Recently updated on July 1, 2025

The definition of a digital bank is very simple – it is a bank that provides its services online. It offers the full range of core banking services found at physical branches: savings accounts, loans, and credit cards, but it primarily operates through websites and mobile apps. It means 24/7 access to banking services from any point on the map.

This level of accessibility led to a drastic rise in demand for digital banking services. Let`s take a look at some statistics:

- Most consumers (71%) prefer to manage their bank accounts through a mobile app or a computer.

- Over two-thirds of UK citizens (36%) have a digital-only bank account in 2024, up from a quarter (24%) at the start of 2023, according to Finder.

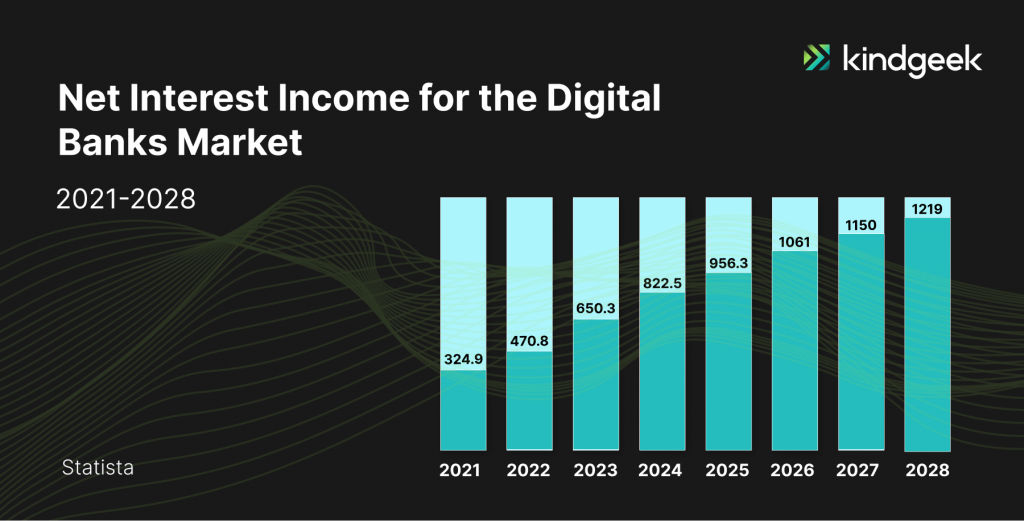

- According to Statista, it is expected that the Net interest income for the digital banks market will display an annual growth rate (CAGR 2024-2028) of 10.34%, leading to a market volume of US$1,219.0bn by 2028.

So, if you are looking for an answer on how to start an online bank company, just keep reading.

Benefits of Building Your Own Digital Bank

Building your own digital bank offers great control over your financial infrastructure, allowing you to tailor every aspect of the banking experience to your specific business needs and customer preferences. Unlike traditional banking partnerships that often come with rigid fee structures, limited customisation options, and lengthy approval processes, developing proprietary banking technology enables you to implement innovative features, maintain direct relationships with your customers, and capture the full economic value of financial services. Let`s look at some of the benefits closer:

Secure authorisation

Both digital and traditional banks deal with the vulnerable and personal financial information of their clients. This means any problems with security are an immediate threat to a bank’s reputation. That`s why you should use a high-quality authentication system. In addition to the traditional banking systems (passwords and CVV codes), you can also consider adding two-factor authentication and/or fingerprint identification.

User-Friendly Mobile Accessibility

Digital banks are primarily accessed through mobile devices, providing your users with the flexibility to manage their finances on the go. Making their experience intuitive and pleasant is extremely important. Your customers should navigate, perform transactions, and access account information seamlessly.

Real-Time Transactions

Your digital bank can offer real-time transaction processing, instantly updating account balances and transaction history. Instant peer-to-peer (P2P) transfers are also a plus, enabling users to send money to other users in real time.

