Recently updated on October 14, 2025

Cutting-edge technologies have become an inseparable part of the financial industry. Given their vast outreach and the considerable number of benefits, more and more market players are going for fintech adoption, so the industry grows and develops each day tremendously.

A significant milestone in fintech has become the deployment of artificial intelligence, a true game-changer that has revolutionized the financial industry in many respects.

The benefits of AI in fintech are immense: this innovative technology reduces unnecessary expenses, streamlines financial management, and increases earnings for businesses and people, just to name a few.

Indeed, a staggering 80% of banks are highly aware of AI benefits, while a whopping 86% of financial services AI adopters anticipate AI to be very or critically important for their business success.

AI zealously drives the financial industry forward and will continue to do so in the future. With an overall AI in fintech market value of $8 billion in 2021, AI technology is predicted to reach $27 billion by 2026.

In this article, we’ll look into how AI impacts the financial sector, overview AI examples in fintech, and discover how they disrupt the industry. Stay tuned.

Content

1.AI impact on the financial industry

2.Top use cases of AI in fintech

3.Challenges of AI in finance industry

AI impact on the financial industry

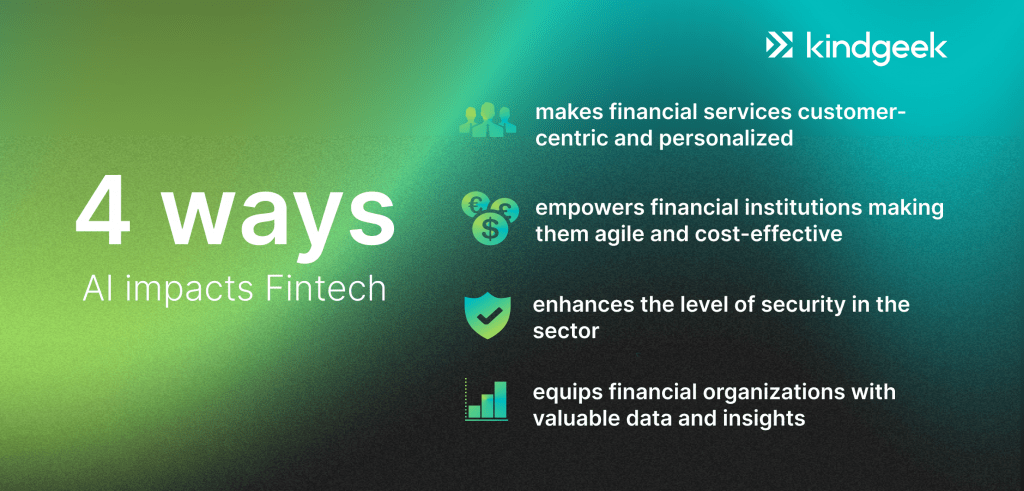

Artificial intelligence in fintech pays off and represents several advantages that financial organizations are capable of leveraging. Let’s take a look at the most prominent ways AI impacts finance:

Better customer service

The financial market clearly ranks top among the most competitive ones. Hence, those leaders who leverage AI can win over new customers and retain existing clients due to better service.

Given that obtaining new customers costs seven times more than keeping a current one, the focus on providing superior customer service is critical to fostering customer retention, loyalty, and positive word-of-mouth referrals, which all translate into business growth and long-term success.

Convenience and Consistency

With AI on board, fintechs become well-equipped to provide prompt support, quick access to relevant information, convenient self-service options, and helpful on-the-spot guidance on any channel – be it a website, mobile app, or even a messenger. Customers can get a satisfying level of service, while fintech providers can expand their presence and increase customer reach.

Personalization

By utilizing AI powers, fintech companies can proactively predict customer needs and future financial behavior to provide personalized recommendations and value-driven offerings at the speed of need. This, in turn, can significantly boost customer engagement and drive sales.

Increasingly human-like experience

With 64% of customers expecting chatbots to provide the same level of service as humans, this figure is clearly set to increase due to the ongoing surge in AI advancements.

Smart chatbots driven by cutting-edge AI models – like the ones behind ChatGPT – are poised to become a new standard for customer engagement. Such AI helpers understand human intent and can build sophisticated human-like interactions with customers, engaging with them in meaningful, context-aware conversations and supporting them in their financial journeys.

