Recently updated on May 26, 2025

Today, most banking interactions are shifting online, driving fintech startups and banks to create a mobile banking app focused on user experience and security.

The global mobile banking industry’s total worth was $1.34 billion in 2024, and by 2032, it is expected to reach $4.26 billion. This indicates a strong opportunity for financial institutions to capitalize on mobile banking growth by creating apps that align with customer expectations.

Developing a mobile banking application is all about understanding people’s values and pains and the specifics of the software market. That’s why we’ve gathered everything you need to know to create the ultimate banking app.

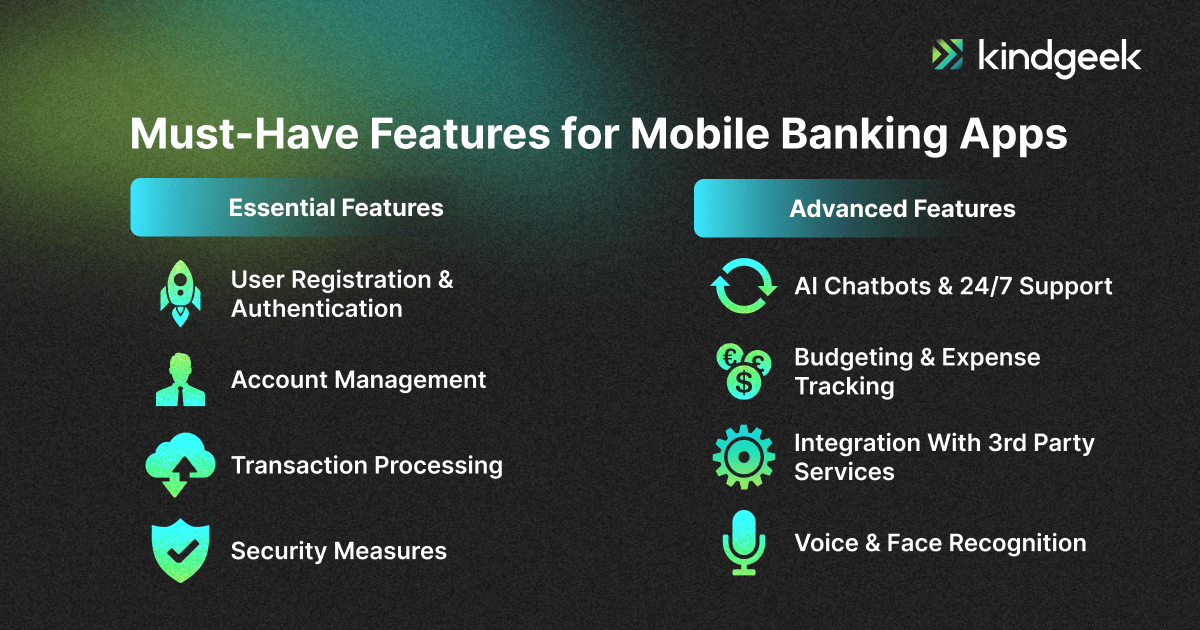

Must-Have Features for Mobile Banking Apps

Before we step into how to build a banking app, let’s understand its essence and which features it could potentially include.

A mobile banking app is a software platform that lets users perform traditional activities like checking balances and transferring funds from their smartphones and tablets. It offers users a safe and easy way to handle their money online.

Essential Features

Some of the core features of these apps include:

User Registration and Authentication

Secure and seamless onboarding is crucial in mobile banking. This feature allows users to create an account with secure methods like email, phone number, and social media integration, verify their identity, and log in safely.

Banking apps verify users through multi-factor authentication, biometrics (fingerprint or facial recognition), or OTPs to ensure account protection.

Account Management

Effective account management allows users to handle various aspects of their accounts without visiting a physical location. This may include making balance inquiries, viewing transaction history, and basic profile editing.

Transaction Processing

Banking apps enable users to manage their finances by sending money, paying bills, transferring funds between accounts, and making peer-to-peer or international wire transfers.

Security Measures

Online banking security measures like two-factor authentication (2FA), biometrics (fingerprint scanning, facial recognition, or voice recognition) and end-to-end data encryption strengthen app protection. They facilitate logging in to the app, authorising transactions, and accessing sensitive information.