Multi-Currency Accounts

Some digital banks provide multi-currency accounts, allowing users to hold and transact in different currencies. This feature is beneficial for frequent travellers or individuals conducting international business. If you are providing banking services from anywhere in the world, you may as well free your clients from the need for constant currency exchange.

Customer support

Almost every customer eventually has some questions about the services they use. This means you should create a high-quality support service to ensure the clients receive all the information they need. With an evolving trend of AI assistants, you can provide 24/7 support to build a strong relationship with your customers.

Must-Have Features for Your Neobank

If you decide to create your own digital bank, you will see that some basic features are unavoidable and are expected as a minimum from a potential user, while ensuring convenience, transparency, and control over finances. These features form the foundation of trust, usability, and day-to-day utility for any digital banking platform:

- Account Balance Overview

Users should be able to see their current balance instantly, without delay or need for manual refresh. A well-designed interface should make it easy to understand available funds and pending transactions and even categorise funds (e.g., savings, spending, goals). This feature is fundamental for financial awareness and control.

- Money Transfers

Whether sending money to friends, paying rent, or transferring to another account, neobanks must offer fast and intuitive money transfer options. Support for peer-to-peer payments, scheduled transfers, and international remittances—ideally with low fees—can significantly improve user satisfaction and convenience.

- Transaction History

A clear, searchable transaction history allows users to review where their money is going. Each entry should include relevant details like merchant name, category, location, and timestamp. Innovative features like automatic categorisation and visual spending summaries can also enhance budgeting and financial planning.

- Card Management

Users expect complete control over their debit or virtual cards directly from the app. This includes the ability to freeze or unfreeze a card instantly, set spending limits, enable or disable online or foreign transactions, and request a new card if needed. These controls improve security and reduce friction in everyday use.

- Instant Notifications

Real-time alerts for every transaction help users stay informed and protected. Notifications can include purchase confirmations, ATM withdrawals, login attempts, or changes to account settings. This immediate feedback loop builds trust and empowers users to respond quickly to any suspicious activity.

Think About Unique Features

Of course, if you choose to stick only to basic features, your digital bank will probably be left behind in the competitive world. But there is a solution. The digital world is already setting some banking features trends, and following them quickly and thoughtfully will greatly benefit your business and make customers’ experience with banks more convenient and satisfactory. What are those features?

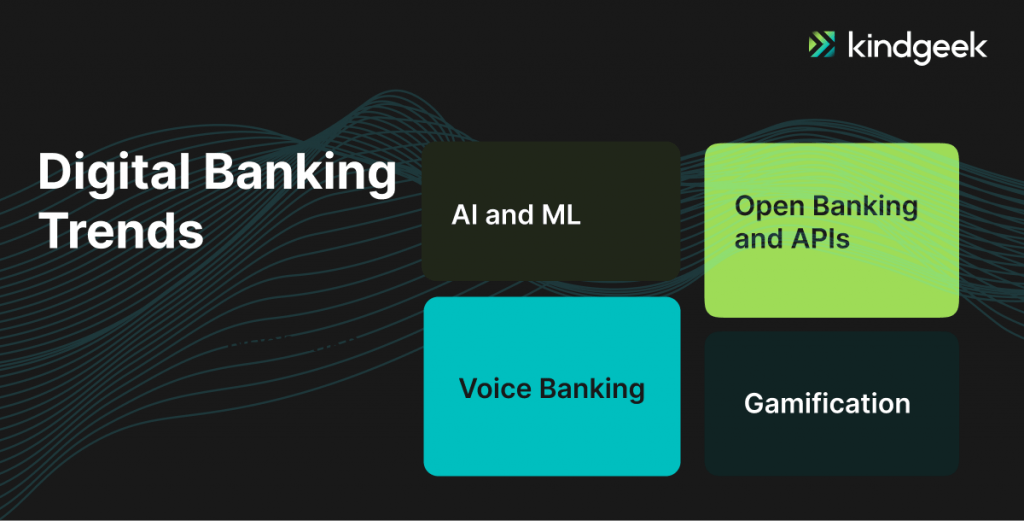

1. AI and ML in banking

AI and ML are reshaping the whole finance sector by automating and fastening many processes, and digital banking is no exception. These technologies are widely utilised for personalised customer experiences, fraud detection, risk management, and the automation of various banking processes. You can read more about it in our previous article. Integration of AI chatbots is also a modern trend in the banking industry that can bring your customers’ experience to a new level.