Cost reduction and workload optimization

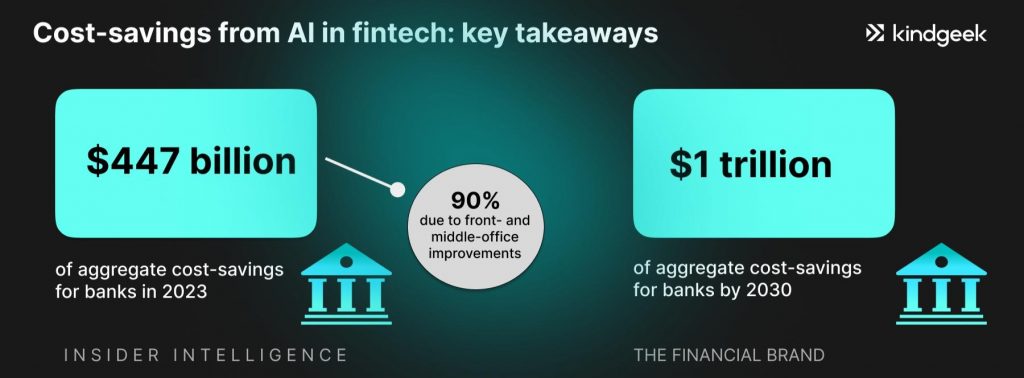

It’s impossible to underestimate the level of contribution AI technology makes to the workflow in finance.

According to a McKinsey report, 44% of businesses embrace AI to leverage automation and cut down their operational costs.

Using AI automation in fintech, companies can eliminate a vast amount of manual work, streamline many business processes, address talent shortages, root out errors, and make the best use of human effort.

Employees, in turn, can refocus their efforts on more value-added tasks that require human input while leaving repetitive, time-consuming tasks to AI.

Enhanced security

As the number of frauds increases at breakneck speed and cyber criminals’ tactics constantly change, financial institutions seek ways to amplify security and protection.

AI-based fraud detection takes security to a new level and addresses issues effectively, keeping financial data and money under efficient protection.

The success of AI-based fraud detection is driven by:

- Accuracy – AI in finance analyzes enormous volumes of data and can spot sophisticated patterns that are not always visible to the human eye

- Real-time analysis – AI analyzes data in real-time, allowing for lightning-fast detection and prevention of fraudulent activities

- Adaptability – AI models take a provocative approach to identifying new forms of fraud by constantly learning and improving on their own

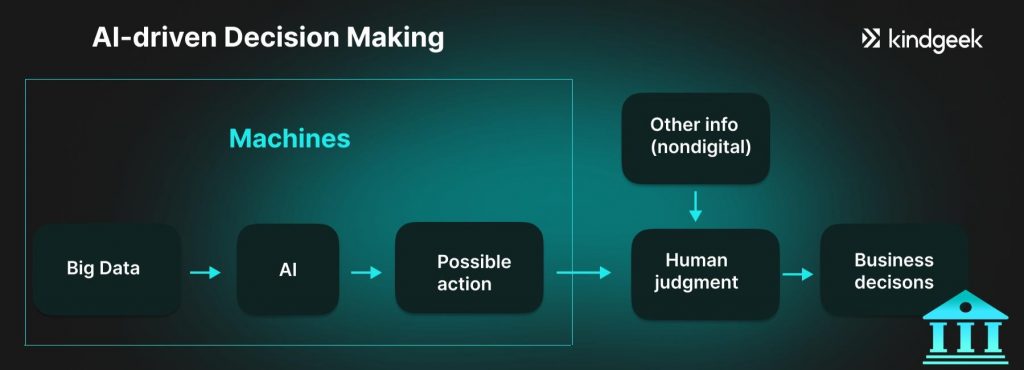

Data-driven decision making

Who has the data has the power. Though true for all, this is especially relevant in finance, where the amount of information increases every hour.

With AI capabilities to accurately process extensive amounts of data, financial organizations can have a helicopter view of many business aspects, allowing them to build strategies and make data-driven decisions.

