Recently updated on April 18, 2025

Transferring money from point A to point B sounds easy on paper. In practice, the process is simple only when it’s two people who are close to each other and have enough cash. Money transfers can be quite a hustle, especially if it’s an international transfer, and it’s neat when software can handle this hustle for you. That’s why peer-to-peer money transfer apps are such a big deal in the world in general and in the fintech sector in particular. And the more society moves into the cashless direction, the greater the need for quick and convenient P2P payment apps. Therefore, local markets crave relevant payment software that can meet the demand of customers. And, if the niche is free or the present options are insufficient in some aspects, you can develop one and enter the fintech arena yourself. Creating a P2P payment app is also quite a hustle, though, but don’t worry, we’ve got you covered.

In this article, you will learn about features of money transfer apps, challenges developers face developing a P2P payment mobile app, a description of some popular payment apps, ways of P2P apps monetization, and the best method for determining the price for developing such an app.

Content:

1. A Profile of a Common P2P Payment App

2. Benefits and Challenges of Building a P2P Payment App

3. 7 Important Features For a Peer-to-Peer Payment App

4. How to Develop a P2P Payment Apps

5. Examples of P2P Payment Apps

6. How to Monetize a P2P Payment App?

7. How Much Does it Cost to Build a P2P Payment App?

8. Consider Kindgeek Your Trusted P2P App Development Partner

9. Conclusions

A Profile of a Common P2P Payment App

A P2P payment app is an application that performs online money transfers from one app’s client to another app’s client. A P2P payment app is a willing horse of the fintech industry. Such apps handle different work that varies from your casual ‘Friday evening with friends’ money transfers to bigger international payments for friends/relatives abroad (though not all apps provide such a possibility). In addition, the apps can be used to pay for home utilities, services, and online purchases. At their core, money transfer apps are simple and straightforward pieces of tech. Their primary function is to make money transfers as simple and fast as possible. It’s worth mentioning though that the majority of the payment apps don’t allow transfers for business purposes, and even if some do, the fees can be quite significant.

Therefore, a well-rounded P2P payment app:

– Is created for personal use, so should have a ‘personal’ feel to it with the possibilities to customize the user experience and visuals, intuitive workflow, and pleasant design

– Is connected to a user’s bank account or debit/credit card depending on a particular payment’s app requirements and policy

– Provides fast money transfers. Though, depending on the type of transaction (international, local) or how the app handles payments, the transaction may take some time.

– Allows canceling a transaction within a certain timeframe

– Contains history of previous transactions

– Sends invoices or bills

– Is well-protected

– Has a chat

– Has push notifications

– Has multi-factor authentication

Some P2P payment apps may provide the possibility to exchange currency, provide microloans, and international money transfer services. An important thing to remember here is that money transfer apps continuously evolve, offering a broader spectrum of services, providing more convenient ways of performing operations, and, overall, making the world of cashless society a more accessible and attractive place to be.

Benefits and Challenges of Building a P2P Payment App

If you know or feel that there is a viable opportunity to enter the market of money transfers and want to create a money transfer app, you will have the following P2P payment opportunities for yourself:

Popular and lucrative niche

As we’ve written in our article “How to Make a Digital Bank Like Monzo,” the fintech industry reigns supreme in the tech world with a staggering $118bn of investments. And, there’s not a functional fintech ecosystem without convenient money transfers. According to Business Insider, “digital peer-to-peer payments are becoming a new social norm” with expectations for “mobile P2P to rise to $336 billion.”

Great prospect for app evolution and scaling up

The fintech sector won’t be slowing down its stunning pace anytime soon. It means that if you can keep up with its pace and ensure the relevance of your product, your business will have a staggering potential for growth and attraction of new customers.

Significant investments

As you see, investors absolutely love fintech. Therefore, with a proper approach, you will have no trouble funding your product. Our experience demonstrates that an MVP (minimal viable product) or other relevant deliverables are enough to attract investments.

Novel technologies

According to P2P payment apps specialty, they should work with cutting edge technologies to ensure the protection of transfers and security of customers’ data. If you create a fintech product, it means that your team will be constantly cultivating proficiency and experience in some of the most promising areas of software development.

However, if you decide to create a mobile P2P payment app, there will be some considerable challenges to overcome as well.

However, if you decide to create a mobile P2P payment app, there will be some considerable challenges to overcome as well. Some of these challenges are the other side of the coin of the aforementioned benefits.