2. Open Banking and APIs

Open banking is a financial concept that revolves around the idea of providing third-party financial service providers access to a consumer’s financial information through Application Programming Interfaces (APIs). Open Banking initiatives are gaining traction, fostering collaboration between financial institutions and third-party developers. This trend can enhance innovation, improve customer experiences, and promote seamless financial data sharing.

3. Voice Banking

The integration of voice-activated banking services is on the rise. Users can perform various banking tasks, check balances, and get information through voice commands, contributing to a more convenient and hands-free banking experience.

4. Gamification

Some digital banks incorporate gamification elements into their platforms to engage users and encourage positive financial behaviours. This could include rewards, challenges, and interactive features to make banking more enjoyable and educational.

Gamification can also become an effective tool for introducing and simplifying complex financial concepts to customers. By breaking down intricate ideas into interactive and easy-to-understand components, banks can help customers better comprehend and grasp complex concepts.

How to Start a Digital Bank

If you are searching for how to start an online bank business, your business must understand that neobanking is as much a technology venture as a financial one. This means you must navigate complex regulatory landscapes while building secure, scalable infrastructure. Acquiring the necessary licenses, ensuring compliance with KYC and AML requirements, and setting up robust data protection protocols are non-negotiables.

On the product side, you need a deep understanding of your target audience’s expectations. Whether you’re serving freelancers, SMEs, Gen Z users, or underserved communities, your feature set, interface design, and customer support model must be tailored accordingly. Success in digital banking depends not only on offering the right tools but on delivering them with speed, simplicity, and a strong brand identity that resonates with modern users.

Now let`s get to the building!

1. Market Research and Planning

It`s the first and one of the most important stages of any development process. By conducting thorough market research, you can identify target demographics, assess competition, and understand the regulatory landscape. Develop a business plan outlining your digital bank’s goals, unique value proposition, revenue model, and growth strategies. There are different questions you should ask yourself about your future clients. For example:

- What services are the most used by your potential customers?

Understanding which financial services your target users rely on most, such as money transfers, bill payments, savings, budgeting tools, or expense tracking, helps you prioritise your feature development. This data reveals not only what is essential to your customers, but also how frequently they engage with those services. Focusing on high-usage features ensures your digital bank meets core expectations from day one, while providing a strong foundation for future innovation.

- What are their preferences in services they have previously used?

Beyond usage frequency, you need to understand how users prefer to interact with financial tools. Do they value speed and automation, or do they want more control and customisation? Are they loyal to specific neobanks or fintech apps, and if so, why? Analysing the strengths and weaknesses of previously used services, whether it’s design, functionality, or pricing, helps you identify what works and what doesn’t. This insight allows you to build a user experience that feels familiar yet meaningfully improved.

- What are their concerns about digital services they used before, and how can you help overcome them?

Security, transparency, hidden fees, and poor customer support are common pain points with digital financial products. During your research, listening to user complaints, reviews, and feedback from other platforms is important. Understanding these concerns lets you address them proactively in your design and communication strategy. Whether it’s offering instant notifications for all transactions, 24/7 human support, or crystal-clear pricing, your goal is to build trust and eliminate friction that users have previously encountered.

2. Regulatory Compliance

Launching a digital bank is not just a tech or business endeavour, but it’s also an intensely regulated activity. Navigating financial regulations is one of the most complex and critical parts of building a neobank. Missteps in this area can lead to delays, penalties, or even project failure. To ensure a smooth launch and long-term sustainability, you must take regulatory compliance seriously.

