Recently updated on July 30, 2025

Over the last years, the concept of open banking and open finance has become extremely popular and widely demanded, creating an entire financial ecosystem of communication between different financial systems, allowing for greater flexibility and a tailored user experience. All of this is possible because of API (Application Programming Interfaces), the calls for which are predicted to increase 427%, from 137 billion USD in 2025 to 720 billion USD by 2029, according to Juniper Research.

In this article, we will discuss how financial API itegration works and why you should consider it. We will also share some insights on how to get started with API integration and what lies in the future of financial API.

Just keep reading!

What Is Financial API Integration and How Does It Work?

At its core, financial APIs are a set of tools and protocols which act like a bridge between different financial applications, systems and third-party services. Because of this connectivity, the financial data can be quickly and effectively and most importantly, securely, exchanged, in order to provide a seamless experience across different platforms. Of course, it all can happen only after the user`s approval.

You can divide financial APIs into different categories, depending on which areas, specifications or purpose you want to highlight. Here, we will divide it into five primary types, where each type addresses specific business needs and enables different aspects of financial service delivery:

1. Payment APIs

Payment APIs form the backbone of digital commerce, facilitating secure transaction processing across multiple channels and payment methods. These interfaces handle everything from basic credit card processing to digital wallet integration, cryptocurrency payments, and alternative payment methods. Payment APIs enable businesses to accept payments seamlessly while managing complex transaction routing through various payment networks.

2. Banking APIs

These APIs provide secure access to customer financial data, including balance information, transaction history, and account details, powering budgeting applications and personal finance management platforms. They also enable payment initiation directly from customer bank accounts, supporting immediate transfers, scheduled payments, and bulk payment processing. Banking APIs serve as the cornerstone of open banking initiatives worldwide, facilitating account aggregation services and enabling fintech companies to build banking products through Banking-as-a-Service (BaaS) models.

3. Trading APIs

Trading APIs enable retail and institutional investors to build sophisticated trading applications and automated investment strategies. These APIs provide programmatic access to equity markets, forex trading, and cryptocurrency exchanges with real-time trading capabilities, portfolio management features, and comprehensive market data analysis. They support order placement and management, real-time price feeds, historical market data access, and advanced risk management tools.

4. Regulatory and Compliance APIs

Compliance APIs ensure financial applications meet regulatory requirements while streamlining compliance processes and reducing operational overhead. These APIs automate customer identity verification through KYC (Know Your Customer) processes, including document scanning, biometric verification, and database cross-referencing against regulatory watchlists. They also provide AML (Anti-Money Laundering) capabilities with transaction monitoring, suspicious activity detection, and regulatory reporting.

5. Investment and Wealth Management APIs

These APIs provide comprehensive investment tracking, performance analysis, asset allocation optimisation, and real-time portfolio valuation with automated rebalancing capabilities. They power robo-advisory platforms offering algorithmic portfolio construction, goal-based investing features, and personalised investment recommendations based on individual risk profiles. Investment APIs also deliver real-time and historical market data, including stock prices, economic indicators, and financial news feeds that support technical analysis tools and market research applications.