Dense competition

A popular and lucrative niche is great, but it comes with hungry competitors who want the bite of the fintech pie as badly as you do. Therefore, you need to be at the top of your game to overcome them.

Security concerns

Dealing with payment apps is a perspective in regards to technologies, but it requires an extremely cautious approach to security. Developing a well-protected P2P app is a feat of software development prowess that calls for an experienced dev team.

Regulations

There are strict regulations regarding money transfers that vary depending on a country, the type of transfer, the sum of money sent, etc. Your instant P2P payment app will have to follow them thoroughly.

High standards

Fintech apps should be an embodiment of the best that a mobile application as a concept can offer, providing sleek intuitive design, bugless functionality, great support, and high-load capacities.

Overall, P2P payment app development is a long and complex process that will involve various stages, such as research and business analysis of the idea, research of regulatory environment, design, planning of secure back-end architecture, software development, quality assurance, support, & maintenance.

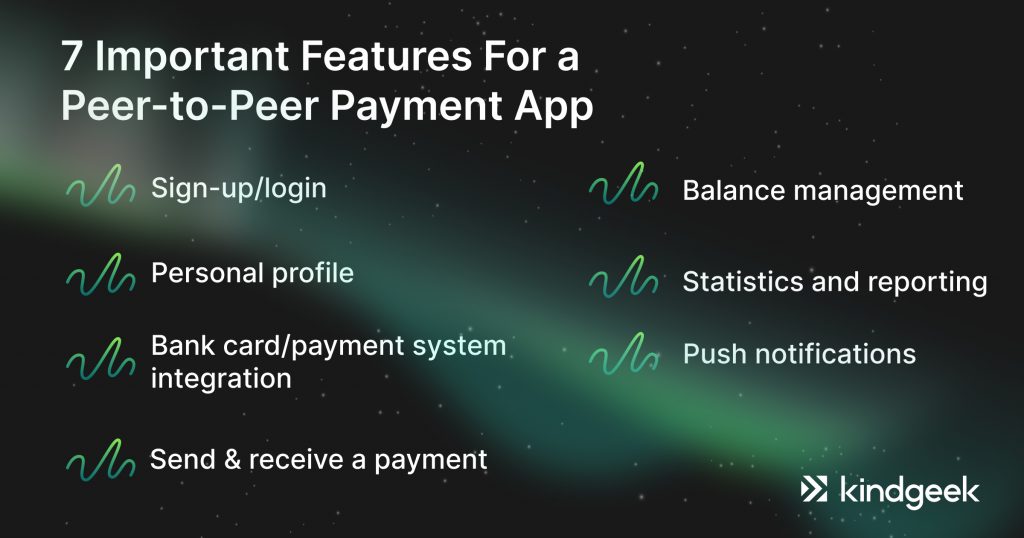

7 Important Features For a Peer-to-Peer Payment App

Before getting started with developing a P2P payment mobile app, let’s highlight the core features that should power your MVP.

Sign-up/login

This is the feature the whole interaction with a mobile P2P app starts with. It should be simple and still secured. For example, consider adding an identity verification procedure when registering in the app and signing in for the first time, and biometrical identification for each subsequent login.

Personal profile

The user’s personal profile should also be simple, convenient, and provide some room for customization: for example, adding a photo. A profile should also have a Settings feature so users can manage their notifications, backgrounds, security, and data the application tracks.

Bank card/payment system integration

This feature is essential to make a money transfer app. You have to add a bank card or other payment system integration so that the users can replenish their balances and transfer money from the application.

Send & receive a payment

This is one more core feature to create in the process of money transfer app development. Make sure the money transfer process is as secure as possible. For example, some modern P2P mobile apps are powered by blockchain to ensure the ultimate security and transparency.

Balance management

With the help of this function, the users should be able to check their balance and replenish it.

Statistics and reporting

Consider providing your users with visual dashboards so that they can immediately get an idea of their spendings. But don’t overload the dashboard and think about the ways to customize the reporting according to the core parameters the users might be interested in.

Push notifications

This is an important feature to drive engagement and instantly notify the user of the received processed and canceled payments.

How to Develop a P2P Payment App and Not Fail

P2P payment app development is pretty challenging since you have to provide the users with money transfer convenience and security, develop an intuitive UI and enjoyable UX, plus make sure your solution has the chance of standing out on the market. So, here is how to develop a P2P payment app in a smart way, following the best P2P payment app development practices and a lean approach.