Key areas to consider include:

Licensing and Authorisations

Identify the appropriate type of financial license for your digital bank. Options may include e-money licenses, full banking licenses, or partnerships with licensed institutions (also known as “Banking-as-a-Service” models).

The licensing requirements vary widely across regions. For example, in some jurisdictions, you must present a working prototype or a proven business model before applying for a license. In others, you can begin the licensing process earlier, often based on your business plan and founder credentials. Understanding these nuances early will save time and resources.

KYC and AML Compliance

You must implement strong Know Your Customer (KYC) and Anti-Money Laundering (AML) processes to verify users and monitor financial activity. These are not optional—they are legally required to prevent fraud, money laundering, and financing of illegal activities.

Consider integrating with trusted identity verification providers or compliance platforms.

Data Protection and Privacy

Compliance with local and international data protection laws such as GDPR (Europe), CCPA (California), or others is mandatory. You must ensure secure data storage, user consent handling, and the right for users to access or delete their data.

Ongoing Reporting and Auditing

Most regulatory bodies require regular reporting on your operations, customer metrics, capital adequacy, and risk exposure. Be prepared to implement internal systems that support real-time auditing and automated compliance tracking.

3. Building a digital bank

This step is the most time-consuming and consists of its own stages:

Core banking system

The term CORE stands for Centralized Online Real-time Environment, meaning that customers can experience the bank as a single unit regardless of location. This system processes daily banking transactions and posts updates to accounts and other financial records. Core banking systems typically include deposit, loan, and credit processing capabilities, with interfaces to general ledger systems and reporting tools. You can find more information here.

User Experience (UX)

You should always keep your end user in mind, so design an intuitive and user-friendly interface for your digital banking platform. Prioritise a seamless user experience across web and mobile applications. Consider features such as biometric authentication, chat support, and personalised dashboards.

Security Measures

Protecting customer data and transactions is a top priority, so you should implement advanced security measures. Include features like multi-factor authentication, encryption, and fraud detection systems. Regularly update security protocols to stay ahead of emerging threats.

Development

Develop a range of banking products and services that cater to your target audience, which you indicated in the first stage. This may include savings, checking accounts, loans, investment products, and innovative features like budgeting tools or round-up savings.

You should also consider developing a feature-rich and secure mobile banking application for iOS and Android platforms. Ensure the app meets industry standards for security and usability. Regularly update the app to add new features and address any issues.

Testing

Conduct thorough testing of your digital banking platform to identify and resolve bugs or usability issues. Perform security testing to ensure the platform can withstand potential cyber threats. User acceptance testing is crucial to gather feedback and make necessary improvements.

Launch a Digital Bank

Launch your digital bank with a comprehensive marketing strategy. Utilise online and offline channels to promote your services. Highlight key features, benefits, and promotional offers to attract the initial customer base.

4. Continuous Improvement

Launching your digital bank is just the beginning—long-term success depends on your ability to evolve continuously based on customer needs, market shifts, and emerging technologies. Neobanks operate in a fast-moving landscape, where user expectations change rapidly and competition constantly introduces new features. That’s why ongoing improvement must be a built-in part of your business strategy, not an afterthought.

Start by creating systems for regularly collecting user feedback. This includes in-app surveys, customer support insights, app store reviews, and social media listening. Combine this qualitative data with behavioural analytics to understand how users interact with your platform: where they drop off, what features they engage with most, and where they face friction. These insights can uncover both minor usability issues and larger strategic gaps.

Improvements should span across multiple areas:

- User Experience (UX): Streamline onboarding, simplify interfaces, and optimise performance based on real user behaviour.

- Feature Development: Introduce new tools that align with user needs, such as personal finance management, savings goals, or integrations with third-party services.

- Security and Compliance: Stay ahead of evolving cybersecurity threats and regulatory updates by implementing regular security audits, patching vulnerabilities, and adapting to legal changes.

- Customer Support: Enhance support quality with faster response times, AI-powered assistants, and multilingual service options.

