Recently updated on July 24, 2024

The dominance of digital banks in fintech is not just a result of technological advancements but also a response to evolving customer demands. Traditional banking is a bureaucratically painful experience, so it’s not strange that user-friendly smartphone-centred banks are booming worldwide. A bright example is Monzo, a well-rounded, rapidly growing digital bank from the UK equipped with the most demanded features.

Applications like Monzo are intricate pieces of tech created using cutting-edge tools with security and intuitiveness in mind. Nevertheless, developing a digital bank similar to Monzo is relatively easy as long as you have the required knowledge and the backup of a software-savvy team.

This guide will provide you with the fundamental features of neobanks and describe how to build an app for online banking like Monzo.

Content:

- Monzo’s Path to Success

- Benefits of Developing a Banking App Like Monzo or Similar

- The Technical Side of Building a Banking App

- Development Stages

- Promoting Your App for Online Banking

Monzo’s Path to Success

The fact that Monzo succeeded in the dense UK market despite the harsh competition proves the bank’s relevance. Besides the obvious currency accounts and spending notifications, Monzo has the following helpful functionality and features:

- Pots: Monzo allows users to create up to 20 personalized pots for various purposes, such as separating money or setting particular goals. Pots are a great tool for organizing your budget.

- Savings: A round-up option rounds a user’s purchase up to the nearest pound and puts the money in a savings pot.

- Cashback: This feature helps you earn back on your orders, restaurant trips, and even taxi rides, turning everyday spending into opportunities for savings.

- Fee-free travel: Monzo offers fee-free foreign transactions and great cash withdrawal options like fee-free cash withdrawal in the European Economic Area. You get even better deals with the Flex Credit Card and Monzo Max.

- Splitting bills: With Monzo, there is no more hustle splitting bills with your friends at a cafe or paying for something. The app will help to figure out how much each one should pay.

- Shared tabs: It’s easy to monitor and manage debts when you can track who paid for what and how much.

- Early payments: If a person receives payments into Monzo, the digital bank ensures that he or she will be paid a day early compared to traditional banks.

- Invite bonus: You can invite a friend, and you both get £5.

- Switch service: Monzo can become your main bank account in just seven working days without any trips to the bank.

- Loans: Monzo can provide up to a £25,000 loan.

- Overdrafts: Depending on your credit score, you can pay overdrafts at 19%, 29%, or 39% EAR.

- Investments: Monzo provides three ready-made investment options and leads you through the essentials of how to invest your finances.

- Real-time notifications: Users receive instant alerts for every transaction.

Monzo is often praised for its simplicity, intuitiveness, and user-centric approach. The app is designed to make banking as effortless and transparent as possible without complicated jargon and confusing processes.

To create online banking like Monzo, you must prioritise security. The app includes biometrics for secure login, and users can instantly freeze and unfreeze their cards through the app. Additionally, Monzo is transparent about fees and charges, helping users avoid unexpected costs.

Benefits of Developing a Banking App Like Monzo or Similar

There is no objecting that apps like Monzo are valuable tools for potential users considering the overall convenience of digital banking. Let’s name a few benefits of Monzo-like apps and why people enjoy using them:

- Easy to start

- Convenient budgeting tool

- Great savings-management tool

- Spending in the EEA zone without fees

- Possibility to get loans and set overdraft limits

- Earn interest on savings

- Customize banking experience

From a business perspective, if you aim to develop online banks like Monzo, you are setting yourself up for a lengthy and complicated but potentially extremely rewarding journey. The fintech sector alone is an attractive and profitable industry.

The neobanking market, in particular, is projected to reach $3.3 trillion by 2032, a significant increase from $69 billion in 2022.

