Recently updated on April 18, 2025

Fintech innovations have made it possible to turn money into digital assets, which can be accessed with a few taps on the screen. This has created an essential need for banks, fintech companies, and other financial institutions to develop applications that allow users to make peer-to-peer payments without cash or physical cards.

The global P2P payment market was valued at $2.21 trillion in 2022 and is projected to reach approximately $11.62 trillion by 2032. Money transfer apps are likely to see increased usage and adoption and play a crucial role in facilitating this trend and broader acceptance globally.

Given the potential, money transfer apps are a profitable niche in today’s cashless world. So this article will describe everything you need to know about money transfer features and how to create a money transfer app that meets the needs of today’s users.

Content:

- Different Types of Money Transfer Apps

- Essential Elements of a Money Transfer Application

- How to Create a Money Transfer App: Development Process

- Final Thoughts

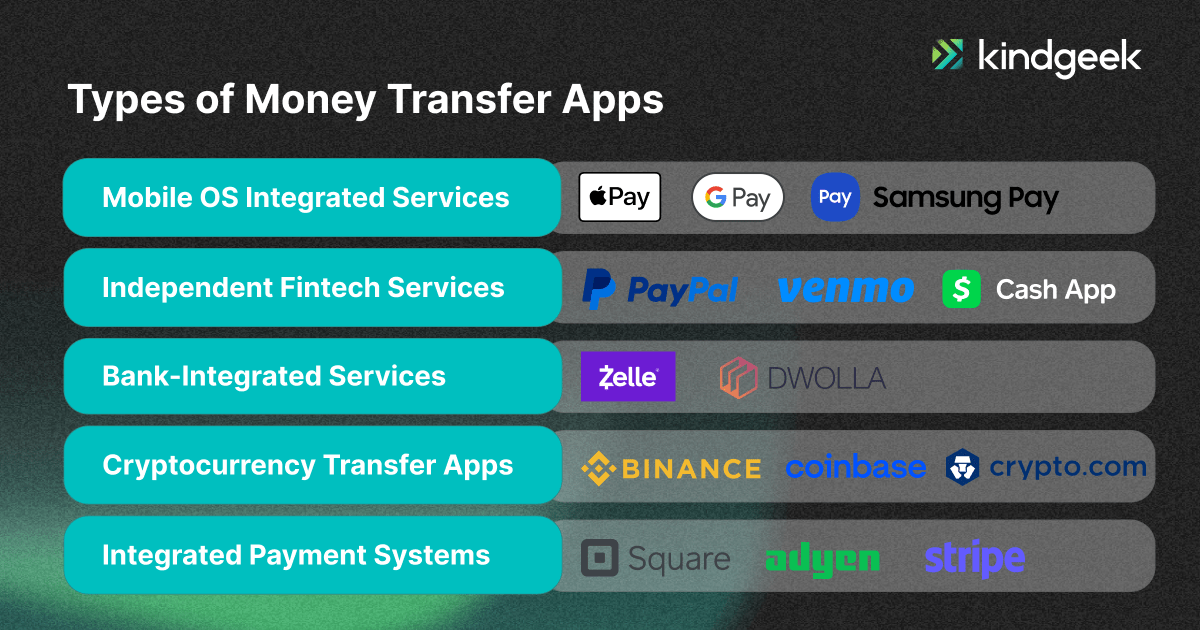

Different Types of Money Transfer Apps

Based on their underlying technology and service model, money transfer apps can be classified into:

Mobile OS Integrated Services

These services are integrated directly into mobile operating systems. They often provide features like contactless payments, in-app purchases, and P2P transfers.

Apple Pay (iOS), Google Pay (Android), and Samsung Pay (Samsung devices) are widely used services that have grown popular due to contactless payments through NFC-enabled payment terminals.

Independent Fintech Services

These apps are standalone financial technology services that function without being tied to a specific operating system. They include popular fintech services like PayPal, Venmo, Cash App, and more.

These apps offer many features, including P2P payments, and often integrate with bank accounts or credit/debit cards.

Bank-Integrated Services

These services are often integrated with specific banks and financial institutions. Users can transfer money within the bank’s ecosystem or between accounts at different banks.

These apps usually come with the bank’s own security measures and customer service. A famous example is Zelle, which partnered with leading banks across the U.S.

Cryptocurrency Transfer Apps

Platforms like Coinbase, Binance, and Crypto.com operate independently from traditional financial systems and focus on transferring and managing cryptocurrencies. They provide wallets, trading platforms, and sometimes integration with fiat currency services.

Integrated Payment Systems

These systems are used by businesses to accept payments online or in person. Examples include Stripe, Square, and Adyen. They often provide APIs for integrating payment processing into apps or websites. They may also include handling transactions, invoicing, and financial reporting features.