1. Add some uniqueness to your future solution

It is projected that by 2023, $1 trillion in payments will be transacted via P2P lending and money transfer applications. The industry is growing rapidly, so adding some unique features to your application already now makes sense. Do your best to suggest some winning ideas that will let your future solution stand out on the market of P2P mobile transfers. Consider making an impact on ultimate clarity, security, the ways to make mobile payments simplified, and promote more trust.

2. Validate your suggestion with market research

As the next step to develop a mobile peer-to-peer payment app, proceed with market research, paying the closest attention to the already launched solutions, the ways they approach money transfer, their strong and weak features, plus the existing problems the users complain about.

To get a better idea of the target audience’s pain points, don’t hesitate to run focus group surveys and ask direct questions. To evaluate the potential of your idea in a given market environment, use the life-proven methods of PEST, SWOT, and Five Models discovery.

3. Check legal regulations in advance

To create a money transfer app that will be law-compliant, you should check the legal regulations of the target market in advance. In addition to GDPR, there are a lot of fintech-specific legal norms such as the Gramm-Leach-Bliley Act (GLBA), the Fair Credit Reporting Act (FCRA), and the Federal Trade Commission Act (FTC Act). Depending on the specificity of your solution, some regulations may be applicable to your business, so it is better to consider legal consulting services along with P2P mobile app development.

4. Get in touch with the development vendor

After you have validated the idea to create a money transfer app and discovered the legal norms you should be compliant with, it’s time to get in touch with a fintech-savvy development vendor. Given that P2P app development comes with a lot of specifics, possible pitfalls, and challenges, it is always better to consider the development vendors with hands-on experience in fintech, ideally, in P2P development. Such a tactic will allow you to reuse their experience and protect your business from costly mistakes.

Kindgeek has the necessary experience and expertise to create a market disruptive P2P payments solution. Get in touch with us right now to unlock the best practices for your project!

5. Create the first MVP

Being supported by an experienced development vendor, you are welcome to create the first Minimum Viable Product. Use the list of the possible features we have shared above to develop the core of your future solution but make sure to focus on the essential features only. After your MVP is ready, get back to your focus group and survey them one more time, discovering their both positive and negative impressions. Use the gathered insights as the guideline for the further development process.

6. Test and check one more time

All solutions need testing and quality assurance, but this process becomes even more important for the apps that take responsibility for seamless data transfer and access financial data. So, make sure to run multiple test scenarios and pay special attention to the solution’s security. There should be no loopholes and errors that hackers may potentially use to steal the users’ data. Also, check one more time if two-factor and biometrical identification work correctly.

7. Grow your app

After your MVP is created, tested, and validated with the help of users’ feedback, you are welcome to grow your solution, scale, support, and maintain it. Make sure to stay tuned to the latest market trends, security assurance practices, and most importantly, the expectations of your users. Such a balanced approach opens the way to create a stable and market-demanded solution.

Examples of P2P Payment Apps

Let’s check out some of the most popular P2P money transfer apps the world has to offer.

Venmo — Casual Transfers

Venmo is a mobile-first P2P payment app that operates in the USA and serves US residents only. The software is owned by PayPal. Unlike the latter, Venmo is created to make purchases and send money to friends and acquaintances. A user can connect a bank account or credit/debit card to Venmo. The app doesn’t put any fees on its casual transactions but charges a 3% fee on transactions made with a credit card.

OFX — Overseas Payments

OFX is a 20 year old money-transfer app that allows sending money to more than 190 countries in different currencies. On top of that, OFX offers a real-time currency exchange tool that allows choosing the most beneficial exchange rate. The app is created for bigger money transfers, so the minimal sum for a transfer is $1000 (OFX’s alternative — TranferWise — doesn’t have such a limitation but operates in fewer countries).

WorldRemit — Smaller Overseas Payments

WorldRemit is similar to OFX but operates in 119 countries and is great for transferring lesser amounts of money. It offers fast transactions, no limitations for transferring money, and straightforward user-flow. It’s simple, fast, and reliable. WorldRemit fees vary depending on the type of currency used and the country. The amount of money to send varies from $4 up to $25.

