Recently updated on April 18, 2025

Does managing business finances make you feel like you’re juggling dozens of balls in the air? There are purchase orders that need to be sent, invoices that need to be followed up, budgets that need to be approved, and reports that need to be run. All that in dozens of spreadsheets all over the place.

Quick fact: according to the U.S. bank, more than 8 out of 10 new businesses fail because of poor cash-flow management.

Fortunately, financial management software provides a comprehensive solution for tracking income, expenses, and overall financial health in one place. This software can automate and simplify financial tasks by integrating advanced features with intuitive interfaces.

This article will cover the best financial management software for business and how to evaluate your company’s needs when choosing these online finance tools.

Content:

- The Criteria for Selecting Financial Management Software

- Top 3 Financial Management Software Tools for Businesses

- Building a Custom Financial Management Software for Small Business

- Benefits of Using Financial Management Software

- Final Thoughts

The Criteria for Selecting Financial Management Software

Finding financial management software that aligns with your unique objectives is crucial, as many solutions are available with varying levels of functionality and scalability. The following criteria can be helpful in evaluating the software:

Feature Set

Ensure that the software has the essential features your business needs, like those related to accounting, invoicing, customer relationship management (CRM), expense tracking, reporting and planning.

Scalability

As your business grows, you’ll likely need software to accommodate increased data and additional users. Consider your long-term goals and whether the software will perform as efficiently for your business in five or ten years.

Integration Capabilities

Verify whether the program easily integrates with your current company tools and systems, such as payroll and CRM.

Cost

Measurable return on investment (ROI) is one of the concrete performance indicators, so your software for financial management should save you money. It’s wise to consider the total cost, including upfront fees, subscription costs, and extra expenses for upgrades.

Security

Any reliable software comes with robust security measures to protect data from breaches and unauthorised access. This is likewise crucial for financial management software, especially given the growing security risks in the fintech sector.

Check the security features of your financial management software, ensuring they include data encryption, multi-factor authentication, and security updates.

Top 3 Financial Management Software Tools for Businesses

Whether you’re looking for a financial management system for small business operations or larger companies, many types of software are available, with varying capabilities and price tags. But how do you find “the one”?

First, explore our analysis of the three most popular financial management software options by key features, interface and integration capabilities:

Xero

Key Features and Benefits: Xero is a simple accounting tool for small and medium businesses that lets you create recurring invoices and reconcile bank and credit card statements. It also helps firms with purchase and sales orders, contact management, payroll, and inventory management.

However, you might face a small capacity for project management and delivery, insufficient inventory management, and limited customer service.

User Experience and Interface: It offers an intuitive and user-friendly interface with customization options.

Cost: The starter plan for small businesses starts at $29/month with optional purchases and a 30-day free trial.

Integration Capabilities: The software integrates with the Xero Accounting mobile app. It’s also possible to connect your account to other apps, which come as separate services with possible additional expenses.

Zoho Finance Plus

Key Features and Benefits: Zoho’s finance suite is an integrated platform for back-office operations: accounting, invoicing, inventory, expense management, and tax compliance. It’s a great financial management solution for small business processes and medium companies.

User Experience and Interface: The platforms provide a personalized user experience and allow you to create custom fields, templates and reports. The design is clear and consistent across all apps.

Cost: There’s a free 14-day trial, after which the monthly pricing is $249/organization.

Integration Capabilities: This unified platform gives users access to all Zoho finance apps.

Oracle Fusion Cloud Financials

Key Features and Benefits: Oracle Fusion Cloud Financials is a cloud-based solution for financial management that connects various apps for payables, receivables, analytics, and more. It’s most suitable for larger businesses and enterprise organizations.

User Experience and Interface: The interface has a modern, clean design that is consistent across different modules. However, transitioning to this system may come with some initial complexities due to its extensive range of features.

Cost: Oracle has a complex pricing system which you can explore in detail by booking a demo or contacting customer service.

Integration Capabilities: Oracle Financials can easily integrate with Oracle products and third-party apps.

Building a Custom Financial Management Software for Small Business

While integrating an off-the-shelf small business finance management software might seem the cheapest option, building custom software with a trusted billing software development company is more cost-effective in the long run. See three main reasons why:

More $ spent now, less later

As a small business owner, investing in financial management software designed for your unique goals can be a good idea, thus saving money in the long run. With custom financial software development for small businesses, you can easily add new functionality as your business grows.

Keeping your data secure

Small businesses and startups don’t get hacked. It’s a lie. In 2023, almost half of small and mid-sized businesses globally experienced a cyber security incident. Tailor-made financing software for a small business is not only not publicly accessible but also uses specialized security code and encryption.

Getting technical support anytime

With your company changing, your financial software also needs to evolve. Custom financial management software providers are responsible for project management and change. Having a personal development team upgrade your platform is more reasonable than customizing ready-made solutions.

