Recently updated on January 21, 2025

In today’s digital economy, Buy Now, Pay Later (BNPL) has evolved from a trendy payment option to an essential part of the modern shopping experience. With major retailers, online platforms, and even traditional banks embracing BNPL solutions, consumers now face an unprecedented array of flexible payment choices.

As BNPL continues to reshape consumer behaviour and challenge credit card dominance, understanding its implications becomes crucial. This guide will give you the answer to what is a BNPL and unpack BNPL pros and cons, helping you navigate the growing landscape of providers and make financially sound decisions.

This article was composed in collaboration with our partner, Sileon. Our partnership started in May 2023 and become an exciting development that drives innovation and shapes the fintech landscape with more cutting-edge solutions.

This partnership combines Kindgeek’s deep fintech software development expertise with Sileon’s scalable Buy Now Pay Later software product, which consists of platform and solution modules. While Sileon’s Platform acts as a core banking system for BNPL, the Solution modules are elective components that can be placed on top of the Platform for an additional tailored BNPL offering.

At the core of Kindgeek’s business philosophy lies a deep dedication to client-centricity. This partnership with Sileon further strengthens Kindgeek’s commitment to delivering tailored solutions for financial institutions and their customers’ unique needs. Our combined expertise enables a shorter time to market.

It also allows us to provide deeper and intricate insights for this article. Just keep reading.

What is Buy Now Pay Later (BNPL), and How does it work?

So what is BNPL meaning? This abbreviation stands for Buy Now Pay Later and is a type of short-term financing that allows consumers to make purchases and pay for them in instalments over a period of time, typically a few weeks or months, instead of paying the total amount upfront. It has become increasingly popular, and some of the biggest retailers and apps, such as PayPal, offer this service.

You’ll often see BNPL payment plans available when you check out online. For in-store shopping, providers usually offer virtual cards that can be downloaded from the provider’s mobile app, saved to a mobile wallet and used at the register.

So how does it work? Let`s overline the typical process from the customer’s perspective:

- At checkout, online or in-store, consumers are given the option to pay with BNPL.

- Then, they`ll typically have to fill out a short application, providing information like name, address, email address, date of birth, phone number, and Social Security number.

- The purchase amount is divided into equal instalments, usually four or fewer, with the first instalment paid at the time of purchase.

- The remaining instalments are automatically charged to the consumer’s debit or credit card on a schedule, typically every two weeks or monthly.

- Many BNPL providers do not charge interest or fees for on-time payments. However, late fees or deferred interest may apply if payments are missed or delayed.

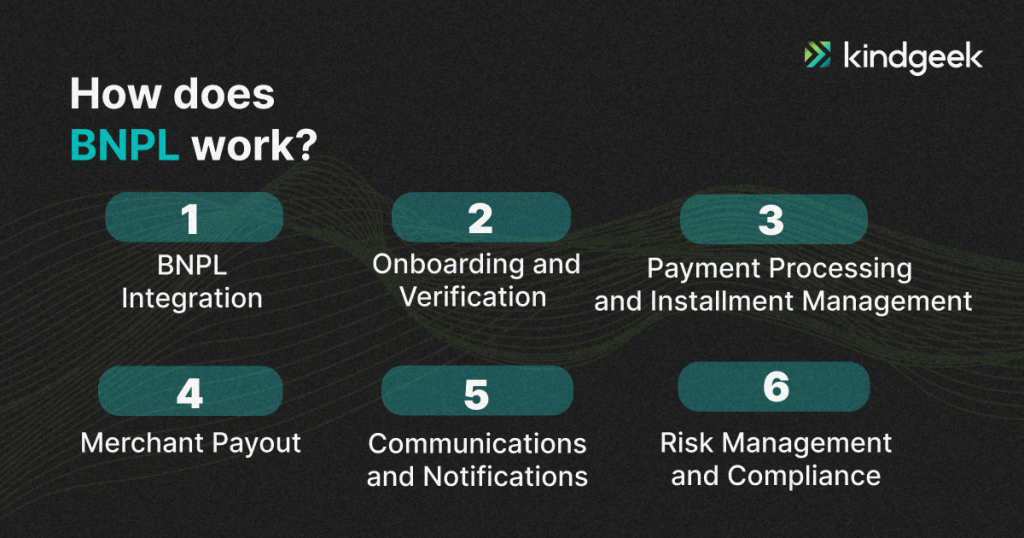

To make this process as simple and easy as it is for the customers, bank card providers, merchants, and BNPL providers ensure some additional and essential steps:

BNPL Integration

BNPL providers offer APIs (Application Programming Interfaces) or software development kits (SDKs) that allow bank card providers and merchants to integrate BNPL payment options. These integrations enable customers to select the BNPL option during the checkout process and provide the necessary information.