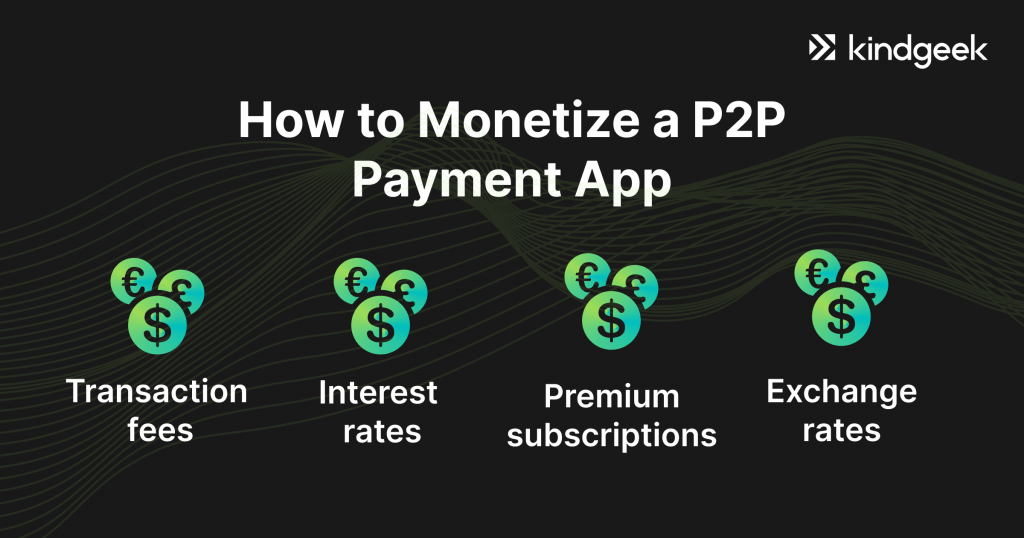

How to Monetize a P2P Payment App?

The most prevalent methods of monetization of money transfer apps include:

- Transaction fees. Some apps put fees on all transactions, others — only on certain types of transactions.

- Interest rates. Some providers make money by earning interest on the money left in accounts they serve and by charging merchants that use the service.

- Premium subscriptions. Some companies offer premium features for a monthly subscription fee.

- Exchange rates. Some P2P payment companies earn money on foreign exchange rates.

How Much Does it Cost to Build a P2P Payment App?

Developing a P2P payment app is similar to developing any other complex and security-heavy application. It requires several stages of development. The process depends on the stage of the idea’s preparedness and overall complexity of a product. The best way to measure the costs is to find a software development team that is capable of conducting a thorough cost estimate.

In case if the idea of creating a money transfer app is in its initial stages of development, the Discovery Phase can be quite handy. At Kindgeek, the Discovery Phase is a complex business analysis procedure that involves BAs as well as UI/UX designers and software engineers.

The discovery phase will not only provide you with the most accurate estimates of future costs but will deliver, depending on the chosen package,

– product concept from Product Manager

– prototypes from Business Analyst

– a visual concept from UI/UX Designer

– architecture concept from System Architect

– estimates of the cost of developing a P2P payment app

Consider Kindgeek Your Trusted P2P App Development Partner

If you are looking for a trusted partner to build your own P2P payment app, money transfer software or digital wallet software solution, consider Kindgeek. With extensive experience in mobile development and fintech app creation, we can estimate the costs, help you build a reliable money transfer app, or conduct the discovery phase. The latter will determine the price and provide you with the above-mentioned deliverables that can be used as a solid foundation for the further development of the product or attracting investors. If you ever wondered how to build a P2P payment app, we have all the answers you need.

If you are interested, contact us.

Conclusion

Creating a P2P application can be a winning business idea in 2023 and beyond. Still, this solution comes with its specifics – ensuring legal compliance and data security can be even more challenging than building the app itself. Kindgeek is here to share our strong legal and tech expertise to create a mobile P2P payments application that will be able to promise data safety, seamless money transfer, perfect usability, and an enjoyable user experience!

How do I make a money transfer app?

Recently updated on April 18, 2024

Generally, you are welcome to follow life-proven Agile and LEAN development methodologies, creating, validating, and testing your application step by step, plus take the specifics of P2P into account.

What technologies should I use for P2P payment app development?

Recently updated on April 18, 2024

Blockchain is an innovative response to modern financial data security issues, so using it as the main technology in P2P payment app development may be a good choice.

What are the benefits of developing a P2P payment mobile app?

Recently updated on April 18, 2024

P2P payments are on the rise, and this market is projected to grow in response to pandemic-related challenges and traditional banking ineffectiveness.

What are the main challenges in money transfer app development?

Recently updated on April 18, 2024

The main challenges in this process are choosing the secured technology, staying law-compliant, and winning the trust of the users.