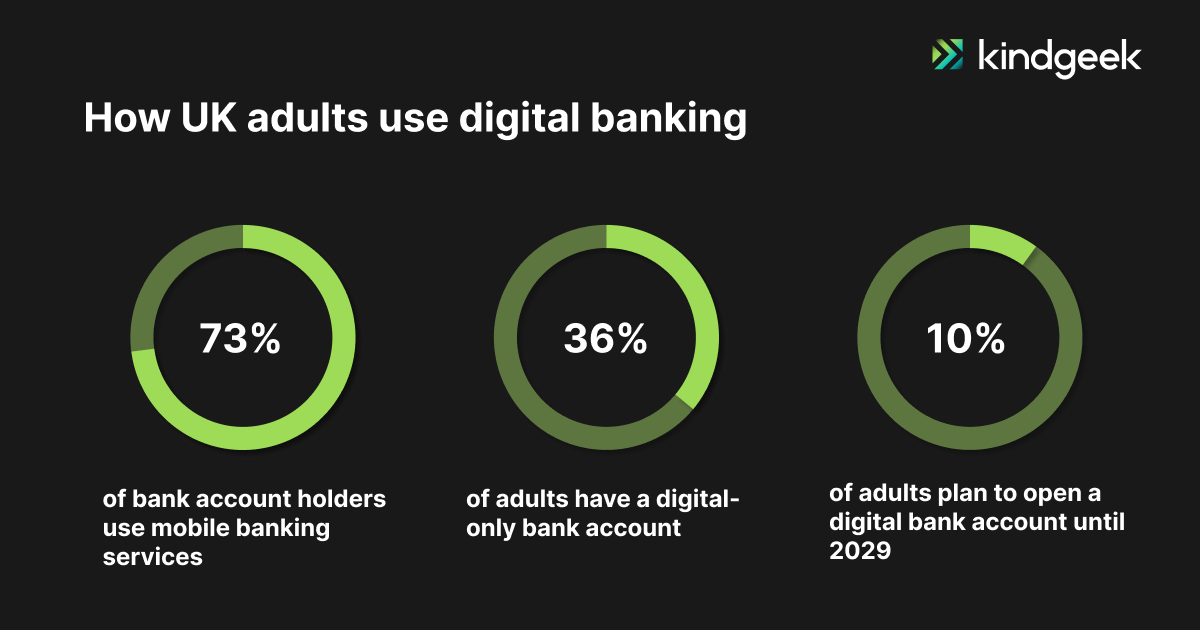

The UK, with its rapidly growing fintech sector, is a bright example of the possible trends. Currently, 73% of UK bank account holders use mobile banking services. According to Finder’s statistics, 36% have a digital-only bank, and 10% of the population want to follow their example within the next 5 years.

In addition, Statista forecasts that the UK neobanks are to reach 28 million customers in 2028, which is a 47% increase from 2023.

The global market’s opportunities are ripe for harvesting; you just need to follow the urge to start an online bank like Monzo to do it.

The Technical Side of Building a Banking App

If you decide to make bank accounts like Monzo, the technical side is a huge deal. It takes a combination of solid frontend development, smooth user experience design, and a strong backend architecture.

On the frontend, the development focuses on creating an intuitive and user-friendly interface. It depends on choosing the right tools and frameworks to ensure the app runs smoothly on both iOS and Android platforms. The design should prioritize simplicity.

At the core of this process is backend development, which involves managing secure, scalable databases to store user data and transaction records.

Integration with financial APIs is important when you create bank accounts like Monzo. Connecting to third-party solutions plays a crucial role in handling tasks such as user authentication, transaction processing, and account management. Banking APIs and payment gateways can ensure secure and efficient transactions with additional functionality.

