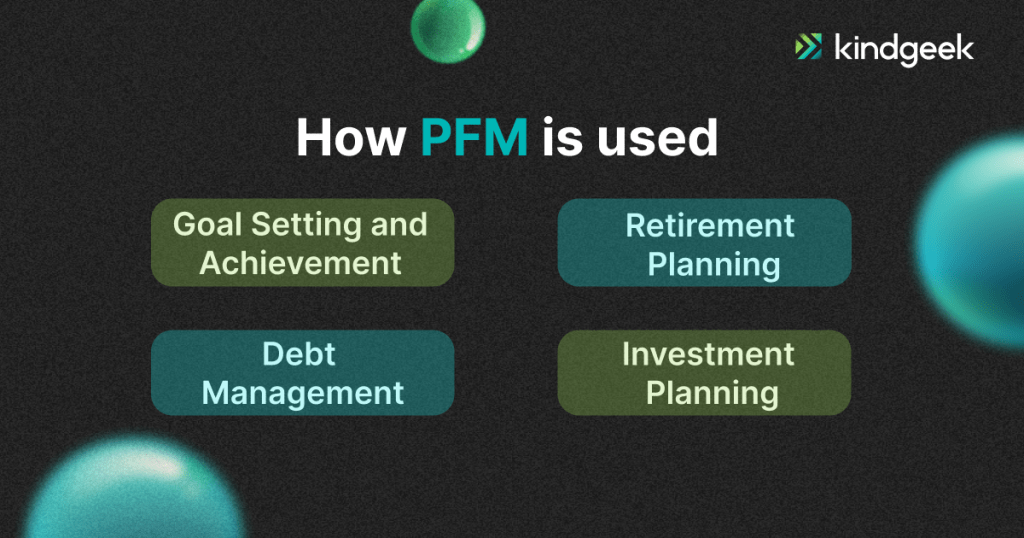

We already mentioned that the most important part of PFM is setting and achieving financial milestones. Let`s discover some of the areas PFM can help you cover:

Goal setting and achievement

This process begins with clearly articulating specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These might range from saving for a down payment on a house to funding a child’s education. PFM tools help break down these larger goals into manageable steps, creating a roadmap for success. They often provide visual tracking mechanisms, allowing users to monitor their progress and stay motivated.

Debt management

PFM tools can provide a comprehensive overview of an individual’s debt situation, including credit card balances, personal loans, mortgages, and student loans. Many PFM systems offer debt reduction strategies, such as the debt snowball or debt avalanche methods, and can calculate the impact of extra payments on the overall debt timeline. By providing clear visibility into debt reduction progress, PFM tools can help maintain motivation and discipline in the debt repayment journey.

Retirement planning

PFM tools can help individuals estimate their retirement needs. They may include retirement calculators that project future savings based on current contribution rates and investment returns. Advanced PFM systems may also integrate with employer-sponsored retirement plans and individual retirement accounts (IRAs), providing a holistic view of retirement savings and helping users optimize their contributions and investment allocations.

Investment planning

PFM tools often provide features for portfolio analysis, showing asset allocation across different investment types and sectors. Many PFM platforms also offer educational resources on investing, helping users make more informed decisions. Some advanced PFM tools even incorporate robo-advisory features, providing automated investment recommendations based on the user’s financial profile and goals.

Advantages of Successful Personal Finance Management

The benefits of effective personal financial management extend far beyond mere number-crunching and budgeting. At its core, PFM offers transformative advantages that can profoundly impact an individual’s financial well-being and overall quality of life.

Let’s explore how these benefits manifest and why they’re crucial for anyone looking to take control of their financial future:

Financial clarity

This is one of the primary advantages that creates a base for everything else. This clarity involves gaining a comprehensive and accurate picture of one’s financial situation. PFM tools and techniques help organize financial data in a coherent and accessible manner, allowing for easy interpretation and analysis. This clarity enables individuals to identify spending patterns, recognize areas of financial weakness, and highlight opportunities for improvement.

With a clear financial picture, decision-making becomes more informed and strategic. Whether it’s deciding on a major purchase, considering a career change, or planning for retirement, financial clarity provides the necessary context to make sound choices aligned with one’s overall financial goals.

Stress reduction

Financial stress is very common and can have far-reaching effects on mental health, relationships, and overall well-being. By implementing PFM strategies, individuals gain a sense of control over their finances, which can dramatically reduce anxiety and stress related to money matters.

Regular tracking and reviewing of finances can prevent unexpected financial surprises, reducing the likelihood of panic-inducing situations. Moreover, having a well-thought-out plan for managing debts, building savings, and working towards financial goals provides a sense of direction and purpose.

Long-term financial stability

This is perhaps the most impactful benefit of effective PFM, setting the stage for a secure and comfortable future. PFM encourages a forward-thinking approach to finances, emphasizing the importance of planning for both foreseeable and unforeseen circumstances.

This stability is achieved through various means: building and maintaining an emergency fund, strategically paying off debts, making informed investment decisions, and planning for major life events. This long-term perspective helps in making balanced decisions that consider both immediate needs and future aspirations, leading to a more stable and secure financial life over time.

Final Thoughts

Ultimately, when you learn what is PFM in banking, you start to understand that it is not just about managing money, it’s about creating a solid foundation for achieving life goals, realizing dreams, and ensuring peace of mind. As both a set of techniques and a category of digital tools, PFM offers individuals the means to take control of their financial lives with great precision and insight.

As financial technologies continue to evolve, PFM tools are likely to become even more sophisticated, offering deeper insights and more personalized recommendations. However, the fundamental principles of sound financial management remain constant. By embracing these principles and leveraging the power of PFM, individuals can navigate the complexities of personal finance with greater ease and success.

If you are looking for a trusted partner to develop your own PFM platform, check out our white-label solution. Our feature-rich toolkit is meticulously crafted through comprehensive user research, delving into financial habits, market dynamics, and individualised financial goals. Pick and mix market-leading features into your finance management app. Your brand – our technology.