Recently updated on July 29, 2024

The payment industry is undergoing a remarkable transformation driven by technological advancements, shifting consumer preferences, and evolving regulatory landscapes. As we navigate the digital age, the way we transact and exchange value is rapidly evolving, presenting both challenges and opportunities for businesses and consumers alike.

In this ever-changing landscape, staying ahead of the curve is crucial. The future of the payment industry is shaped by a confluence of trends that are redefining the way we think about and conduct financial transactions. From the rise of mobile wallets and contactless payments to the advent of cryptocurrencies and blockchain technology, the payment ecosystem is being reshaped at an unprecedented pace.

From this article you will learn about the future of the payment industry, some current payment processing trends, and desired ways of payment methods evolution.

Content:

1. The Current State of a Payment Gateway

2. Evolution of Payment Methods

3. What to Expect in the Future of Payment Technologies?

4. Payment Industry Trends to Pay Attention

The Current State of a Payment Gateway

A payment gateway is basically a middleman between a user and a bank. The gateway is responsible for the transfer of payment information, such as debit or credit card data, between a portal from which the payment is made (an online marketplace, an app with a subscription, etc) and a bank that processes the information. Usually, a middleman is an element of ineffectiveness as it adds a third-party link to a process chain.

However, a payment gateway is a justified link, which is very expensive, risky, and complicated to remove. The gateway has all the means necessary as well as an established process for a secure transaction of huge quantities of payment data. Well-protected processing of payments in different currencies, on the scale, and in accordance with local regulations is a complicated task, and the gateways exist to make it seamless and smooth.

Evolution of Payment Methods

To talk about evolution, it is important to understand some basic technologies behind payment processing. Condensed to its basics, the process of payment processing has the following steps:

1) A customer enters their credit/debit card information on a merchant’s web resource. Then, the data either goes through the merchant system, which transmits it to a payment gateway, or bypasses the system and goes straight to the gateway. The second option warrants lighter regulations the merchant should comply with.

2) A payment gateway takes care of the data, encrypts it, and sends it to a payment processor of an acquiring bank that works with a merchant.

3) The acquiring bank sends the payment data to a credit card association (Visa, MasterCard, etc).

4) The association decides the fate of the transaction, checking its validity based on the state of the card and funds available. Then, the credit card issuer sends the authorization (or rejection with the reasons why) back to the payment processor, which in turn, sends it to the gateway.

5) Now, the gateway can show the merchant that the customer’s request is valid, so the merchant can satisfy the order.

The process looks quite complicated and a little bit convoluted even without diving deeper into details. However, the digital wonders allow a transaction to be processed in seconds. Nonetheless, the end of the process doesn’t mean that the merchant will receive payments immediately. Getting the money is a long process, which can take up to three days, and involves the processing of authorized requests by acquiring banks and a lot of bureaucratic noodling.

So, it seems like payment gateways exist within a well-functioning system that has had years to improve and determine the best financial ‘logistics.’ Yeah, but not really. If you look closely enough, you will notice that the digital economy hasn’t evolved in years. There might have been some changes to the algorithms and protocols, but the essence of the process hasn’t changed at all. Regardless of how fast transactions occur within the system, they still run on the same old squarish wheels. There are still a ton of steps with plenty of middlemen and protocols. Such a situation allows for a lot of fees and a lot of bureaucratic establishments to stay in the game. The evolution of the system is impossible with such a rigid system.

Innovative payment methods, if given the chance, can embrace the responsibility to make meaningful changes and challenge the status quo of the transaction processing system, improving merchants’ experience. There are several ways of reshaping the payment industry to disrupt the digital economy better.

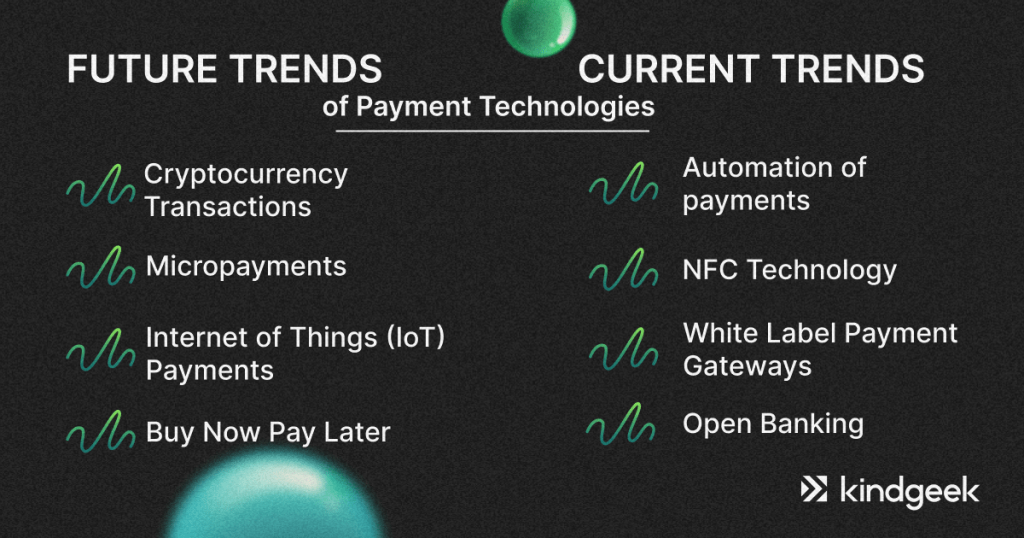

We’ve divided the possible future payment processing into two categories:

1. Future trends to expect

2. Practical current trends to try

Let`s dig deeper in the next chapters.

What to Expect in the Future of Payment Technologies?