Overall, a custom financial management solution for small business tasks provides a few benefits over packaged software, but it all comes down to meeting your specific demands.

Custom Financial Management Software Development vs. Packaged Software

| Criteria | Custom financial management software | Ready-made solution |

| Available functionality | Depends on the project | Limited by the platform |

| Flexibility | Performed by adding more finance management features as your business scales | Low as you get a fixed list of features that are hard to customize and scale |

| Launch speed | Depends on the task | Fast, in most cases, even instant, as the approach suggests already existing options |

| Costs | Lower in the long term but requires an investment | Lower in the short term as you can launch in a moment. However, future improvements and software updates are costly |

| Security | High-level custom software uses the most secure protocols and encryptions | Not solved to the full, without any extra security standards, making the software more vulnerable to hackers’ attacks |

| Maintenance | Provided by the development company | It may be challenging, as you need to engage a third-party company to implement new functionality |

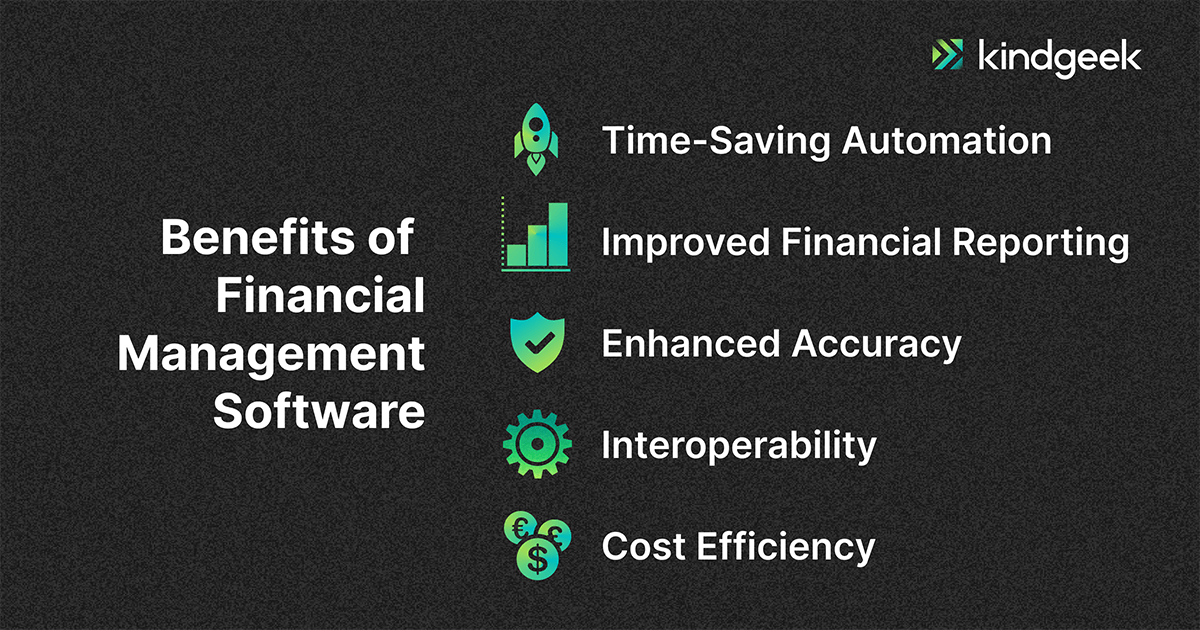

Benefits of Using Financial Management Software

Financial management software can automate many tedious and error-prone tasks. It can transform how your business handles financial operations with these significant benefits:

Time-Saving Automation

Automation is a game-changer. It saves time and allows employees to focus on more strategic activities. As a result, businesses can enhance productivity and reduce the risk of human error while employees are freed from repetitive tasks.

Improved Financial Reporting

Financial data becomes more accessible, enabling timely insight and informed decision-making. Businesses can get customizable reports which are easy to interpret, even for those without extensive financial expertise.

Enhanced Accuracy

Automated calculations and data entry minimize human errors, which are nearly unavoidable in manual processes. Financial management software makes it easier to deal with numbers and comply with regulations.

Interoperability

Ideally, an automated business system for financial management integrates seamlessly with other systems like CRM and ERP. You can also centralize everything in one place and easily align your business processes for better cooperation between departments.

Cost Efficiency

Ultimately, everything depends on how cost-effective the software proves to be. If you select the right tool to manage your business operations, the profit will significantly outweigh the initial investment.

Final Thoughts

From streamlining budgeting to enabling real-time insights, financial management software can transform your financial performance. You can easily find the ultimate solution for your business, whether a custom platform or a ready-made one, as long as you carefully assess your challenges and requirements.

If you decide to develop custom software for financial management, Kindgeek can help you turn your vision into an innovative fintech solution.