Customer Onboarding and Verification

When customers choose the Buy Now Pay Later option, the provider’s platform collects and verifies their personal and financial information, such as name, email, phone number, and debit or credit card details. Soft credit checks or alternative data sources may be used to assess creditworthiness and fraud risk.

Payment Processing and Installment Management

The BNPL provider processes the initial down payment and captures the customer’s payment method for future instalments. The platform manages the instalment schedule, automatically charging the customer’s payment method on the predetermined dates for the remaining instalments.

Merchant Payout

BNPL providers typically pay the merchant the total purchase amount upfront, minus any fees or commissions. This ensures that merchants receive payment immediately, while the BNPL provider is responsible for collecting instalments from the customer.

Customer Communications and Notifications

BNPL platforms often have robust communication systems to send payment reminders, instalment due date notifications, and other customer updates via email, SMS, or in-app notifications. Some providers offer customer portals or mobile apps where customers can manage their BNPL orders, view payment schedules, and update payment methods.

Risk Management and Regulatory Compliance

BNPL providers leverage data analytics and machine learning algorithms to assess risk, detect fraud, and make informed decisions about extending credit to customers. They may use customer data, purchase history, and external sources to refine their risk models and improve the overall customer experience.

They also must adhere to various regulations related to consumer lending, data privacy, and financial services, which may differ across jurisdictions. Their platforms are designed to comply with relevant laws and industry standards.

Buy Now Pay Later (BNPL) Solution Integration: 5 Reasons to Add from Sileon

As a bank card provider, integrating Buy Now, Pay Later solutions into your credit and debit card offerings can be highly beneficial for both you and the end user. Here are several compelling benefits of BNPL as an option that can enhance the overall experience:

Increased Revenue and Profitability

Integrating BNPL options can significantly increase the profitability of your debit and credit cards. It opens up new revenue streams and enhances the overall value proposition for cardholders.

Modernise Your Cards and Attract New Customers

BNPL integration helps exceed your existing cardholders’ digital expectations and attracts new customers looking for convenient payment options. It modernises your card offerings and aligns with current market trends.

No Tech Barrier with BNPL SaaS

You can easily integrate BNPL solutions into your existing card infrastructure with BNPL Software as a Service (SaaS). This plug-and-play approach minimises tech barriers and accelerates implementation.

Bypass Checkout and POS Complexities

BNPL allows you to reach customers seamlessly without relying on complex checkout or point-of-sale (POS) infrastructure. This streamlined process enhances customer convenience and satisfaction.

Responsible BNPL Practices

Offering BNPL through your cards enables a sustainable BNPL model with responsible lending practices. This fosters trust among cardholders and promotes long-term financial wellness.

Integrating BNPL options into your card offerings aligns with consumer trends, promotes financial inclusion, and strengthens your competitive position in the market. It’s a strategic move that not only benefits end users with enhanced payment flexibility but also drives business growth and customer engagement for the bank.

Risks associated with BNPL and How to mitigate them

Despite the compelling advantages of integrating Buy Now Pay Later services into payment portfolios, providers must carefully consider and actively manage the associated risks. The rapidly evolving BNPL landscape, coupled with increasing regulatory scrutiny and changing consumer behaviour, demands a robust risk management framework.

For example, in 2023, the Office of the Controler of the Currency (OCC) provided guidance on managing risks associated with BNPL lending for the U.S. It contains a list of risks that includes the following:

- The lack of clear, standardised disclosure language could obscure the true nature of the loan, resulting in consumer harm or present a risk of violating prohibitions on unfair, deceptive, or abusive acts or practices.

- The highly automated nature of BNPL lending, with instantaneous credit decisions and frequent firm reliance on third parties, can elevate operational risk, including elevated first payment default risk from fraud.

- Lenders may lack comprehensive information about an applicant’s BNPL borrowing activity, as credit reporting agencies often have limited capture of BNPL loan data. This incomplete reporting can make it challenging for lenders to assess an applicant’s total debt obligations and financial commitments before approving new credit lines.

To mitigate those risks, OCC suggests the following practices:

Credit Risk Management

Banks are advised that methods to collect BNPL debt, mitigate losses, and contact borrowers may require specialised approaches and strategies that differ from traditional consumer debt collection practices. With regard to charge-off practices, banks are advised to appropriately tailor their charge-off policies for the short-term nature of BNPL loans.

Operational Risk Management

Banks are advised to establish: internal controls and processes for handling merchandise returns and merchant disputes; processes to confirm that potential borrowers are of legal age to obtain credit; procedures to address first payment default; controls to identify suspected fraud in a timely manner; and risk models.

Third-Party Risk Management

Managing the risks arising from third-party relationships in connection with making BNPL loans, such as relationships with merchants, is a must.