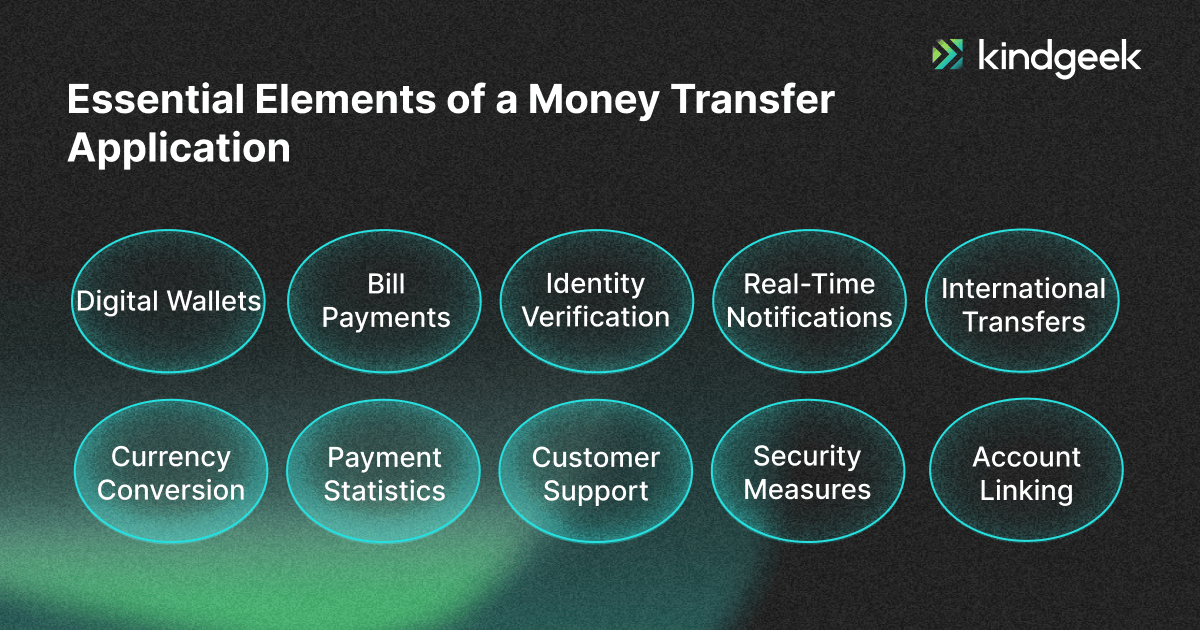

Essential Elements of a Money Transfer Application

When it comes to managing your money on the go, a well-rounded application is your best financial ally. Money transfer app development should focus on implementing these important features:

Digital Wallets

Digital wallets allow users to store funds electronically, enabling quick and secure transactions. This eliminates the need for physical cards, which immensely benefits many users.

Digital wallets can be linked to bank accounts or payment cards, providing a convenient way to manage finances within the app.

Bill Payments

Money transfer apps can be used to pay bills, such as utilities, rent, and internet. This feature takes care of various bills in one place, streamlining the payment process.

Identity Verification

There’s always a heightened risk of fraud when dealing with financial operations. Therefore, money transfer apps development must prioritize security and regulatory compliance, including an identity verification process. This may involve uploading identification documents or using biometric data to confirm the user’s identity.

Real-Time Notifications

Instant notifications for every transaction or account change help quickly detect and respond to suspicious activity. These real-time alerts drive customer loyalty by helping users stay informed about their financial activities.

International Transfers

This feature is trendy among businesses dealing with global transactions. It allows users to send money abroad, supporting multiple currencies and delivery methods. International transfers can be made to bank accounts, digital wallets, or cash pick-up locations, offering flexibility for different needs.

Currency Conversion

This is a valuable feature for sending money across borders. When performing international transfers, the app automatically converts currencies at the current exchange rate.

Payment Statistics

When you create a money transfer application, detailed reports and analytics are a feature worth including, as they help users manage their finances more effectively. Payment statistics can include expense breakdowns by category, transaction history, and budgeting tools.

Customer Support

Quality customer support through various communication channels can assist users with issues or questions. The app may also offer self-help resources like FAQs or community platforms.

As customer service chatbots are gaining popularity, their integration into money transfer app development can boost user engagement and simplify support workflows.

Security Measures

Employing advanced security technologies, such as data encryption, multi-factor authentication, and suspicious activity monitoring, is critical to protecting users from fraud.

Account Linking

This feature allows for seamless management of multiple payment methods within a single platform. Users can link their bank accounts or payment cards to the app for easy and convenient payments.

