Recently updated on September 23, 2025

What is the best programming language for fintech? Our experience demonstrates that “THE best does not exist, but Java is one of the most suitable options.”

Java is one of the most demanded programming languages – 90% of Fortune 500 companies use Java. According to the September 2025 TIOBE Programming Community index, which measures the popularity of programming languages, Java secured a solid fourth place behind Python, C++ and C, signaling its yearslong relevance.

This language is everywhere: yep,it is quite possible that one of your acquaintances learns Java or even your smart fridge most likely runs on it. Being the king of enterprise software, Java reigns over the finance industry, and for a reason. For many institutions, it stands out as the best coding language for finance since it is armed with everything required to create reliable and viable applications of all sorts, and fintech solutions in particular.

So if you are thinking about utilizing Java for finance software, just keep reading.

Content:

- Security and safety of Java

- Platform-independence of Java

- A pivot of Big Data

- Maturity of language

- Conclusion

- Kindgeek – Your Trusted Tech Partner

Why Financial Institutions Prefer Java

Because of its established reliability in enterprise use, Java remains a go-to choice for financial systems. To be more practical, let’s dive deep into the reasons why.

1. Security and safety of Java

Black Hat defines Java as a simple, portable, and robust language developed with security in mind. Simple and robust = a programmer needs to have special talent to “break” it and make software written in Java behave unpredictably.

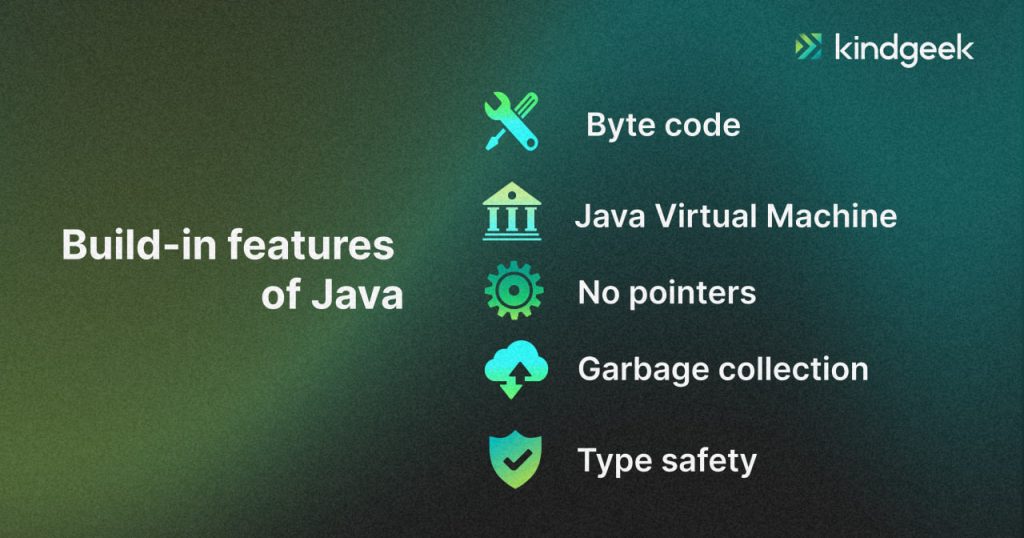

This is why Java for financial modeling is so good – it is safe, and it has built-in features that make it difficult to cause certain security flaws. Those features are:

1) Byte code. To run its programs, Java in banking transforms code into bytecode, which is difficult to modify or attack.

2) Java Virtual Machine. Java executes its code within a specially designed sandbox (JVM) and not on a host computer. As a result, a computer cannot: receive damage to hardware, software, or information that a program may cause; pass unauthorised information to third parties; or become unusable because of resource depletion.

3) No pointers. Unlike C or C++, Java does not use pointers, which can cause unauthorized access to information if other software receives values of the pointers.

4) Garbage collection. Transparent storage management helps ensure a program’s integrity and avoid crashes due to improper freeing of memory.

5) Type safety. Java for fintech makes it impossible to operate on objects that are not valid for these operations. The absence of type safety is often a source of many headaches in other languages.

2. Platform-independence of Java

Java’s programs can run on different systems (Windows, Mac, Linux, Android, Ios). It makes Java a top finance programming language for entrepreneurs who want to go cross-platform and reach the widest audience possible with minimum investments.

However, it is essential to remember that platform independence is not absolute, which means that Java programs still require some tweaking under the hood to fit the peculiarities of different systems but significantly less tweaking than programs written in other languages.

3. A Pivot of Big Data

Big Data disrupts the Finance Industry. The creation of 2.5 quintillions of data and the necessity to efficiently analyse relevant information to be at the top of the industry makes Big Data an obligatory business tool.

At the same time, Java is a pivot in the world of Big Data. Therefore, it is natural for a large number of Java projects in the financial industry to keep up with the pace of progress and implement their own Big Data solutions.

4. Maturity of Language

Java is a mature language that has dominated various industries for over 20 years. Java has a huge and active online community (sources claim there were more than 17.1 million Java developers as of 2023, and the number has definitely grown since). The legacy of the language is enormous – the Internet is a whole of solutions to common issues that may appear in the process of fintech application development using Java, as well as a variety of ready-to-use solutions to different tasks. It makes the process of learning Java and coding in Java smooth and straightforward, as developers always have a “strong shoulder” to lean on.

The piece of mind that comes with a language with a rich legacy and active community is an essential aspect of developers’ confidence.

Conclusion

Java emerges as an unrivalled choice for financial applications with Java programming due to its multifaceted advantages. Foremost it’s about robust security, providing a shield against cyber threats and ensuring the integrity of sensitive financial data. Next, it is the independence of Java, enabling seamless deployment across various operating systems and devices, crucial for widespread accessibility in the finance sector.

Equally compelling is Java’s strength in managing the data-driven demands of modern finance. Its proven ability to handle big data empowers institutions to process and analyse vast volumes of information with precision, enabling real-time insights, predictive analytics, and smarter decision-making. Beyond this, the maturity of Java as a language adds another layer of confidence: an extensive community support, along with a rich ecosystem of libraries and frameworks, making it a stable and enduring choice for developing complex financial systems that demand stability, scalability, and performance.

Together, these qualities position Java in finance as a steadfast cornerstone, empowering developers to engineer secure, adaptable, and high-performing applications tailored to the dynamic needs of the fintech industry.

Kindgeek – Your Trusted Tech Partner

If you are looking to develop a secure application for fintech in Java, consider Kindgeek. We are a full-cycle fintech development company that provides core fintech banking and payment solutions to serve as a software shortcut for businesses looking to launch their fintech products.

Our expertise spans multiple technologies, including extensive experience with Java for finance. One of bright examples is Advant, a Java-driven robust white-label digital banking platform for SMEs designed to provide a unique, and comprehensive, self-service system.

Speaking about white-label, our fintech solution can significantly speed up your way to the market. With a wide range of pre-built features, combined with thoughtful customization and development, you receive a solution with the functionality to jumpstart your online finance business or get digital without heavy upfront investment.