What programming language is the best choice for your Fintech application? Our experience demonstrates that “THE best does not exist, but Java is one of the most suitable options.”

Java is one of the most demanded programming languages; 90% of Fortune 500 companies use Java; Java reigns over the Finance industry; it is quite possible that one of your acquaintances learns Java; even your smart fridge most likely runs on Java. Java is everywhere, and for a reason. This language is armed with everything required to create reliable and viable applications of all sorts, and Fintech stuff in particular. So if you are thinking about building a financial web application using Java, keep reading.

Content:

- Security and safety of Java

- Platform-independence of Java

- A pivot of Big Data

- A mature language of Java

- Conclusions

- Consider Kindgeek as your trusted partner

Why Java is so popular in Finance and Fintech software solutions? Well, because Java is…

1. Secure and Safe

Black Hat defines Java as a simple, portable, and robust language developed with security in mind. Simple and robust = a programmer needs to have special talent to “break” it and make software written in Java behave unpredictably.

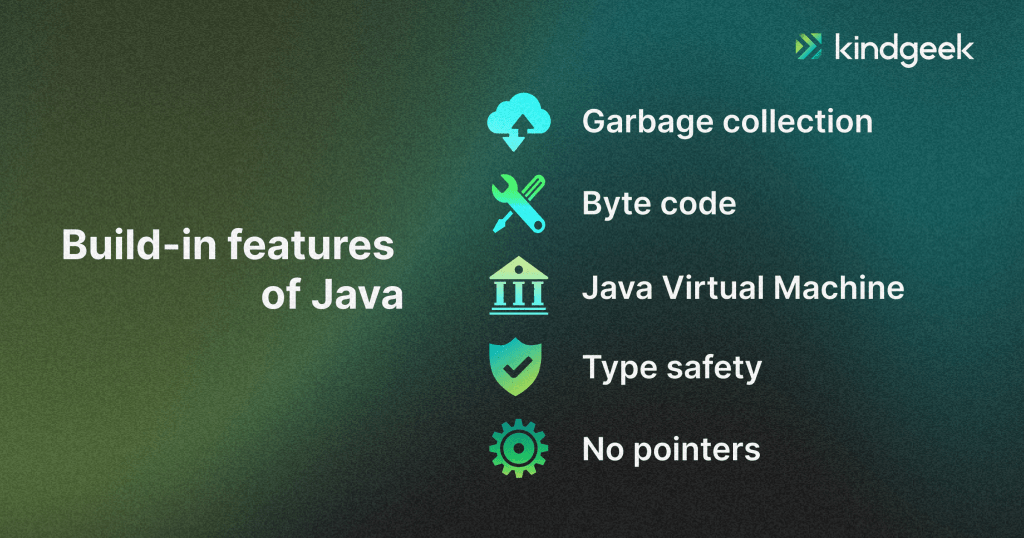

This is why Java for financial modeling is so good – it is safe, and it has built-in features that make it difficult to cause certain security flaws. Those features are:

1) Byte code. To run its programs, Java transforms code into bytecode, which is difficult to modify or attack.

2) Java Virtual Machine. Java executes its code within a specially designed sandbox (JVM) and not on a host computer. As a result, a computer cannot: receive damage to hardware, software, or information that a program may cause; pass unauthorised information to third parties; or become unusable because of resource depletion.

3) No pointers. Unlike C or C++, Java does not use pointers, which can cause unauthorised access to information if other software receives values of the pointers.

4) Garbage collection. Transparent storage management helps ensure a program’s integrity and avoid crashes due to improper freeing of memory.

5) Type safety. Java makes it impossible to operate on objects that are not valid for these operations. The absence of type safety is often a source of many headaches in other languages.

2. Platform-independent

Java’s programs can run on different systems (Windows, Mac, Linux, Android, Ios). It makes Java for financial applications an attractive option for entrepreneurs who want to go cross-platform and reach the widest audience possible with minimum investments.

However, it is essential to remember that platform independence is not absolute, which means that Java programs still require some tweaking under the hood to fit the peculiarities of different systems but significantly less tweaking than programs written in other languages.

3. A Pivot of Big Data

Big Data disrupts the Finance Industry. The creation of 2.5 quintillions of data and the necessity to efficiently analyse relevant information to be at the top of the industry makes Big Data an obligatory business tool.

At the same time, Java is a Pivot in the world of Big Data. Therefore, it is natural for a large number of Java projects in the financial industry to keep up with the pace of progress and implement their own Big Data solutions.

4. A Mature Language

Java is a mature language that has dominated various industries for over 20 years. Java has a huge and active online community (sources claim there are more than 17.1 million Java developers as of Q1 of 2023). The legacy of the language is enormous. The Internet is a whole of solutions to common issues that may appear in the process of fintech application development using Java, as well as a variety of Java methods for financial engineering and ready-to-use solutions to different tasks. It makes the process of learning Java and coding in Java smooth and straightforward, as developers always have a “strong shoulder” to lean on.

The piece of mind that comes with a language with a rich legacy and active community is an essential aspect of developers’ confidence.

Conclusions

Java emerges as an unrivalled choice for financial applications with Java programming due to its multifaceted advantages. Foremost among these is its robust security while working with financial data in Java, providing a shield against cyber threats and ensuring the integrity of sensitive financial data. The platform independence of Java is another significant factor, enabling seamless deployment across various operating systems and devices, crucial for widespread accessibility in the finance sector.

Moreover, Java’s pivotal role in handling big data proves invaluable, allowing financial institutions to process and analyse vast volumes of information efficiently, facilitating informed decision-making and predictive analytics. Finally, the maturity of Java as a language underscores its reliability, extensive community support, and rich ecosystem of libraries and frameworks, making it a stable and enduring choice for developing complex financial systems that demand stability, scalability, and performance.

As the financial landscape evolves, Java remains a steadfast cornerstone, empowering developers to craft secure, adaptable, and high-performing applications tailored to the dynamic needs of the finance industry.

Consider Kindgeek as your trusted partner

If you are looking to develop a secure application for fintech in Java, consider Kindgeek. We are a full-cycle fintech development company that provides core fintech banking and payment solutions to serve as a software shortcut for businesses looking to launch their fintech products. Our white-label fintech solution can significantly speed up your way to the market. With a wide range of pre-built features, combined with thoughtful customisation and development, you receive a solution with the functionality to jumpstart your online finance business or get digital without heavy upfront investment.