Given that the stakes in the business world are high, top companies waste around $250 million annually because of ineffective decision-making – the need for amplifying human efforts and judgment with the accuracy, speed, and precision of AI-driven data analysis is higher than ever.

Top AI use cases in fintech

With all the aforementioned in mind, let us discuss the impact of AI in fintech industry through the lens of prominent AI examples.

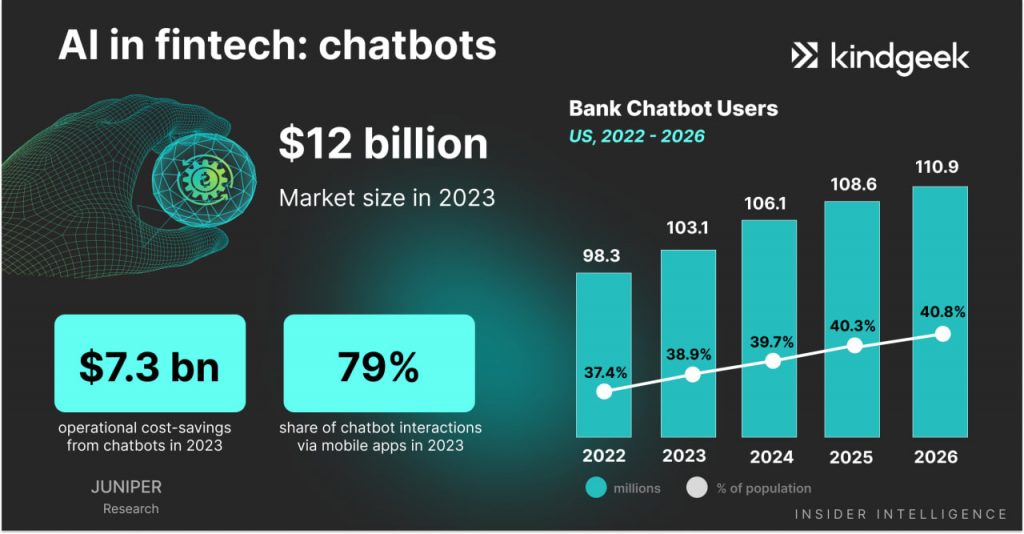

Chatbots as virtual assistants

Nowadays, chatbots are not just cold response machines. They can be really smart and act as digital assistants. Upon any immediate request, users can quickly get support, guidance in financial operations, advice on financial services, good savings plans, insights on expenditures, and deposit options. And all of this is a matter of just a few clicks or taps – no need to seek and wait for external assistance.

Given the AI capabilities of compiling data on user preferences and activity patterns, all users can receive a truly personalized financial management experience that will allow them to achieve their financial goals, plan expenses carefully, and interact with a bank more straightforwardly.

For example, Bank of America won the hearts of its customers with its smart AI chatbot – Erica. By utilizing cutting-edge Natural language processing (NLP) and advanced analytics, Erica engages in impressively human-like interactions and skillfully helps bank customers stay on top of their finances 24/7. Convenient self-service options, personalized insights and recommendations (account for over 60% of engagement), and seamless experience – no wonder Erica’s popularity and credibility grow, hitting over 333 million customer requests in 2023, a staggering 35% year-over-year increase.

Loan underwriting

AI is also a powerful tool for credit scoring and financial risk management. Earlier, loan applications were considered for two or three weeks and took the time and effort of many different specialists.

Now, AI solutions in fintech can assess potential borrowers in a timely fashion, at lower costs, and with better precision as they take into account more data and, thus, more factors. Therefore, companies can now better understand their applicants’ creditworthiness, reduce default risk, and provide personalized loan options.

McKinsey’s findings indicate that the use of AI has been shown to significantly enhance credit-approval turnaround time and approval rates for applications. Indeed, AI is expected to save financial institutions up to $31 billion of their underwriting and collection system costs by 2030, according to industry data.

Data analysis and financial reporting

In an industry heavily reliant on gathering and processing large amounts of data, the application of AI is a definite game-changer. Machine learning, a subset of AI, meticulously collects every single data set without missing a spot, processes this extensive amount of data, and forms accurate reports and predictions.