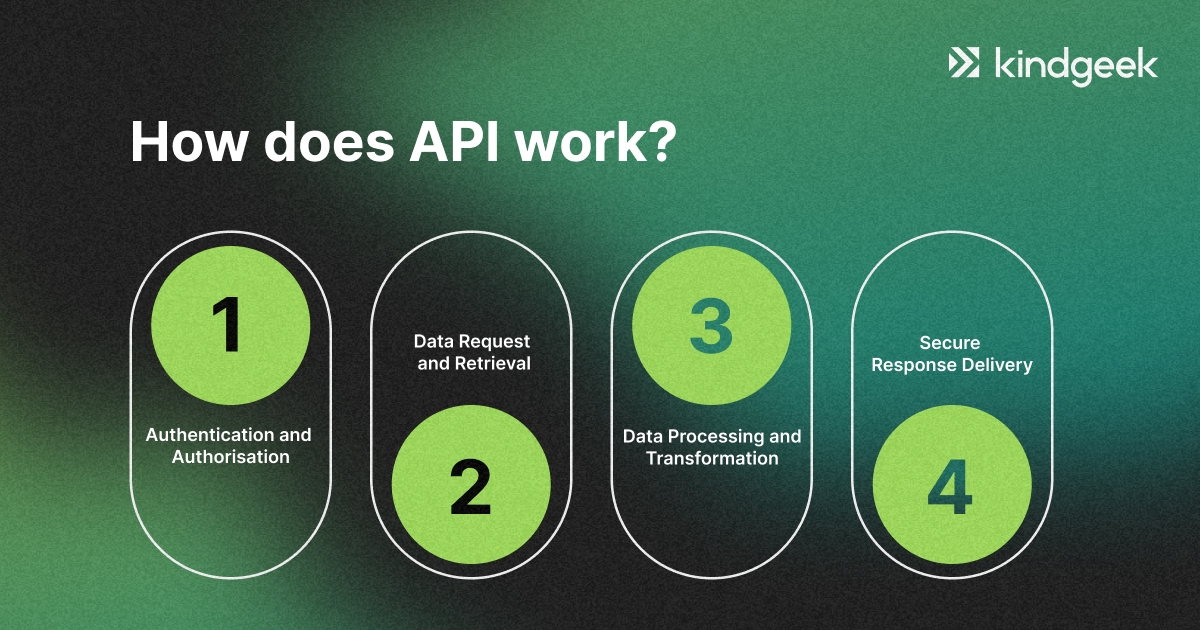

Now let’s see how this will work. When a third-party application needs to access banking information, the process unfolds through a sophisticated sequence of authentication and data exchange:

Authentication and Authorisation

The process begins when a user grants permission to an application to access their financial data. The financial API validates this request through secure protocols, generating special access tokens that permit specific, limited access without exposing actual login credentials. These tokens serve as temporary digital passes with defined permissions and expiration dates.

Data Request and Retrieval

Once authenticated, the application sends specific requests to the financial API for information or actions, such as checking account balances, retrieving transaction history, or initiating payments. The API translates these requests into formats the financial institution’s systems can understand, then retrieves the requested data from core banking systems.

Data Processing and Transformation

After retrieving the raw financial data, the API processes and transforms it into standardised formats that third-party applications can easily consume. This step often involves normalising inconsistent data structures, enriching transaction data with additional information, and applying business rules based on regulatory requirements.

Secure Response Delivery

Finally, the processed data travels back through the secure connection to the requesting application. The API encrypts this information during transit and delivers it in a consistent, developer-friendly format. The application then presents this information to users through intuitive interfaces or uses it to perform automated functions like categorising spending or generating financial insights.

3 Main Concepts of API For Financial Integration

| Concept | Key Components | Details |

| API Endpoints and Data Formats | Common Financial API Endpoints | An API endpoint is a specific digital address (URLs) where an API accepts requests from applications, functioning as the gateway for accessing resources or services hosted on the API’s server |

| Data Formats | JSON (JavaScript Object Notation): Lightweight, human-readable format that has become the standard for most modern APIs due to its simplicity and compatibility with JavaScript XML (eXtensible Markup Language): More structured but verbose format still used by some legacy financial systems | |

| Security and Compliance Requirements | Regulatory Compliance | PSD2 (Payment Services Directive 2): European regulation requiring banks to provide API access to account information and payment initiation Open Banking: Standards framework for secure financial data sharing through APIs GDPR: Data protection requirements affecting how personal financial information is processed and stored |

| Security Measures | Encryption: TLS/SSL for data in transit, field-level encryption for sensitive data Tokenisation: Replacing sensitive data with non-sensitive equivalents Rate Limiting: Preventing abuse through request quantity restrictions | |

| Performance and Reliability | Latency and Response Time | Synchronous vs. Asynchronous: Immediate responses vs. callback patterns for longer operations SLAs: Service level agreements defining maximum acceptable response times (typically 100-500ms for critical financial operations) Caching Strategies: Balancing data freshness with performance requirements |

| Error Handling and Resilience | Standardised Error Codes: Clear, consistent error responses with appropriate HTTP status codes Idempotency Keys: Ensuring operations aren’t accidentally repeated during network issues Circuit Breakers: Preventing cascading failures when downstream systems fail Fallback Options: Degraded service patterns when primary systems are unavailable |

Financial API Integrations: How to Do It Best

When implementing API for financial management, it is important to follow industry best practices to ensure the security, reliability, and maintainability of your systems. These approaches have been refined through years of successful implementations across the financial technology sector. Let`s take a look.

Understand Authentication and Authorisation

Mastering the authentication mechanisms specific to financial APIs is fundamental. Implement relevant protocols, manage tokens securely with proper rotation policies, and understand the distinction between authentication (proving identity) and authorisation (permission levels). Never store sensitive credentials in code repositories or configuration files, and implement proper secrets management systems. Regularly audit authorisation scopes to ensure they follow the principle of least privilege.