Advanced Features

Understanding how to make a banking app starts with core functionality. But to stand out in today’s market, you need to integrate advanced features that can truly set your app apart from the competition.

AI Chatbots and 24/7 Support

Fintech chatbots provide users with instant, 24/7 assistance for common banking inquiries. Thanks to recent advancements in AI technologies, these chatbots have become more intelligent and conversational.

With AI in banking, your mobile app can evolve into a full-on assistant. Chatbots can handle checking account balances, guiding users through transactions, and offering personalized financial support.

Budgeting and Expense Tracking

These features help users manage their finances more effectively. They can include tracking saving goals, expenses and financial health reports.

Integration with Third-Party Services

Mobile banking apps can integrate with external platforms through reliable APIs. This way, users can manage their finances within a more connected and comprehensive financial ecosystem.

Third-party services may include payment gateways, accounting tools, investment apps, or e-commerce services. For example, mobile payment integration allows users to link their accounts with platforms like Apple Pay or Google Pay for seamless transactions.

Voice and Face Recognition

Biometric authentication adds an extra layer of protection against fraud while streamlining access to accounts. Users can log in or authorize transactions using their voice or face, two of the most convenient and widely accepted types of biometrics, especially when used together.

Common Types of Banking Apps for Mobile Users

If you’re planning to create a banking app, it’s essential to understand the different types available and what each one offers to users.

Neobank Apps

Neobank apps are digital-only banks that have no physical branches. They offer easy account setup, budgeting tools, virtual and physical cards and international transfers.

Mobile Payment Apps

Mobile banking apps allow users to send/receive money and make purchases directly from their phones. Many of these apps double as digital wallets, enabling users to store card details and make contactless payments in stores or online.

Retail Banking Apps

Retail banking apps are the most common apps offered by traditional banks for everyday consumers. They provide money transfers, bill payments, and personal financial tools.

Business Banking Apps

Business banking apps are designed for small to mid-sized businesses or freelancers, offering more advanced tools to help manage company finances. They include features like invoicing, payroll integration, expense tracking and multiple user access.

Lending and Credit Apps

Lending and credit apps focus on personal loans, Buy Now Pay Later (BNPL), credit score tracking and payment reminders.

Investment and Wealth Management Apps

These apps combine banking with investment tools, allowing users to manage assets, portfolios, and savings.