Finally, adopt a culture of experimentation and agile development. Regular updates, A/B testing, and iterative product releases allow you to stay nimble and user-focused. A digital bank that listens, adapts, and innovates is one that builds lasting trust and customer loyalty in a highly competitive market.

And that`s how to start your own online bank!

Challenges You May Face

Of course, building a solution from scratch is not easy and presents its challenges. Especially if we are talking about the financial world, which deals with highly sensitive data. Understanding these challenges upfront is crucial for any business venturing into the digital banking space.

Regulatory Compliance and Licensing

The most significant barrier to entry remains navigating the intricate web of financial regulations. The regulatory landscape varies dramatically between countries, with some markets requiring full banking licenses while others offer more accessible electronic money institution (EMI) or payment service provider (PSP) licenses.

Solution: Many successful digital banks have adopted a phased approach, starting an online bank with partnerships with established banks or obtaining less restrictive licenses like EMI permits. This “banking-as-a-service” model allows new entrants to offer banking services while leveraging existing infrastructure and compliance frameworks.

Technology Infrastructure and Security

Digital banks must build robust, scalable technology platforms capable of handling millions of transactions while maintaining 99.9% uptime. The challenge extends beyond basic functionality, encompassing advanced security measures, fraud detection systems, and seamless integration with third-party services.

Solution: Cloud-native architecture has emerged as the preferred approach, offering scalability, reliability, and cost-effectiveness. Microservices architecture allows banks to build modular systems that can evolve independently, while containerization ensures consistent deployment across environments. For security, implementing zero-trust security models, multi-factor authentication, and AI-powered fraud detection systems provides multiple layers of protection.

Customer Trust and Brand Recognition

Established banks benefit from decades of brand recognition and customer trust, while digital banks must build credibility from scratch. Customers remain hesitant to entrust their money to unknown entities, particularly without physical branches where they can seek assistance.

Solution: Transparency becomes paramount in building trust. Digital banks can prominently showcase their regulatory compliance, security certifications, and deposit protection schemes. Providing exceptional customer service through multiple channels, including 24/7 chat support and comprehensive self-service options, helps bridge the gap left by the absence of physical locations.

Operational Scalability

As digital banks grow, they must scale their operations efficiently while maintaining service quality. This includes customer service, compliance monitoring, risk management, and technology infrastructure.

Solution: Automation and artificial intelligence play crucial roles in scaling operations efficiently. Building scalable processes from the beginning, rather than retrofitting them later, proves more cost-effective and efficient. Strategic partnerships with specialised service providers can also help manage specific operational aspects without requiring internal expertise in every area.