Development Stages

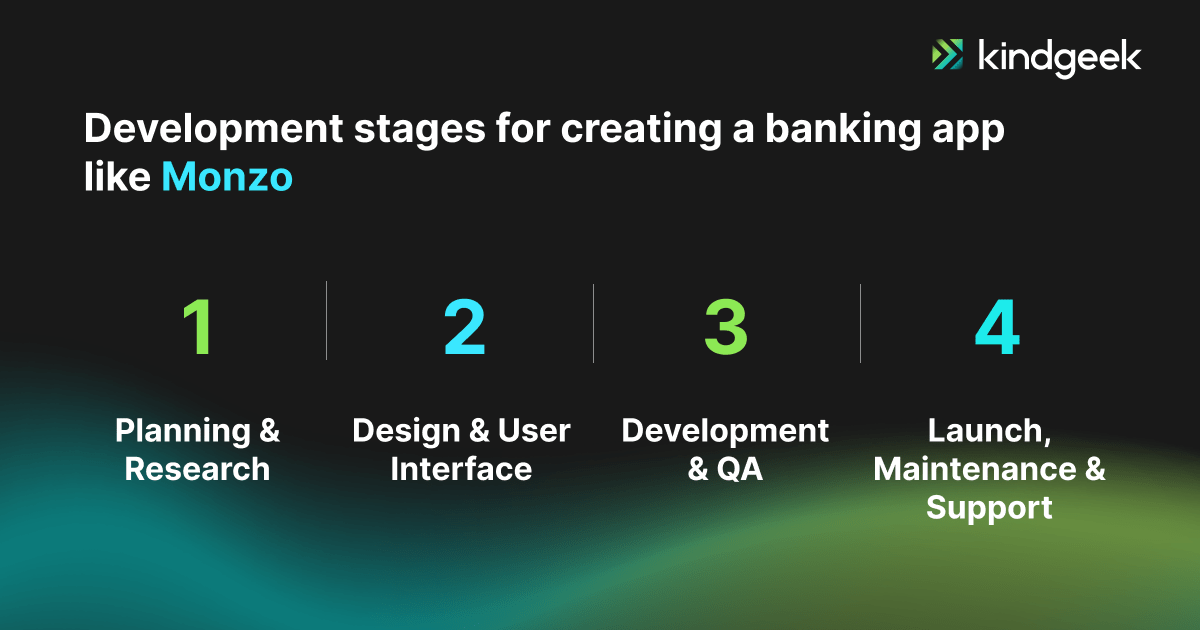

Developing a mobile banking app like Monzo involves several stages, each crucial for the successful launch of the app:

Step 1: Planning & Research

Suppose you have a rough idea/vision of a banking app to develop, but you didn’t conduct an analysis of the market and competitors to determine exact functionality, accurate blueprints of the future system, and UI/UX mockups. In that case, the Discovery phase is what you need. In addition, the discovery stage will provide you with the cost estimates for developing a complete product.

Thus, depending on the chosen package, as a result of the discovery phase, you will have the following:

– product concept from the Product Manager

– prototypes from Business Analyst

– a visual concept from UI/UX Designer

– an architecture concept from System Architect

– price for the development of the product

Now, you own a solid foundation upon which you can create apps like Monzo.

Step 2: Design & User Interface

The design phase follows, starting with the creation of wireframes and prototypes to visualize the app’s layout and user flow. Usability testing with real users is essential to gather feedback and refine the design before development begins.

Step 3: Development & QA

The development process will be split into iterations called sprints, during which the parts of the functionality will be developed and tested. Roughly, the structure of each sprint is the following:

- Planning

- Design

- Development

- QA phase

- Review

You can speed up this process by choosing a white label fintech solution. With a wide range of pre-built features, combined with thoughtful customization and development, you receive a solution with the functionality to develop apps like Monzo without heavy upfront investment.

Step 4: Launch, Maintenance & Support

Finally, deployment and launch involve preparing the app for submission to the Google Play Store and Apple App Store, ensuring compliance with their guidelines and requirements. After the launch, it is time to brace for the influx of customers. It’s a vital stage that will demonstrate the robustness of the digital bank and can uncover hidden weaknesses.

Software that does not evolve fades into obscurity. Therefore, it will be essential to update the digital bank you developed so it stays relevant and suits the latest trends. The support and maintenance phase of a successful product lasts for as long as the product remains in the market.

Promoting Your App for Online Banking

The promotional efforts can start even before the app’s launch. You can create anticipation through teasers and announcements on social media, your website, and relevant forums. Offering a beta version to a limited audience can also help gather valuable feedback.

When you create a banking app like Monzo, digital marketing plays a significant role in promoting it. This includes optimizing your content for search engines and reaching audiences through social media platforms.

Content marketing is another effective strategy. This involves sharing information about your app through informative articles, blog posts or video tutorials.

Collaborating with influencers in the fintech and financial sectors can also significantly boost your app’s promotion. Fintech, in general, and smartphone-centered online banking like Monzo, in particular, are lucrative and promising niches. There are many opportunities for entrepreneurs who want to conquer their share of the market.

To develop a banking app like Monzo, you need expertise in both software development and business strategy. However, you don’t have to make it on your own. We can help. Kindgeek has all the software and business expertise required to create a neobank app that will be competitive and appealing.

Contact us if you are interested in our possible partnership or want to build an online banking app. We’ll be happy to make your vision a reality.