Cryptocurrency Transactions

It’s quite difficult to predict how exactly such a future of payment technology would function and which legislations would regulate it on a global scale (there are possibilities to pay in crypto nowadays, but they are rather local, to say the least). However, if a cryptocurrency-based transaction becomes a practical reality on a scale, it is quite possible that a new set of regulations would have to be developed to monitor it, which would provide a great opportunity for the reinvention of old practices. In any case, crypto transactions can be a cheaper and safer way of money exchange.

Micropayments

If the transaction cost is reduced to a negligible tiny amount, the transfer of incredibly small amounts of money would become viable. If so, it would allow for extremely accurate billing of the transaction services. It’s like renting a house, but instead of paying for a whole month, you pay for each second that you spend there. Not a single cent less. Not a single cent more.

So far, attempts at micro and nano payments have been unsuccessful because a sufficiently low transaction fee makes them infeasible. Currently, some providers implement micropayments, but only for a limited number of services.

For instance, Jamatto, is a micropayment provider that allows websites and publishers to receive payments as small as 1 cent.

It is difficult to predict the future scope of an online payment system based on micropayments. Implementing such a system on a global scale is a very ambitious and not 100% viable idea. However, such a paradigm shift is possible with the improvement of technologies and money transfer logistics.

Internet of Things (IoT) Payments

Imagine a world where your everyday objects seamlessly handle payments for you. That’s the promise of IoT (Internet of Things) payments. As more devices become connected to the internet, they will be able to initiate and process transactions automatically.

Take your smart refrigerator, for example. With IoT payments, it could sense when you’re running low on milk and order more, paying for the groceries without you lifting a finger. Or picture your self-driving car effortlessly paying tolls and parking fees as you go about your day.

But enabling this IoT payment ecosystem requires sophisticated technology. Devices must securely communicate with payment gateways and financial institutions. Biometrics, encryption, and other authentication methods ensure only authorized transactions go through. Regulatory bodies will also need to weigh in to protect consumer data and privacy.

Buy Now Pay Later

It is a type of short-term financing that allows consumers to make purchases and pay for them in instalments over a period of time, typically a few weeks or months, instead of paying the total amount upfront.

The appeal is obvious, especially for younger shoppers wary of traditional credit but still seeking payment flexibility. No more delaying gratification – BNPL makes coveted purchases more immediately accessible. For retailers, offering these pay-over-time options can boost sales and customer loyalty. An easier checkout process translates into higher conversion rates and larger basket sizes.

While undeniably convenient, responsible BNPL use will be crucial as the industry matures and regulators inevitably get involved.

Payment Industry Trends to Pay Attention

Automation of payments

A well-tuned payment network with ‘smart’ gateways within a corporate environment will allow for automatic payments to suppliers and service providers at predetermined periods of time with minimal involvement of people. The gateways that innovate the fastest and can support such a functionality first will have a cosy, profitable place within such a B2B payment environment. Automation of payments is an attractive payment processing trend, and we hope it will continue to evolve.

NFC Technology

NFC (near-field communication) technology enables contactless payments, which boosts the convenience of the payment process on the user side. The trend is expected to spread even further, affecting different sectors from transportation to the retail and hospitality industry. NFC is perhaps one of the trendiest payment technology trends because it’s easy to implement and popularize.

White Label Payment Gateways

A white label, one of the payment gateway trends, is a customizable payment processing service that enables businesses to accept online payments from customers using various payment methods such as credit and debit cards, digital wallets, and bank transfers. Unlike traditional payment gateways, white-label solutions allow businesses to brand the payment gateway with their logo and design, providing a seamless and consistent customer experience. You can experience even more benefits by discovering the synergy between white label payment gateways and digital wallets.

Open Banking

Open banking is a financial concept that revolves around the idea of providing third-party financial service providers access to a consumer’s financial information through Application Programming Interfaces (APIs). It opens up traditional banking systems to external parties, fostering collaboration, innovation, and competition within the financial industry.

This unlocks a world of personalized financial services tailored to each user’s unique situation and needs. That clunky one-size-fits-all banking experience? Now a relic, replaced by hyper-customized solutions made possible by an open ecosystem of integrated providers.

But such openness doesn’t come without risks. Data privacy and security are paramount concerns that must be addressed through robust authentication, encryption protocols, and clear user consent processes.

Final Thoughts

The payment industry will continue to grow and develop, and sometime in the future, drastic change will be absolutely required to push through another ceiling on the path of improvement or to satiate another market need. Payment processing trends strive towards simplification of the sector. The simpler the processes will be, the more leeway entrepreneurs will have to act and develop their businesses. And payment transactions are an essential part of the simplification.

However, as the payment industry continues to innovate, it is crucial to address concerns around data privacy, security, and consumer protection. Striking the right balance between innovation and robust safeguards will be key to ensuring the long-term success and adoption of these new payment technologies.

Nonetheless, so far, we have to work with what we have. And we have plenty. Despite the archaic bureaucratic systems in some places, the ripeness of the opportunities the availability of powerful computers and reliable software make the dreams of the cashless, transparent, and well-optimized economy as close as they have ever been. You simply have to reach your hand and try to seize a couple of opportunities and enter the FinTech game to build the future.

And if you need some help in doing so, we have a lot to offer. We know the hard work that goes into the creation of reliable Fintech systems, we know the intricacies of working with payment gateway providers, and the complexities of the regulatory environments.

We also provide a white label digital banking platform, which serves as a foundation for digital finance products. The customizable white-label core allows you to build on top of it and create a unique customer experience. No need to start from scratch – go to market quickly and cost-effectively.So, if you want our experience and expertise to become your asset, contact us, we’ll be happy to help. From the product discovery phase to deployment and beyond, we guide through the whole process of developing fintech products. We build software solutions that resolve core business needs with a product-oriented mindset.