Expert Tips for Building a Digital Bank

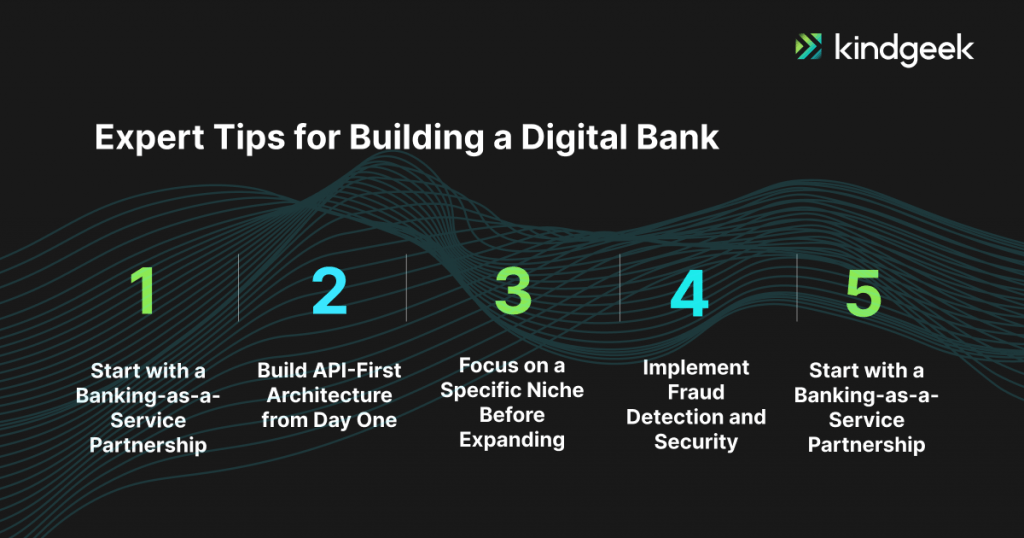

1. Start with a Banking-as-a-Service Partnership

If it`s suitable for your business needs, consider partnering with an established bank through a Banking-as-a-Service model, rather than pursuing a full banking license immediately, to reduce your time-to-market dramatically. This approach allows you to leverage existing banking infrastructure, compliance frameworks, and regulatory relationships while you focus on building your customer experience and technology platform.

2. Build API-First Architecture from Day One

Designing your entire technology stack with robust APIs as the foundation is crucial for long-term success. This approach enables seamless integration with third-party services, payment processors, credit bureaus, and other fintech partners that will be essential to your offering. An API-first architecture also makes it easier to scale your platform, add new features, and adapt to changing market conditions.

3. Focus on a Specific Niche Before Expanding

Attempting to serve everyone from launching a digital bank is a recipe for excessive customer acquisition costs. Digital banks typically starting an online bank by focusing on underserved market segments such as freelancers, small businesses, millennials, or specific geographic regions. This targeted approach allows you to deeply understand your customers’ unique needs, build tailored solutions, and create strong word-of-mouth marketing within your chosen community.

4. Implement Real-Time Fraud Detection and Security

Digital banks face significantly higher fraud risks than traditional banks due to the lack of physical verification points and the increased sophistication of online fraud. Implementing machine learning-based fraud detection systems that can identify and prevent suspicious transactions in real-time is essential for survival. These systems should analyse transaction patterns, device fingerprinting, and behavioural biometrics to flag potentially fraudulent activity.

5. Launch with Core Features and Iterate Rapidly

Resist the temptation to build a feature-rich platform from day one. Instead, launch with essential banking services, like basic checking and savings accounts, instant payments, and simple budgeting tools, and then rapidly iterate based on real user feedback and behaviour. This lean approach not only gets you to market faster but also prevents you from investing resources in features that customers don’t actually want or use.

Consider Kindgeek Your Trusted Partner

If you are looking to create your own digital bank, consider Kindgeek. We specialise in helping businesses unlock their full potential. Since launch, we have provided core fintech banking and payment solutions as a software shortcut for businesses looking to launch their fintech products, from digital wallets to neobanks, accommodating startups and enterprise-level customers.

We can also follow a component-based approach and assemble readily available building blocks to shape your custom business-specific solution. We ensure faster deployment times and cost efficiency while maintaining the highest quality standards.

Check our cases, and see how we can become your perfect match.

Final Thoughts

Discovering how to create an online bank is one of today’s most challenging yet rewarding financial business opportunities. Success requires more than innovative technology. It demands regulatory expertise, robust security, and genuine customer trust.

For those ready to take on this challenge, focus on solving specific problems for targeted customer segments, build experienced teams that combine technical and banking expertise, and maintain flexibility to adapt based on market feedback. Start lean, iterate rapidly, and prioritise compliance and security from day one.

The financial services industry creates unique opportunities for well-prepared businesses to reshape how people interact with money. The future of banking is digital, and it’s being written by those bold enough to reimagine what financial services can be. And we are hoping that now you know how to create a digital online bank from scratch.

What is a digital bank?

Digital bank offers the full range of core banking services found at physical branches: savings accounts, loans, and credit cards, but functions digitally.

What are the digital banking trends of 2024?

Here are some of the main digital banking trends at the moment: AI and ML, open banking, neobanks, voice banking and gamification.

What are the steps to building a digital bank from scratch?

Some basic steps to build a digital bank are market research and planning, regulatory compliance, product building and continuous improvement.