Recently updated on March 20, 2024

In the dynamic world of finance, open banking, with its intricate web of interconnected technologies, collaborative ecosystems, and innovative financial solutions, emerges as a transformative force, reshaping traditional approaches.

This article delves into key trends, from collaborative fintech partnerships to the role of APIs, uncovering how open banking is driving innovation and collaboration in the banking sector.

What is open banking technology, and what are its main features?

Open banking is a financial concept that revolves around the idea of providing third-party financial service providers access to a consumer’s financial information through Application Programming Interfaces (APIs). It opens up traditional banking systems to external parties, fostering collaboration, innovation, and competition within the financial industry.

In an open banking infrastructure, banks share customer data securely and efficiently with authorised third-party developers, fintech companies, and other financial institutions. Data sharing allows for the developing of new and enhanced financial products and services, ultimately benefiting consumers by offering more choices, improved user experiences, and often more competitive pricing.

The core principles of open banking include transparency, security, and customer control. Users have the ability to grant and revoke access to their financial data, ensuring that their privacy and security are prioritised. Open banking in financial institutions has the potential to drive innovation, promote financial inclusion, and create a more interconnected and efficient financial ecosystem.

In the dynamic realm of open banking, numerous companies have embraced the concept, harnessing the power of diverse APIs to redefine the financial landscape. Let’s explore a few examples of these innovators:

Salt Edge

Salt Edge builds open banking API solutions that empower businesses to create smart services for their customers. Their mission is to provide a universal platform that will take the burden off various types of businesses and allow the world to create dozens of use cases based on Salt Edge open banking solutions.

Plaid

Plaid offers a comprehensive suite of APIs that seamlessly connect fintech applications to users’ bank accounts. They bring together the technology of PIS (Payment Initiation Services) and AIS (Account Information Services), enabling users to effortlessly manage budgets, track investments, and streamline payment processes securely.

TrueLayer

TrueLayer, with its array of APIs, including AIS, Payments Initiation, and Data API, plays a pivotal role in enabling secure access to financial data. Fintech companies rely on TrueLayer’s technology to develop applications that redefine how users manage finances, make payments, and gain insights into their financial well-being.

Open Bank Project

The Open Bank Project, as an open-source solution, provides a variety of APIs, including AIS, Transactions, and Identity. This initiative fosters collaboration by offering an open banking platform that financial institutions can leverage to implement open banking functionality, encouraging innovation across the industry.

Adyen

Adyen, with its Checkout API, delivers Payment Initiation Services that redefine the landscape of online payments. Businesses globally choose Adyen to seamlessly accept payments, supporting various payment methods and enhancing the overall transaction experience for both online and in-store purchases.

How does open banking in fintech drive innovations?

Open banking is a driving force behind a wave of innovations in the financial sector, fostering collaboration, competition, and improved services. As technology advances, open banking will likely play a central role in shaping the future of finance. Let`s take a look at what makes it possible:

Enhanced Customer Experiences

Open banking in financial services encourages the development of customer-centric financial applications. By allowing third-party developers access to account information, users can enjoy consolidated views of their finances, leading to more intuitive and personalised experiences. Fintech apps can provide insightful recommendations, budgeting tools, and tailored financial advice, enhancing user satisfaction.

New Products and Services

With open banking APIs, traditional financial institutions and fintech startups can collaborate to introduce innovative products and services. This includes real-time payments, peer-to-peer lending platforms, robo-advisors, and other solutions that cater to specific financial needs. This collaborative approach results in a diverse and competitive marketplace.

Ecosystem Collaboration

Open banking encourages collaboration between traditional financial institutions, fintech companies, and other players in the financial ecosystem. This collaborative approach fosters a culture of innovation, with different entities working together to create comprehensive and interconnected financial solutions.

Data-Driven Insights

The availability of comprehensive financial data through open banking APIs enables the development of sophisticated analytics and machine learning applications. These applications can give users actionable insights into their financial behaviours, allowing for better financial planning and decision-making.

Open banking services providers offer a wide range of services that change how we view our banking experience, such as payment initiation services (PIS), account information services (AIS), and event notification services (ENS).

In the realm of open banking, Payment Initiation Services are revolutionising how we conduct financial transactions. Imagine a seamless online shopping experience where, instead of relying on traditional payment methods, you initiate secure payments directly from your bank account. This is the magic of PIS at work. Open banking companies empower online and mobile payment applications, facilitating effortless peer-to-peer transfers and integrated checkout experiences. The result? A swift, secure, and streamlined payment process.

Account Information Services offered by open banking companies bring a new dimension to financial management. AIS enables personal finance management apps to access account-related information, presenting users with a unified dashboard showcasing balances, transaction histories, and intricate details of their accounts. This wealth of data empowers users to make informed financial decisions, paving the way for intuitive budgeting, insightful analytics, and a holistic understanding of their financial well-being.

The role of Event Notification Services in open banking is to keep users informed and secure in real-time. Consider receiving instant alerts about significant events or changes related to your bank account — be it a substantial transaction, a fluctuation in your account balance, or a potential security concern. ENS provides timely and relevant notifications through various channels. This not only enhances transparency but also empowers users with the knowledge to take immediate actions, ensuring a proactive and secure approach to managing their financial affairs.