They, in turn, help financial companies build actionable data-driven strategies, effectively cater to customer needs, see early signs of potential issues, and take measures on time, keeping safe from threats that might impact their overall functioning or revenue.

Additionally, with recent strides in tech, financial companies can leverage the superpowers of LLMs to analyze financial data, make accurate predictions, and always be one step ahead.

An Asian bank utilized advanced analytics to enhance its customer targeting and product recommendations. By analyzing several sets of big data, the bank managed to uncover over 15,000 micro customer segments. Subsequently, the bank developed a next-product-to-buy model, suggesting appropriate products to these segments, which resulted in a threefold boost in the likelihood of a sale.

Fraud Detection

Service providers have made the security of their clients a number one priority, and AI helps fintech companies with that.

Financial institutions are implementing AI-based systems in record numbers, with more than $217 billion spent on AI applications that help prevent fraud and assess risks.

The AI-based system quickly detects suspicious behavior, verifies user identity, and instantly responds to cyber attacks that threaten clients’ accounts.

ML’s power to quickly process and analyze vast amounts of data in real-time and its ability to learn from experience equals improved models, and no human input is needed. Unlike rule-based fraud detection, ML solutions can trace more complex fraudulent patterns and allow for streamlined verification processes.

Process Automation

Robotic process automation is the perfect tool to boost productivity, improve accuracy and speed, and cut operational costs. Forward-thinking companies realize the value, and according to a Gartner report, nearly 80% of financial leaders have already implemented or are planning to implement RPA.

Artificial intelligence-enabled software can take over and handle high-volume repetitive tasks that previously required humans to perform. RPA can review and verify data, gather and retrieve information from documents, perform data entry, generate reports according to parameters, etc. Use cases of RPA include, but are not limited to, purchase orders, invoices, payroll processing, reconciliation of accounts, and financial reporting.

Additionally, sensational LLMs can step in and help financial companies optimize operational processes across multiple departments, ultimately driving efficiency, accuracy, and substantial cost savings.

Challenges of AI for fintech

Let’s face it – there are no ideal systems, so although AI technology in fintech has many advantages and is considered, by right, a positive game changer for the industry, there are some struggles to face.

Data challenges

As data is the lifeblood of AI, the importance of data sets being quality is immense. If data is not trustworthy, clear, and complete, then the analysis risks being unreliable (with inconsistent data results).

Another challenge is to aggregate information and prepare it for efficient analysis. Typical obstacles? Too many silos, huge piles of uncleaned and unstructured data among the few.

Solutions to data challenges

Adopting a smarter approach to data management gives agility and flexibility to process, store, analyze, and aggregate various data sets regardless of their source.

Deloitte suggests these four steps for effective data management:

1. Invest in centrally governed data lakes: Create scalable and secure data architectures that allow centralized storage of data assets, ensuring a single, curated source of truth across the organization.

2. Automate data acquisition: Develop tailored and optimized ingestion pipelines for internal and external data sources to automate data loading, promoting consistency, speed, and efficiency.

3. Implement smart data management for quality assurance: Establish a central catalog of data assets that complies with organizational governance controls, ensuring data quality before incorporation into AI projects or applications.

4. Standardize data preparation and transformation: Use a standardized platform and coding language for implementing data preparation and transformation pipelines to enhance reusability and shareability, facilitating collaboration among teams and individuals, and expediting data preparation processes.