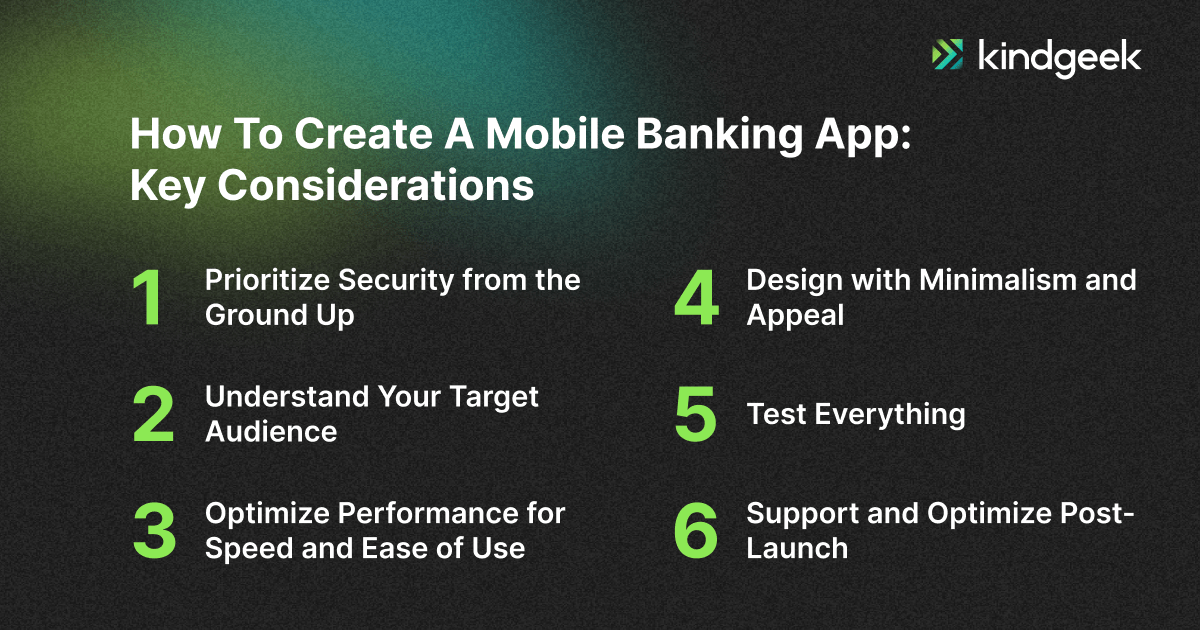

How To Create A Mobile Banking App: Key Considerations

How to create a mobile banking application that is secure, fast, and user-friendly? Below are the most important aspects to consider when developing a successful mobile banking system:

1. Prioritize Security from the Ground Up

Security is the backbone of any mobile banking app. To gain user trust and meet industry regulations, implement:

- End-to-end encryption

- Biometric authentication (face, fingerprint)

- Two-factor authentication (2FA)

- Real-time fraud detection systems

- Secure APIs for all integrations

Regular audits, compliance with strict financial regulations for fintech mobile app development, and penetration testing are essential to keeping data safe.

2. Understand Your Target Audience

Before building, research the behaviors, needs, and pain points of your app’s intended users. Are they Gen Z? Small business owners? Retirees? This will influence which features to prioritize, how to onboard users and what level of personalization is expected.

At Kindgeek, we start with product discovery to make informed decisions about further development. This means thoroughly researching the market and understanding user needs and preferences.

Here’s what you should cover during this phase:

- Market research

- User needs analysis

- Feature prioritization

- Technology assessment

- Regulatory requirements

- Prototype development

- Business model

- Risk assessment

- Budget and resource planning

- Roadmap development

By aligning features with user expectations, your app will offer a more intuitive experience across generations and drive higher engagement.

3. Optimize Performance for Speed and Ease of Use

If you’re researching how to make a mobile banking app that users won’t abandon, performance should be at the top of your list. A successful app should be lightning-fast and intuitive. You can improve performance with:

- Lightweight architecture and optimized backend processes

- Caching and lazy loading for smoother navigation

- Streamlined user flows with minimal steps for core actions (e.g., transfers or bill payments)

A fast, responsive app ensures a seamless banking experience and reduces frustration.

4. Design with Minimalism and Appeal

A banking app’s design must strike a delicate balance: it should be simple and approachable while also being visually appealing and highly functional. Here are some of the best UI/UX practices to achieve this balance:

- Intuitive navigation

- Clean and minimalist design

- Responsive and fast performance

- Accessible and inclusive design features

- Security design

By incorporating these features, a banking app can provide a user-centric experience that is both efficient and enjoyable.

5. Test Everything

Want to know how to build a mobile banking app that truly works under pressure? The answer lies in thorough testing. This includes:

- Functional testing for all features

- Usability testing to catch confusing flows or hidden issues

- Performance testing under load

- Security testing to identify vulnerabilities

- Ongoing A/B testing to refine user experience

The app should go live after multiple testing phases because anything less risks user trust and retention.

6. Support and Optimize Post-Launch

Post-launch maintenance is critical for your app’s ongoing success. To improve the app continuously, monitor app performance, user feedback, and security incidents. Provide regular updates to fix bugs and introduce new features.

Develop a Mobile Banking App with Kindgeek

If you are interested in white label or custom mobile banking app development, consider Kindgeek. We support companies in launching their products by offering core fintech banking and payment solutions, from digital wallets to neobanks, catering to startups and enterprise-level customers.

You can also construct your digital finance product with our white label digital banking platform. The customizable white-label core allows you to build on top of it and create a unique customer experience.

Conclusion

The digital transformation in banking has redefined how financial services are delivered, making mobile apps a core customer touchpoint.

Mobile application development for banking requires a strategic focus on user experience, performance, and security. With these pillars in place, you can turn your idea into a fully functional, trusted digital solution.

All you have to do is partner with reliable fintech providers who offer end-to-end support, from concept and design to development and launch. If you’re ready to start, we’ll help you move your project forward.