Compliance Risk Management

Bank management is advised to consider the applicability of consumer protection-related laws and regulations to the bank’s specific BNPL products, particularly with respect to product delivery methods, marketing, advertising, and other standardised disclosures. They should also consider billing dispute and error resolution rights and practices relating to automatic payments, multiple payment representations, and late fees. BNPL lending should be incorporated into a bank’s compliance management system.

As with any other industry, being aware of risks and taking steps to mitigate them is crucial to a business’s operation. This is especially true in the financial services industry, where the security of a customer and a service provider is a number one priority.

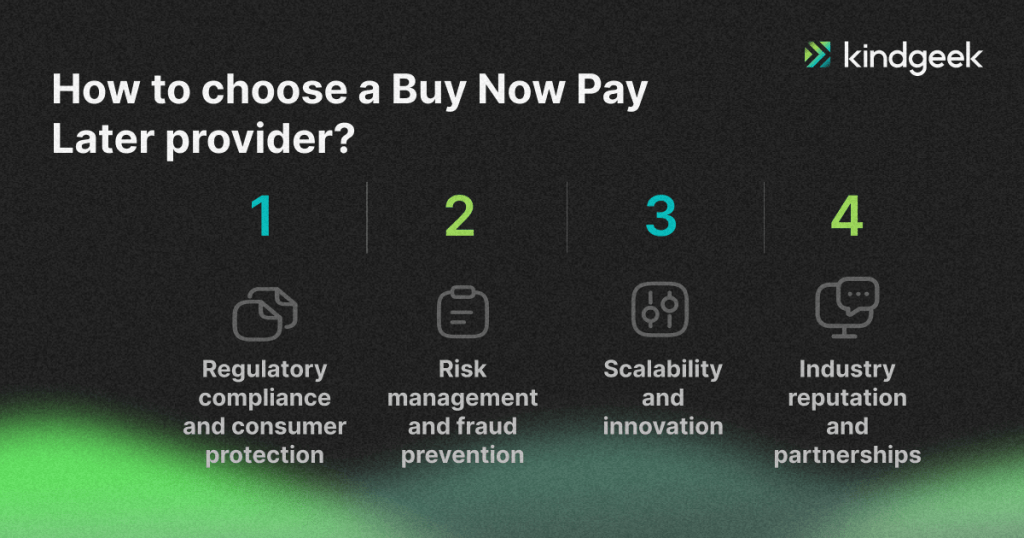

How to choose a Buy Now Pay Later provider?

Choosing the right Buy Now Pay Later provider is a critical decision that requires careful consideration of various factors:

Regulatory compliance and consumer protection

Whenever you bring in a third-party service provider to your business, ensuring they have your customers’ best interests in mind should be a priority. BNPL providers should adhere to relevant consumer protection laws and regulations. They should prioritise data privacy, fair lending practices, and responsible lending principles, fostering trust and safeguarding consumer interests.

Risk management and fraud prevention

A BNPL provider will have access to your customers’ most sensitive information, including payment methods and other identifying information required to process their approval check. It means that they should have robust strategies to detect and prevent various forms of fraud, including identity theft, account takeovers, and synthetic fraud. Their ability to handle data breaches and protect customer information is a testament to their commitment to security.

Scalability and innovation

As the BNPL market continues to grow, providers must be able to scale and handle increasing transaction volumes and customer growth. Their investment in BNPL technology, data analytics, and product innovation is crucial to staying ahead of evolving market trends and consumer preferences.

Industry reputation and partnerships

Research the provider’s standing within the industry and their relationships with merchants, lenders, consumer advocacy groups, industry associations, regulators, and other stakeholders. Providers prioritising transparency, ethical practices, and responsible lending are more likely to foster trust and maintain a positive reputation.

By thoroughly evaluating these factors and adopting a holistic approach, you can make an informed decision when choosing a BNPL provider that aligns with your business values, prioritises consumer protection, and offers a secure, transparent, and responsible lending experience.

Conclusion

The BNPL has fundamentally transformed the retail and financial services landscape, evolving from a niche payment option to a mainstream financial tool that shapes consumer expectations and shopping behaviours. As artificial intelligence and open banking continue to enhance credit decisions and user experience, BNPL providers are pushing the boundaries of financial innovation while navigating increasing regulatory oversight.

For businesses, success in the BNPL space now extends beyond mere implementation. It requires strategic partnerships with providers who demonstrate the understanding of buy now pay later pros and cons, have strong risk management capabilities, embrace regulatory compliance, and prioritize financial inclusion and customer education.

Looking ahead, the future of BNPL lies in its ability to adapt to changing market conditions, regulatory requirements, and consumer needs. As the industry matures, we’re likely to see more sophisticated offerings that combine the convenience of BNPL with enhanced financial wellness tools, helping consumers make more informed decisions about their purchasing power and financial health.