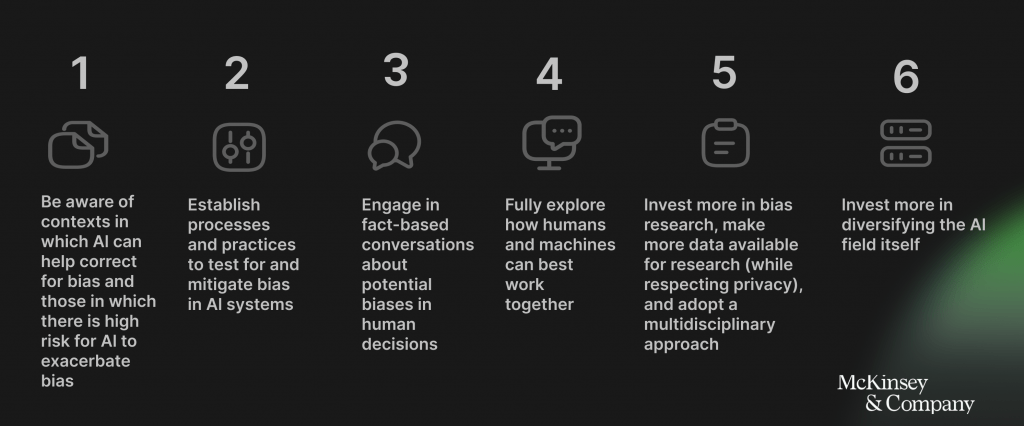

AI bias

As humans sometimes might be biased, consequently might be AI. The bias might be traced to the algorithms or the training data.

Hence, external control is needed to detect such cases.

McKinsey suggests six potential ways forward for businesses and policy leaders to consider when dealing with AI and bias.

Integration and implementation

Another potential challenge might be the correct implementation of AI within the existing company infrastructure. Experienced AI solution providers’ support is crucial to installing proper, secure by design, algorithms, complying with legal requirements, and ensuring a seamless user experience and smooth functioning.

Nevertheless, as AI continues to grow and improve, it’s important to note that:

1) technological advancements are here to stay

2) the number of powerful, undeniable benefits and opportunities overshadows the challenges

3) issues can be mitigated if sticking to best practices

4) forward-thinking businesses realize AI value and take action

5) in the modern market environment, it’s challenging to gain a competitive edge without leveraging AI in the financial industry

Consider Kindgeek Your Trusted Fintech Development Partner

Kindgeek is a one-stop-shop fintech development company that illuminates how finance companies can reach their full potential with digital solutions. From product discovery services to deployment and beyond, we guide you through the whole process of developing fintech products.

We match innovative technologies, including AI, with specific business challenges to help fintech companies drive efficiency, cost savings, and a competitive edge amidst the dynamic financial market landscape.

Additionally, our experts have extensively worked with GenAI and LLMs, particularly with OpenAI GPT, and developed a comprehensive suite of AI assistant services to help you leverage the latest advancements in AI. Contact us if you would like to develop AI solutions for fintech or learn how to use AI in fintech given your particular case, with our AI Transformation services.

At Kindgeek, we also provide a white-label digital banking solution, which serves as a foundation for digital finance products, general ledger solutions development for automating core accounting processes, or any other custom software development that comes to mind.

Final thoughts

The role of AI in fintech has been transformative. Today, it’s rightfully considered a game changer for the financial industry – not only does it improve a business from both internal and customer sides, save costs, and provide valuable advantages that make you always one step ahead.

With AI driving the future, more and more companies are resorting to deploying this cutting-edge technology to be competitive in the market and win over customers.

As the financial market is highly competitive, implementing AI solutions in fintech is essential, as staying away from technological advancement can cost more in the long run.

How is AI used in fintech?

The use cases of artificial intelligence in fintech are truly ample and span across all areas – front office (e.g., chatbots and AI assistants), middle office (e.g., fraud detection and risk management), and back office (e.g., underwriting).

What are the use cases of AI in finance?

While the future of AI is definitely bright, we can already see how AI is transforming fintech today. Top use cases encompass smart chatbots for customer services, systems for loan underwriting and risk management, fraud detection solutions, process automation, and data analysis.

What are the benefits of AI in finance?

AI and fintech are a perfect match. Exceptional customer service, operational efficiencies, better security, and cost-savings are all among the key benefits of embracing AI in financial services, and business executives take great notice of them.

What is the impact of AI on financial services?

Artificial intelligence in fintech carries proven potential to:

- boost customer satisfaction, and improve retention rates;

- streamline processes and automate time-consuming tasks;

- enhance the level of security and detect anomalies with hawk-eyed precision;

- turbocharge decision-making across all business aspects.

Why is AI game-changing for the financial industry?

Because of the agility, flexibility, and precision. For example, due to the capabilities of AI and ML in fintech, companies can get game-changing insights and predictions about strategies, investments, trends and more – all accurately based on a treasure trove of their business data from hundreds of sources.