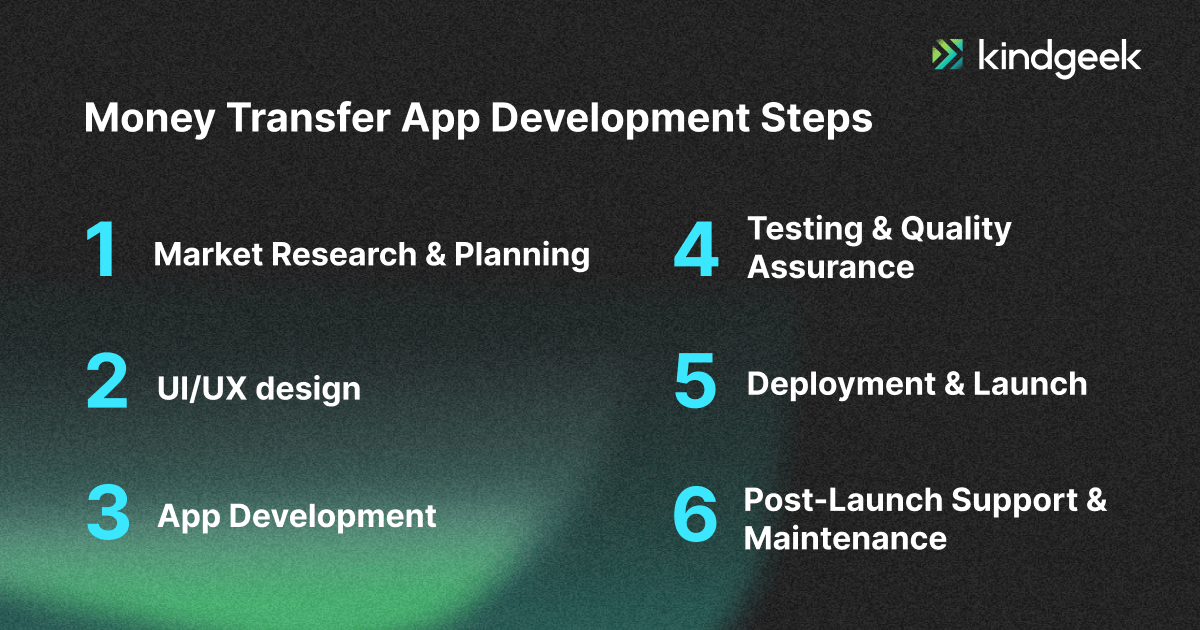

How to Create a Money Transfer App: Development Process

If you want to build money transfer app features that make a difference, follow these steps:

Market Research and Planning

Thorough market research is crucial before proceeding with development. This step is all about understanding market needs and user expectations.

Kindgeek’s expert discovery approach includes preparing an effective development strategy, designing carefully planned product architecture, and optimizing resources. It defines your app’s features, target users, value proposition, and a detailed project plan and timeline to guide the software development process.

UI/UX design

User experience is key to the success of any money transfer app. In this step, you’ll design a user-friendly interface that simplifies sending and receiving money and accessing additional features.

Wireframes are created to visualize the app’s layout, while app user flows are mapped out to illustrate the user’s path through the app.

App Development

With market research complete and UI/UX design in place, the next step is to understand how to build a money transfer software that is technically sound and efficient. Front-end and back-end development are critical components.

Here, developers build the core of your app. For the back-end part, they develop server-side logic, integrate with banking APIs, and set up databases to securely store user information and transaction data.

Front-end development uses design prototypes to create an intuitive, responsive application that provides a seamless user experience while interacting with the back-end.

Testing and Quality Assurance

Thorough testing is crucial to identifying and fixing bugs or issues before launching the app. This step includes functional testing, security testing, performance testing, and user acceptance testing.

Deployment and Launch

Once you create an application for money transfer that passes all testing phases, it’s ready for deployment. This step involves publishing the app on app stores like Google Play and the Apple App Store, setting up cloud infrastructure, and configuring the app for live use.

Post-Launch Support and Maintenance

Deployment and launch only mark the start of the journey. But how to make a money transfer app work in the long run?

After launching the app, ensure continuous support and maintenance to keep everything running smoothly. This step involves monitoring the app’s performance, gathering user feedback, and making improvements over time.

Final Thoughts

With a deep understanding of technology and user needs, creating apps for money transfer operations becomes a rewarding experience. It’s an opportunity to capture a significant share of the digital payments landscape.

By following a structured approach — from market research to ongoing maintenance — you can implement key features for seamless user experience and security. With continuous support and regular updates, your application can remain on top of the game.

If you want your app to stay aligned with evolving market demands, Kindgeek offers comprehensive support and expertise to bring your idea to users.