Don`t Neglect Rate Limits

Financial APIs typically implement strict usage limits to ensure system stability. You should design your integration to work within these constraints by implementing intelligent retry logic with exponential backoff strategies. Cache responses when appropriate to reduce unnecessary calls, and distribute requests evenly over time rather than sending them in bursts. Monitor your usage patterns against allocated quotas and set up alerts well before reaching critical thresholds. For mission-critical operations, negotiate appropriate rate limits with API providers.

Prioritise Security and Data Protection

As with everything in the financial sector, security must be integrated into every aspect of your API implementation. Implement proper data encryption both in transit and at rest, and regularly scan for vulnerabilities. Apply strong input validation on all data entering your systems through APIs, and implement fraud detection measures appropriate to your use case. Maintain comprehensive audit logs of all sensitive operations, and establish clear protocols for handling security incidents. Regularly review and update your security practices as threats evolve.

Test Extensively

Your financial API testing must be comprehensive and continuous. Implement automated testing pipelines that cover unit tests, integration tests, and end-to-end scenarios. Create dedicated test environments that simulate production conditions without affecting real financial data. Test edge cases thoroughly, including timeout handling, partial failures, and recovery scenarios. Perform regular security penetration testing and compliance verification.

The Future of API Integration

The financial API landscape is evolving rapidly, with several transformative technologies reshaping how financial data and services are delivered. Let us outline three significant trends that are driving innovation in financial APIs:

AI and Machine Learning Integration

Financial APIs now leverage machine learning algorithms to detect fraudulent transactions in real-time, identifying unusual patterns that might indicate potential fraud before transactions are completed. This capability has dramatically reduced false positives while improving security.

Predictive analytics APIs can also forecast customer financial behaviour, cash flow patterns, and market movements, enabling more proactive financial management. These APIs transform raw transaction data into actionable insights, helping businesses anticipate financial needs before they arise.

Another area is risk assessment, where APIs utilise machine learning to evaluate creditworthiness more accurately by analysing alternative data sources beyond traditional credit reports, expanding financial access to previously underserved populations.

Blockchain Technology and Smart Contracts

Decentralized finance (DeFi) APIs are providing programmatic access to blockchain-based financial services, including lending, borrowing, and trading without central authorities. These APIs allow developers to integrate cryptocurrency and tokenised asset functionality into traditional applications.

Smart contract APIs are now simplifying the creation and management of self-executing contracts with terms directly written into code. This reduces the need for intermediaries in financial agreements and ensures automatic enforcement of contractual terms.

Cross-border payment APIs that are built on blockchain technology are enabling faster, cheaper international transfers by eliminating multiple intermediaries and reducing settlement times from days to minutes or seconds.

Open Banking and Embedded Finance Evolution

Banking-as-a-Service (BaaS) APIs, for example, have evolved from basic account information access to comprehensive banking functionality that can be embedded into non-financial applications. This has given rise to “embedded finance,” where financial services appear natively within non-financial platforms and applications.

Financial orchestration APIs now coordinate complex multi-step financial workflows across different providers, enabling seamless customer experiences that may involve multiple financial institutions working together behind the scenes.

Real-time payment APIs have also advanced beyond basic transfers to include request-to-pay functionality, variable recurring payments, and enhanced data sharing, creating more flexible payment experiences that adapt to modern consumer and business needs.

Consider Kindgeek as Your Trusted Partner

If you are looking for a secure and trustworthy API integration partner, consider Kindgeek. We are a full-cycle fintech development company that provides core fintech banking and payment solutions to serve as a software shortcut for businesses looking to launch their fintech products.

Our white-label fintech solution can significantly speed up your way to the market. With a wide range of pre-built features, combined with thoughtful customisation and development, you receive a solution with the functionality to jumpstart your online finance business or get digital without heavy upfront investment.

You can also choose from a whide range of integrations to make you product stand out and bring maximum value.

Final Thought

Financial APIs have already transformed from simple data connectors to sophisticated platforms powering innovation across the financial ecosystem. If you are looking to implement these interfaces, prioritising security, reliability, and scalability becomes essential to your success. The financial API landscape continues evolving rapidly, with artificial intelligence, blockchain technology, and embedded finance creating new possibilities for both traditional institutions and fintech innovators.

The future of financial services will increasingly depend on these digital connections—enabling faster development cycles, more personalised customer experiences, and business models that were impossible just a few years ago.

If you decide to work on mastering financial API integration, it will garantee a significant competitive advantages through enhanced agility and expanded service offerings. As regulations continue to promote greater openness and standardisation, we can expect even more innovation in how financial data and capabilities are shared, accessed, and utilised across the global economy.