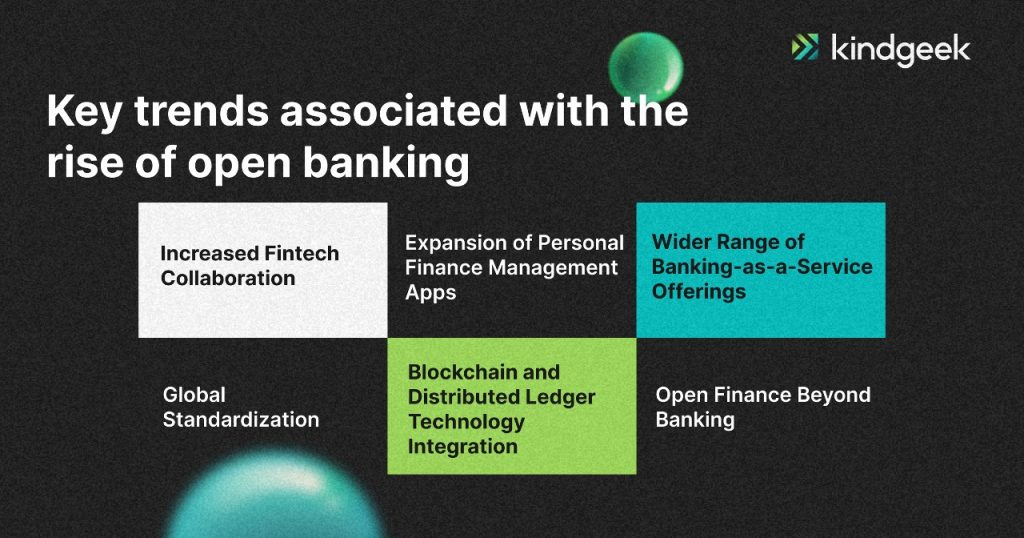

As open banking becomes increasingly popular, we`ll witness significant changes in how financial data is shared and used. Here are some key innovative trends we can expect with the rise of open banking:

Increased Fintech Collaboration

The collaboration between traditional financial institutions and fintech companies is likely to intensify. Fintechs will play a significant role in developing innovative products and services, leveraging open banking APIs to enhance customer experiences and offer tailored financial solutions.

Expansion of Personal Finance Management Apps

With access to comprehensive financial data, personal finance management apps will become more sophisticated. We can expect more and more apps that not only track spending but also provide actionable insights, budgeting recommendations, and automated financial planning based on real-time data.

Global Standardization

Efforts toward standardising open banking practices and APIs will likely increase, especially with regulatory bodies playing a crucial role. Global standards would facilitate interoperability and collaboration among financial institutions on an international scale, fostering a more connected and efficient financial ecosystem.

Wider Range of Banking-as-a-Service (BaaS) Offerings

Banking-as-a-service (BaaS) platforms will expand, allowing non-banking entities to offer financial services without becoming licensed banks. This trend will lead to a proliferation of specialised financial products embedded into various applications and platforms.

Open Finance Beyond Banking

The concept of open finance will extend beyond traditional banking services to include insurance, investments, and other financial products. Open insurance and open investment platforms may emerge, providing users with a more holistic approach to managing their entire financial portfolio.

Blockchain and Distributed Ledger Technology Integration

Blockchain and distributed ledger technology may become more prevalent in open banking. These technologies can enhance security, transparency, and efficiency in financial transactions, potentially revolutionising aspects of payment processing and identity verification.

Collectively, these trends indicate that the rise of open banking will bring a transformative shift in the financial industry, with a strong focus on collaboration, innovation, and customer-centric solutions.

How does Open Banking in financial services foster an ecosystem collaboration?

Open banking’s influence goes beyond individual institutions, sparking a broader shift towards ecosystem collaboration. This technology allows traditional banks, fintech startups, regulators, and non-financial players to work together in a connected financial landscape, redefining how services are delivered and experienced.

Banks, partnering with specialised fintechs, can create comprehensive solutions addressing various facets of a customer’s financial life. Ecosystem collaboration enables a unified approach to banking, payments, investments, and insurance, providing customers with an integrated and holistic experience.

Eventually, this collaboration extends its reach beyond finance, forming partnerships with non-financial entities as well. Collaborations with retail, healthcare, and e-commerce bring innovative financial products seamlessly embedded in everyday services, enriching the overall customer experience.

And, of course, at the heart of such collaboration lies a commitment to customer-centric design. By pooling resources and expertise, collaborators can create products and services finely tuned to meet the evolving needs of customers, elevating their financial experiences.

Conclusion

The impact of open banking on the banking industry has been widely recognised by industry experts, with many predicting that it will continue to drive innovation and collaboration in the future.

If you want to develop your own banking solution and need help figuring out where to start, contact us. Kindgeek is a full-cycle fintech development company that provides core fintech banking and payment solutions to serve as a software shortcut for businesses looking to launch their fintech products. Our white-label fintech solution can greatly speed up your way to the market. With a wide range of pre-built features, combined with thoughtful customisation and development, you receive a solution with the functionality to jumpstart your online finance business or get digital without heavy upfront investment.

How does open banking affect the traditional banks?

In an open banking system, banks share customer data securely and efficiently with authorised third-party developers, fintech companies, and other financial institutions, fostering collaboration, innovation, and competition within the financial industry.

What are some of the examples of open banking products and services?

Account Information Services (AIS), Payment Initiation Services (PIS), Fund Confirmation Services (FCS), Card-based Payment Instrument Issuers API, and others.

What is open banking definition?

Open banking is a financial concept that revolves around the idea of providing third-party financial service providers access to a consumer’s financial information through Application Programming Interfaces (APIs).